Ethereum: Why ETH’s drop below $4K shouldn’t worry you

03/15/2024 16:15

There has recently been a decline in the price of Ethereum as some traders take advantage of the recent surge in price.

- Ethereum has dropped below the $4,000 price range.

- Supply outside exchanges still exceeds supply in exchanges.

Ethereum [ETH] experienced a surge beyond the $4,000 price threshold, suggesting the possibility of surpassing its previous all-time high (ATH).

Although the price has since dipped below $4,000, certain metrics suggest a potential resurgence, with the chance of reaching a new ATH still on the horizon.

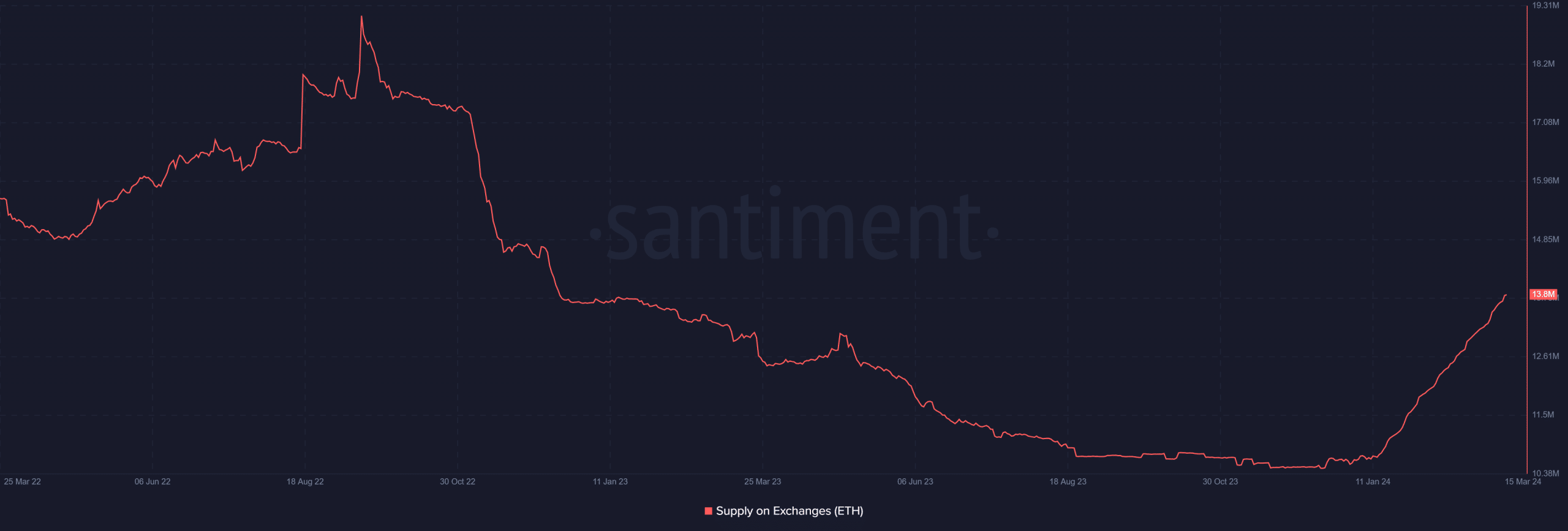

How Ethereum supply on exchanges has trended

New data from CryptoQuant suggests that Ethereum exhibits signs of strength based on its exchange reserve metric.

The chart illustrates a consistent exchange spot reserve metric decline over the past few months. This decline showed that holders withdrew their assets from exchanges, signaling a reluctance to sell.

However, a closer examination of the metric on Santiment showed a contrasting trend.

Since January, there has been an uptick in the supply of Ethereum on exchanges. The chart showed a rise from about 10 million to over 13 million at the time of this writing.

This increase suggests that more traders have deposited their assets onto exchanges, likely capitalizing on the recent surge in ETH price.

A comparison of the supply outside of exchanges to the supply on exchanges helped to gain a clearer understanding. Analysis of the supply off exchanges indicates a relatively stable trend recently.

At the time of this writing, the volume was over 121 million, indicating a significant amount of ETH being held outside of exchanges.

