With most smart contracts no longer deployed on Ethereum, analysts expect the Dencun upgrade to further boost this trend as layer-2 solutions improve.

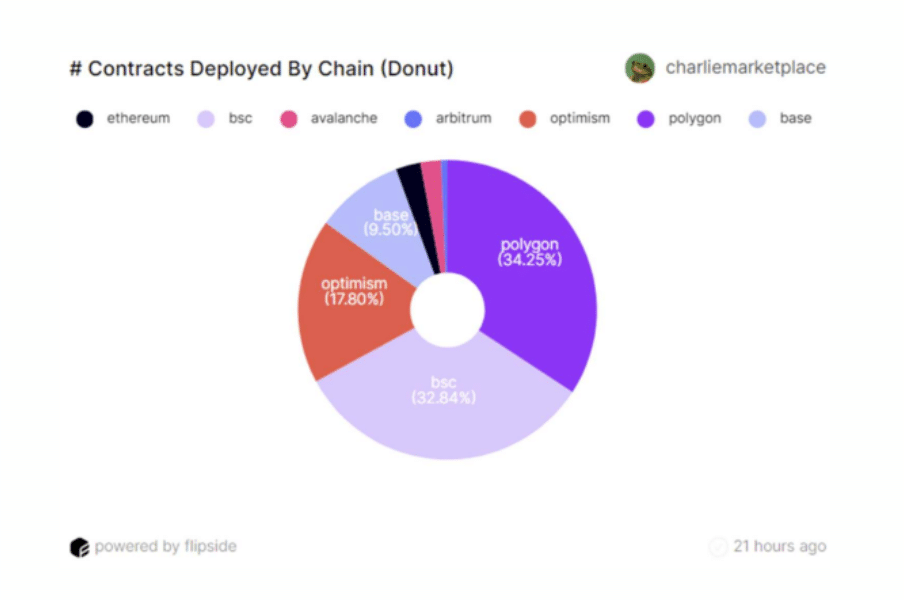

Ethereum is quickly losing its status as the top hub for deploying smart contracts amid growing competition among layer-2 networks (l2), analysts at Flipside revealed in a recent research report. According to their data, nearly 640 million smart contracts have been deployed since January 2022, with Polygon and BNB Chain (formerly Binance Smart Chain) leading in contract deployments.

Moreover, Flipside says Optimism, a layer-2 solution which operates on top of Ethereum’s architecture, has accounted “for two thirds of total EVM smart contract deployments so far in 2024.”

“As the majority of EVM contracts are no longer deployed directly on Ethereum, we expect the forthcoming Dencun upgrade to further accelerate this trend as L2 solutions become more accessible and efficient.”

Flipside

Analysts noted that contract deployers have also surged, making up 34.7% of categorizable deployers across observed chains since Jan 1, marking a significant increase from 11.2% in both 2022 and 2023. However, Flipside pointed out that it “isn’t just developers that can deploy contracts,” adding that smart contracts can also deploy contracts.

“For instance, ‘Factories’ like UniswapV2Factory allow anyone to create liquidity pools for their tokens permissionlessly. This tends to lead to deployments consolidating around deployers like these.”

Flipside

In the meantime, deployers related to non-fungible tokens (NFTs) saw a decline from 18.6% to 8.2% over the same period, analysts said, suggesting that the next bull run “might prioritize decentralized finance over NFTs, which dominated the previous cycle.”

In January, Michael Novogratz’s crypto bank Galaxy Digital said in a research report that 2024 will be a crucial year for Ethereum, as other layer-1 blockchains such as Solana will likely raise the stakes.

Galaxy Digital analysts note that Ethereum’s modular architecture, particularly various rollup types, will introduce new challenges and technological risks due to their early stage of development. Singling out Solana as the most distinctive general-purpose blockchain embracing a monolithic architecture, they position it as the primary competitor against Ethereum.