Bernstein predicts crypto market cap could grow to $7.5 trillion by end of 2025

Published 1 minute earlier on

Quick Take

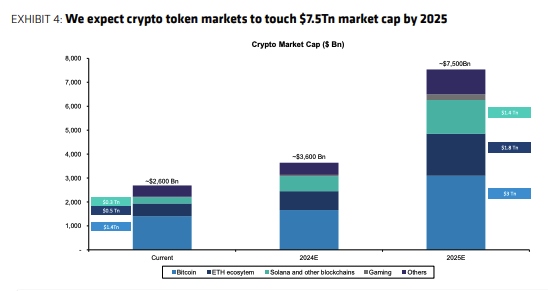

- Analysts at Bernstein have projected the overall crypto market cap could surge threefold to $7.5 trillion by the end of 2025.

- Growth will be led by the Bitcoin and Ethereum ecosystems amid “unprecedented” institutional adoption, the analysts said.

Analysts at Bernstein have projected that the overall cryptocurrency market capitalization could surge threefold to $7.5 trillion by the end of 2025. The growth, according to Bernstein analysts, can come with “unprecedented” institutional adoption of crypto. “We expect total crypto market cap to reach $7.5 trillion by 2025 vs. $2.6 trillion today, led by Bitcoin ($3 tillion by 2025), Ethereum ecosystem ($1.8 trillion by 2025) and leading blockchains e.g. Solana, Avax, etc. ($1.4 trillion by 2025),” Bernstein analysts Gautam Chhugani and Mahika Sapra wrote in a note to clients on Thursday. “Blockchain gaming to be the consumer killer app,” they added. Chhugani and Sapra forecast continued success for the new U.S. spot bitcoin exchange-traded funds, with assets under management rising fivefold from the current $60 billion to $300 billion by 2025. Crypto market cap projections. Image: Bernstein. The Bernstein analysts also initiated coverage on Robinhood stock with an outperform rating. The analysts projected a price target of $30 — 80% to the upside — suggesting it was “riding on the crypto comeback arc.” Anticipating a “monster of a crypto cycle over 2024-2025,” the analysts expect the fintech app — which boasts 11 million active traders — to grow its crypto revenues ninefold — five times the 2025 consensus view. “We expect 2025 to be the inflection year for full-year positive net income of ~$910 million vs. loss of $541 million in 2023,” they added. Shares in the stock and crypto trading app closed at $17.16 on Wednesday, gaining nearly 5% for the day and 46% over the past month, according to TradingView. Meanwhile, the GM 30 Index, representing a selection of the top 30 cryptocurrencies, increased by 0.5% to 162.13 over the last 24 hours. On Monday, the Bernstein analysts argued that Bitcoin miners remain the best equity proxy to bitcoin as the cryptocurrency heads toward an ultimate price target of $150,000 this cycle. Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures. © 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Robinhood ‘riding on the crypto comeback arc’

RELATED INDICES

About Author

James Hunt is a reporter at The Block, based in the UK. As the writer behind The Daily newsletter, James also keeps you up to speed on the latest crypto news every weekday. Prior to joining The Block in 2022, James spent four years as a freelance writer in the industry, contributing to both publications and crypto project content. James’ coverage spans everything from Bitcoin and Ethereum to Layer 2 scaling solutions, avant-garde DeFi protocols, evolving DAO governance structures, trending NFTs and memecoins, regulatory landscapes, crypto company deals and the latest market updates. You can get in touch with James on Telegram or X via @humanjets or email him at [email protected].