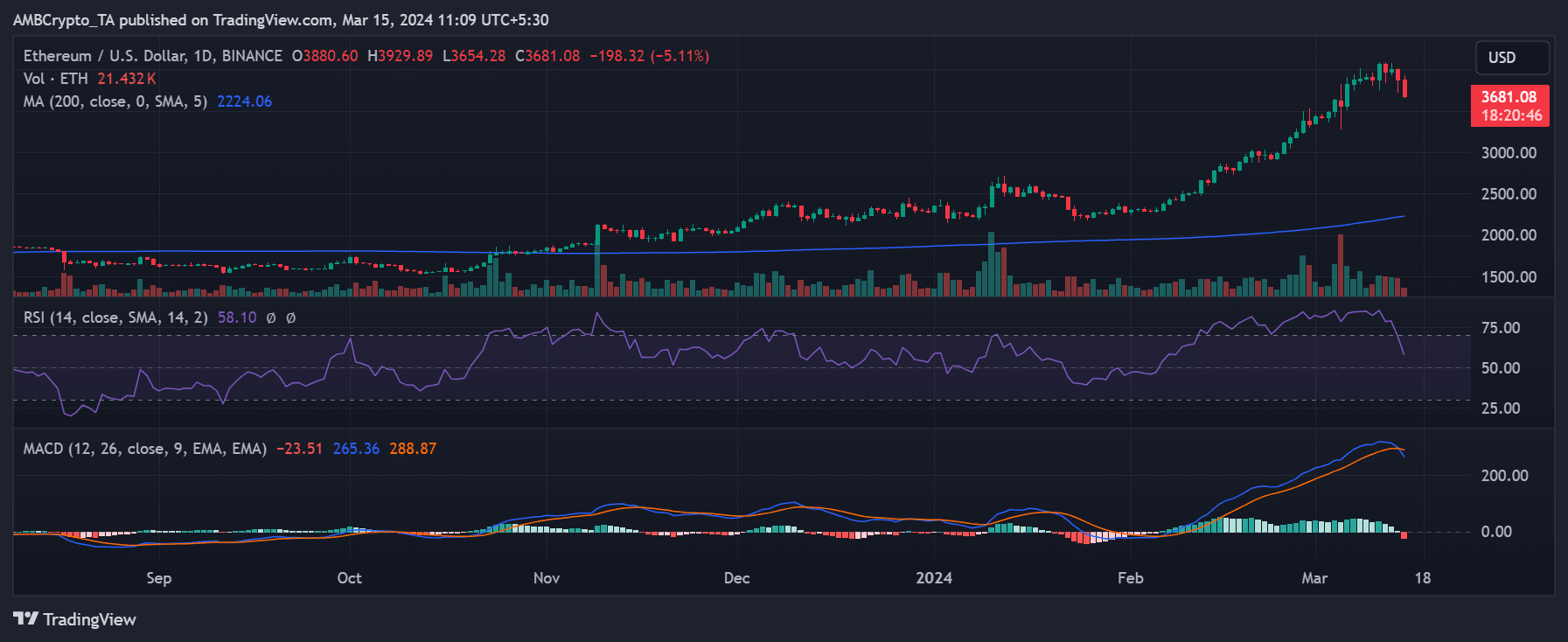

Ethereum drops below new high

Analysis of Ethereum’s performance on a daily time frame revealed a notable decline of over 3% by the end of 14t March, with prices settling around $3,870. This marked a retreat from the $4,000 price level earlier in the week.

However, at the time of writing, the decline had deepened further, with prices plummeting by over 5% to approximately $3,680. These declines represent the most significant and consecutive drops since around 24th February.

Despite this downturn, data on the supply of Ethereum on exchanges suggests that this may be a temporary setback.

The supply off exchanges still significantly exceeds the supply on exchanges, indicating a substantial amount of Ethereum being held outside trading platforms.

How much are 1,10,100 ETHs worth today

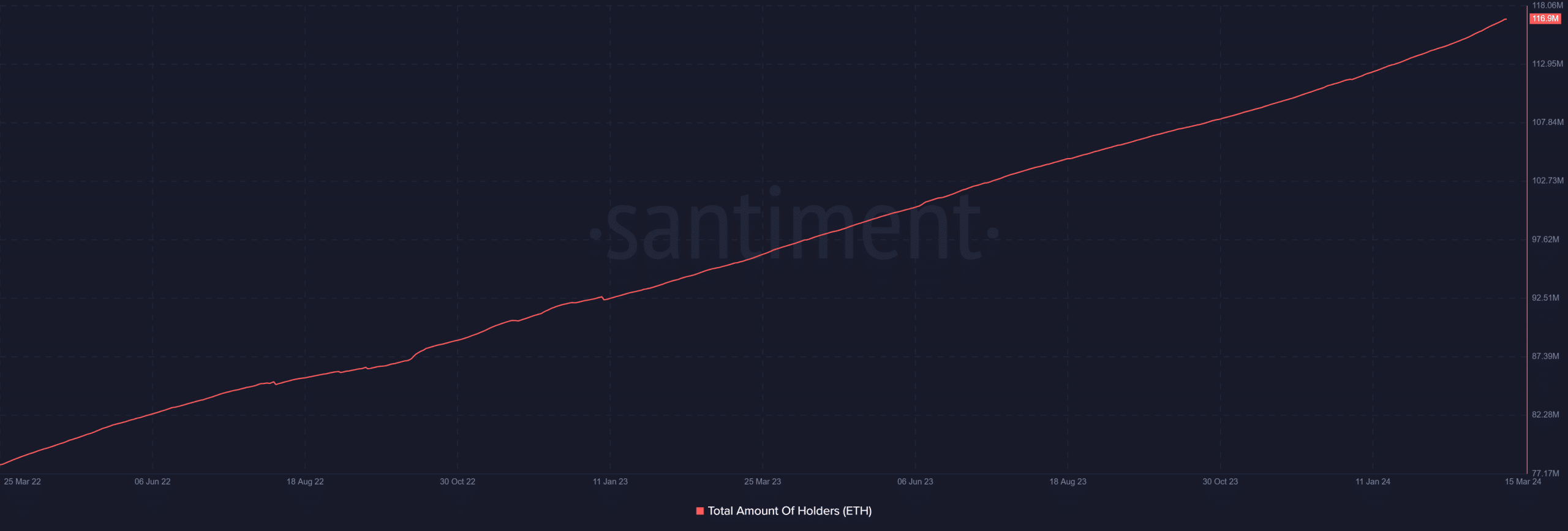

Volume of holders continues to rise, still

Analysis of the total number of Ethereum holders on Santiment revealed continued growth over the months. At the time of this writing, the number was approaching 117 million. This ongoing increase suggests sustained interest from holders who continue to accumulate Ethereum.

The accumulation trend remains a bullish sign for Ethereum, despite its recent price decline when considered alongside the significant volume of Ethereum held outside of exchanges.