Spot Bitcoin ETFs together overtake SPDR Gold Shares ETF in terms of AUM

03/15/2024 23:18

The cumulative influx of capital that has been dumped into the latest 11 spot Bitcoin ETFs has now topped the size of the largest spot gold exchange traded fund. Learn more here.

bodnarchuk

Bitcoin (BTC-USD) advocates have long argued that the cryptocurrency could provide an alternative investment to gold (XAUUSD:CUR), with Michael Saylor, co-founder and former CEO of MicroStrategy, earlier this month stated that Bitcoin is going to “eat” gold. While this contention remains controversial, the crypto market passed an interesting milestone with regards to gold this week.

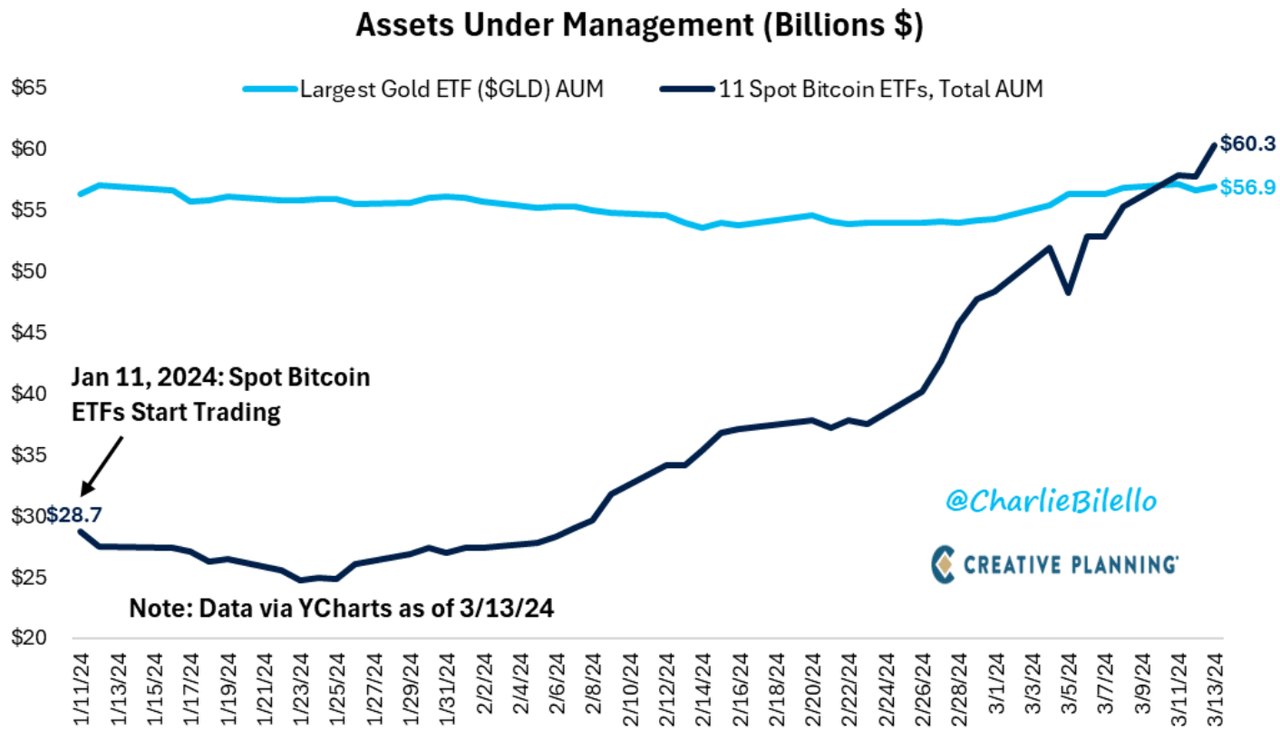

The cumulative influx of capital that has been dumped into the 11 recently launched spot Bitcoin ETFs has now topped the size of the world's largest spot gold exchange traded fund.

Spot Bitcoin ETFs, which started trading on U.S. exchanges for the first time back on January 11, have now amassed more than $60B of assets under management in just over two months of trading. The influx of cash has now surpassed the world’s largest spot gold ETF, SPDR Gold Shares ETF (NYSEARCA:GLD), by $3B, as GLD holds $56.9B under management.

See the below chart that Charlie Bilello, Chief Market Strategist of Creative Planning constructed, showing the relationship of AUM between the 11 spot Bitcoin ETFs and GLD.

The 11 spot Bitcoin exchange traded funds: (IBIT), (ARKB), (GBTC), (DEFI), (EZBC), (HODL), (BRRR), (BTCO), (BTCW), (FBTC), and (BITB).

2024 Price Action: Bitcoin currently is +61.6% year-to-date while gold is +4.5% year-to-date.