Crypto Product Inflows Soar to Record High, CoinShares Says

03/12/2024 04:10

(Bloomberg) -- A wave of investor interest is driving billions of dollars into cryptocurrency assets this year, pushing inflows to record-breaking levels, according to CoinShares International Ltd.Most Read from BloombergOne of the Most Infamous Trades on Wall Street Is Roaring BackStock Rally Stalls in Countdown to Inflation Data: Markets WrapThese Are the Best Countries for Wealthy ExpatsBond Investors Are Lining Up to Fund the War Against PutinA record $2.7 billion flowed into crypto assets l

(Bloomberg) -- A wave of investor interest is driving billions of dollars into cryptocurrency assets this year, pushing inflows to record-breaking levels, according to CoinShares International Ltd.

Most Read from Bloomberg

One of the Most Infamous Trades on Wall Street Is Roaring Back

Stock Rally Stalls in Countdown to Inflation Data: Markets Wrap

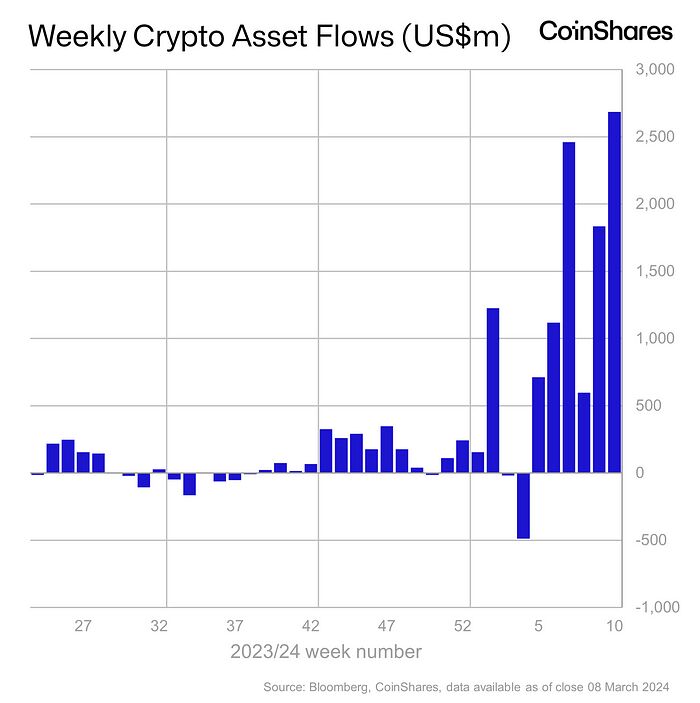

A record $2.7 billion flowed into crypto assets last week, according to a Monday report from the digital asset manager and crypto research firm. The bulk of the flows went toward Bitcoin, reads the report. Earlier on Monday, Bitcoin topped $72,000 for the first time ever, and has now notched six straight days of gains.

A combination of bullish events is helping drive the surge in inflows. These include the US Securities and Exchange Commission’s approval of spot Bitcoin exchange-traded funds in January and the upcoming halving event in April, which will cut the supply of new Bitcoin in half.

Since the start of this year, about $10.3 billion has flowed into crypto assets, close to the $10.6 billion of inflows recorded by the market over the entire course of 2021, according to the report by CoinShares’ head of research, James Butterfill. That was also the year Bitcoin hit its last all-time high near $69,000.

Spot Bitcoin ETF offerings, including from BlackRock Inc. and Fidelity Investments, have attracted a majority of the inflows to crypto markets in 2024. They’ve also helped offset outsized outflows from Grayscale Investments’ Bitcoin ETF since it’s conversion from a trust in January.

But as Bitcoin keeps setting new records, some investors appear to be hedging against a correction.

“Despite recent price rises, the inflows into short Bitcoin continue” wrote Butterfill, pointing to a further $11 million seen last week.

Most Read from Bloomberg Businessweek

Academics Question ESG Studies That Helped Fuel Investing Boom

Luxury Postnatal Retreats Draw Affluent Parents Around the US

How Apple Sank About $1 Billion a Year Into a Car It Never Built

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

How Microsoft’s Bing Helps Maintain Beijing’s Great Firewall

©2024 Bloomberg L.P.