Ethereum (ETH) Price: No Major Barrier to ATH, Data Shows

03/08/2024 21:40

Ethereum (ETH) profitability soars 94%, is ATH breakthrough in view?

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Recent data from the on-chain analytical platform, IntoTheBlock, has revealed promising insights for Ethereum (ETH) investors. With the current price hovering around $3,944, the data indicated that no notable barriers are preventing Ethereum from reaching an all-time high (ATH).

Profitability of Ethereum addresses

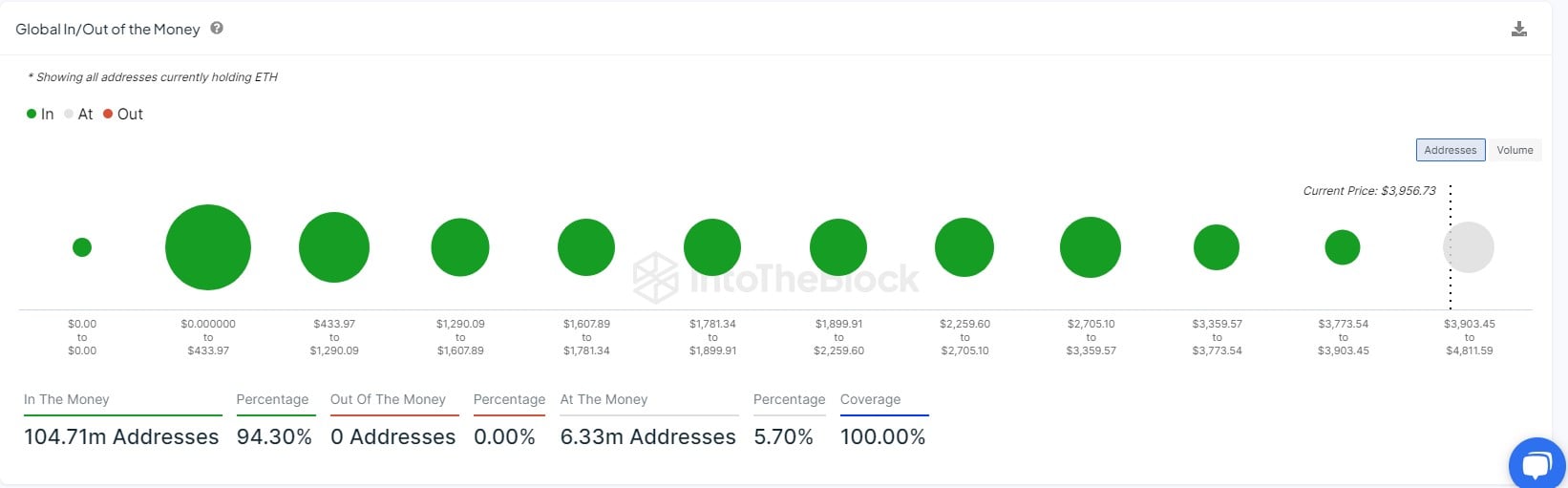

IntoTheBlock's statistics show that 94.3% of Ethereum addresses are profitable. Of the 111.04 million Ethereum addresses, 104.71 million are "In The Money," the highest figure in over a year. This data reflects a highly favorable sentiment for Ethereum, with the majority of investors experiencing increases in their holdings.

While the majority of Ethereum addresses are in profit, approximately 5.7% of addresses are at the breakeven point. These addresses, totaling 6.33 million, hold Ethereum acquired at prices ranging from $3,903.45 to $4,811.59.

However, with Ethereum's current price at $3,944 and showing a 4.4% increase in the last 24 hours, these addresses are not immediately under pressure to sell. This limited selling pressure has now contributed to Ethereum's favorable position for a sustained rally.

Furthermore, the recent transfer of $102.18 million worth of Ethereum by whales to Binance has sparked renewed investor confidence. This influx of funds signals growing institutional interest in Ethereum. Such developments, combined with positive market sentiment, suggest that Ethereum is on track for price appreciation.

Factors driving Ethereum’s bullish outlook

Looking ahead, expectations are soaring ahead of the highly anticipated Dencun upgrade scheduled for March 13. This upgrade will introduce proto-danksharding, aiming to make layer-2 transactions as affordable as possible for users.

Widely viewed as a crucial step forward for the Ethereum network, the implementation of this upgrade addresses longstanding concerns and lays the groundwork for future growth, further supporting Ethereum's bullish outlook.

Moreover, there is speculation surrounding the potential approval of an Ethereum spot Exchange-Traded Fund (ETF). Similar to the recently approved Bitcoin ETFs, the approval of such an ETF could attract a new wave of institutional investments, driving Ethereum's price even higher.