Bitcoin Has $70,000 In Its Sights: Stocks to Watch

03/05/2024 01:52

Several stocks are making waves in conjunction with Bitcoin's ascent.

The journey for Bitcoin investors back to all-time highs hasn’t been an easy one. Similar to past instances, the most recent (and severe) drawdown saw Bitcoin lose more than 75% of its value in less than a year. But the world’s largest cryptocurrency by market capitalization has been on a tear since bottoming in late 2022, and now all-time highs are back within reach.

A new asset class in cryptocurrency generated both institutional and retail interest alike over the last decade. Cryptocurrencies not only provide the potential for significant price appreciation, but also serve as a way to diversify portfolio holdings. The so-called “hodlers” are more focused on the former; after all, major cryptocurrencies like Bitcoin have widely outperformed nearly every imaginable security since their inception.

Cathie Wood’s Latest Bitcoin Update

The scorching rally of late produced record inflows into the newly created set of spot Bitcoin ETFs. The SEC approved 11 spot Bitcoin ETFs in January, which generally emphasize access to the cryptocurrency along with low fees.

Cathie Wood’s ARK Invest was one of the first companies to be approved with its ARK 21Shares Bitcoin ETF ARKB. The fund provides direct, regulated exposure to Bitcoin which is kept in cold storage by an institutional-grade custodian, offering greater protection than the typical custody options available to individual investors.

The ARKB ETF has already garnered more than $2 billion in assets under management, the fastest ramp for any of ARK’s ETF offerings. Investors in ARKB have already enjoyed a 33% return since the fund’s January 10th inception date.

Image Source: StockCharts

Cathie has been a long-term proponent of Bitcoin, touting its existence as a global and decentralized monetary system. Now that the SEC gave the green light to institutions, she believes the revolution of the digital currency age has just begun. In her opinion, every financial institution now has a fiduciary responsibility to provide access to investors.

Stocks to Watch as Bitcoin Soars

Outside of owning crypto outright, several stocks are making waves in conjunction with Bitcoin’s ascent. Coinbase COIN, the largest U.S. cryptocurrency exchange, has been a big beneficiary of the latest move. A Zacks Rank #1 (Strong Buy), Coinbase shares surged more than 250% over the past year as earnings estimates are on the rise.

Back in February, the exchange blew away expectations for the fourth quarter. Earnings of $1.04/share represented a 1,256% surprise over the -$0.09/share estimate, while revenues of $953.8 million marked a 30.3% surprise. Coinbase has delivered a trailing four-quarter average earnings surprise of 377.6%.

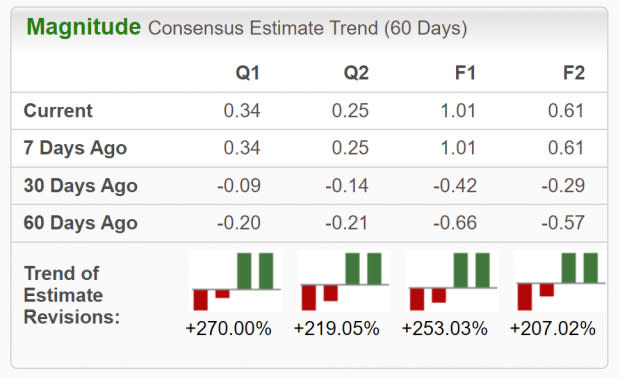

Analysts covering COIN are in agreement and have been raising earnings estimates across the board. Looking at 2024 as a whole, EPS estimates have been increased by 253.03% in the past 60 days. The Zacks Consensus Estimate now stands at $1.01/share, translating to a 173% improvement relative to last year.

Image Source: Zacks Investment Research

MicroStrategy MSTR has also benefitted immensely from the run-up in Bitcoin. The analytics software company built up a vast reserve of the cryptocurrency over the years. As per founder Michael Saylor, MicroStrategy now holds 193,000 Bitcoin that were acquired at a total cost of roughly $6.09 billion, or $31,544 per Bitcoin.

Image Source: StockCharts

MSTR stock is soaring another 20% in early trading on Monday as Bitcoin presses up against all-time highs. Investors have been rewarded over the past year as MicroStrategy shares delivered a return north of 400%.

Marathon Digital Holdings MARA is another stock to keep an eye on amid Bitcoin’s rise. The digital asset technology company mines cryptocurrencies, focusing on the blockchain ecosystem and generation of digital assets. Currently a Zacks Rank #3 (Hold), Marathon Digital Holdings is witnessing positive earnings estimate revisions.

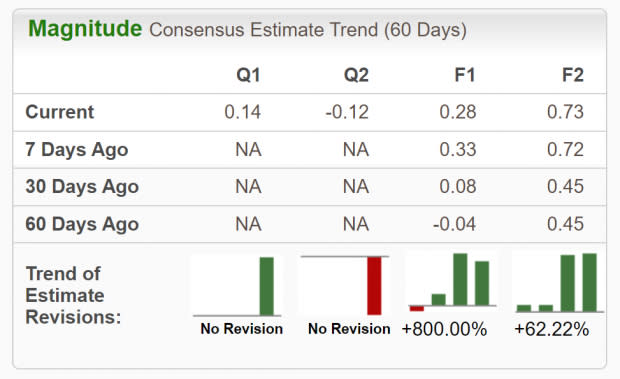

Image Source: Zacks Investment Research

Estimates for the current fiscal year have increased an astounding 800% over the past 60 days. The 2024 Zacks Consensus Estimate of $0.28/share would reflect nearly 65% growth relative to last year. Revenues are projected to surge 72.3% to $667.5 million.

Bottom Line

Bitcoin bulls are back in charge as the cryptocurrency looks set to test its all-time high in the coming days. The launch of spot Bitcoin ETFs is paving the way for this recent leg higher.

Crypto-related stocks have also taken full advantage of the rise in Bitcoin, providing exceptional returns for investors over a short period of time. Keep an eye on the stocks mentioned above that are witnessing phenomenal growth rates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

ARK 21Shares Bitcoin ETF (ARKB): ETF Research Reports