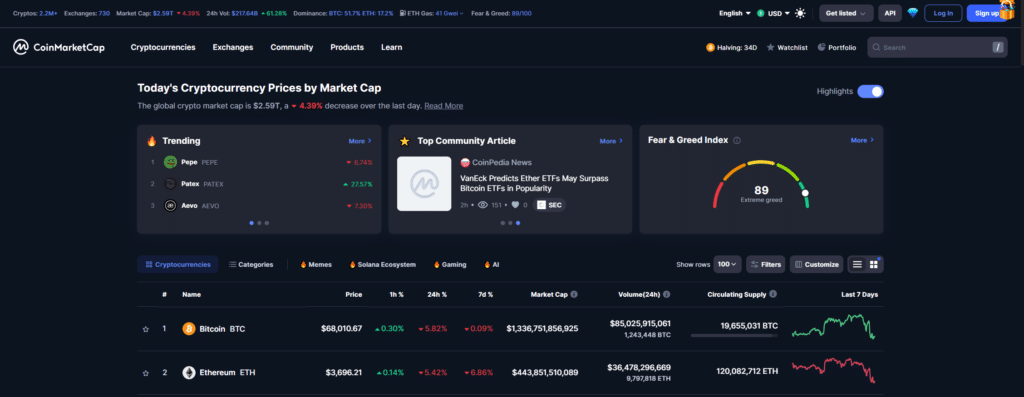

According to one options agency, declines in Bitcoin, Ethereum, and the total crypto market cap sparked short-term skepticism among traders.

QCP Capital released a March 15 update pointing to volatility concerns in cryptocurrency markets as Bitcoin (BTC), the leading token, dropped below $66,000 for the first time in nearly two weeks.

BTC was down over 5% in the last 24 hours and dipped to $65,565 during trading hours. Ethereum (ETH) also retraced more than 5% to around $3,566 before recovering slightly at press time. The total crypto market fell to $2.6 trillion, down 4% on the day, per CoinMarketCap.

QCP Capital analysts said markets were “particularly nervous” due to the valuation correction across crypto’s two largest tokens. The firm said this negative risk reversal extended to May, as indicated by large capital investors.

We’ve also seen some sizeable unwinding of calls by institutional players who were the ones buying calls aggressively on the way up.

QCP Capital

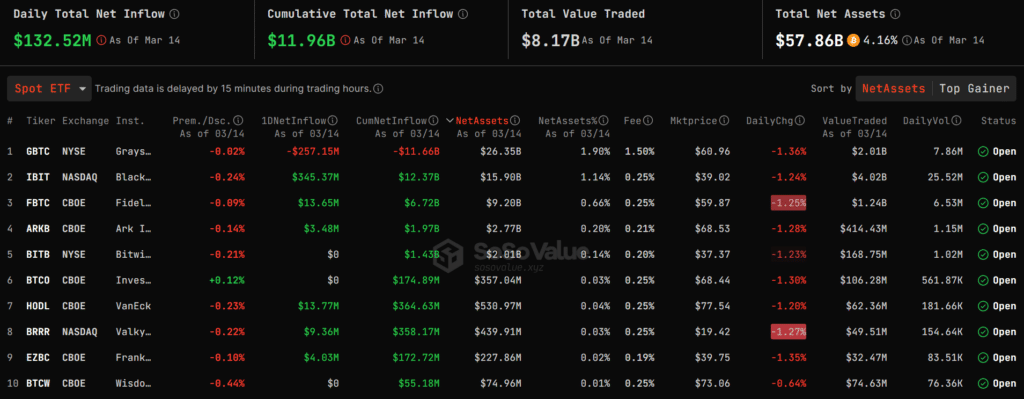

Spot Bitcoin ETFs recorded $132m net inflows

Bitcoin’s market correction was preceded by rare lackluster interest in spot BTC ETF on March 14. SoSo Value data showed total net inflows of $132.5 million across 10 tradable funds, with BlackRock again taking the lead with $345 million.

However, $257 million in net outflows from Grayscale’s GBTC dampened the influx into BlackRock’s iShares Bitcoin ETF (IBIT). Funds issued by Bitwise, Invesco Galaxy, and WisdomTree reportedly had $0 net inflows.