Ethereum’s Dencun fuels 5x hike over $25 billion – All you need to know

03/18/2024 13:30

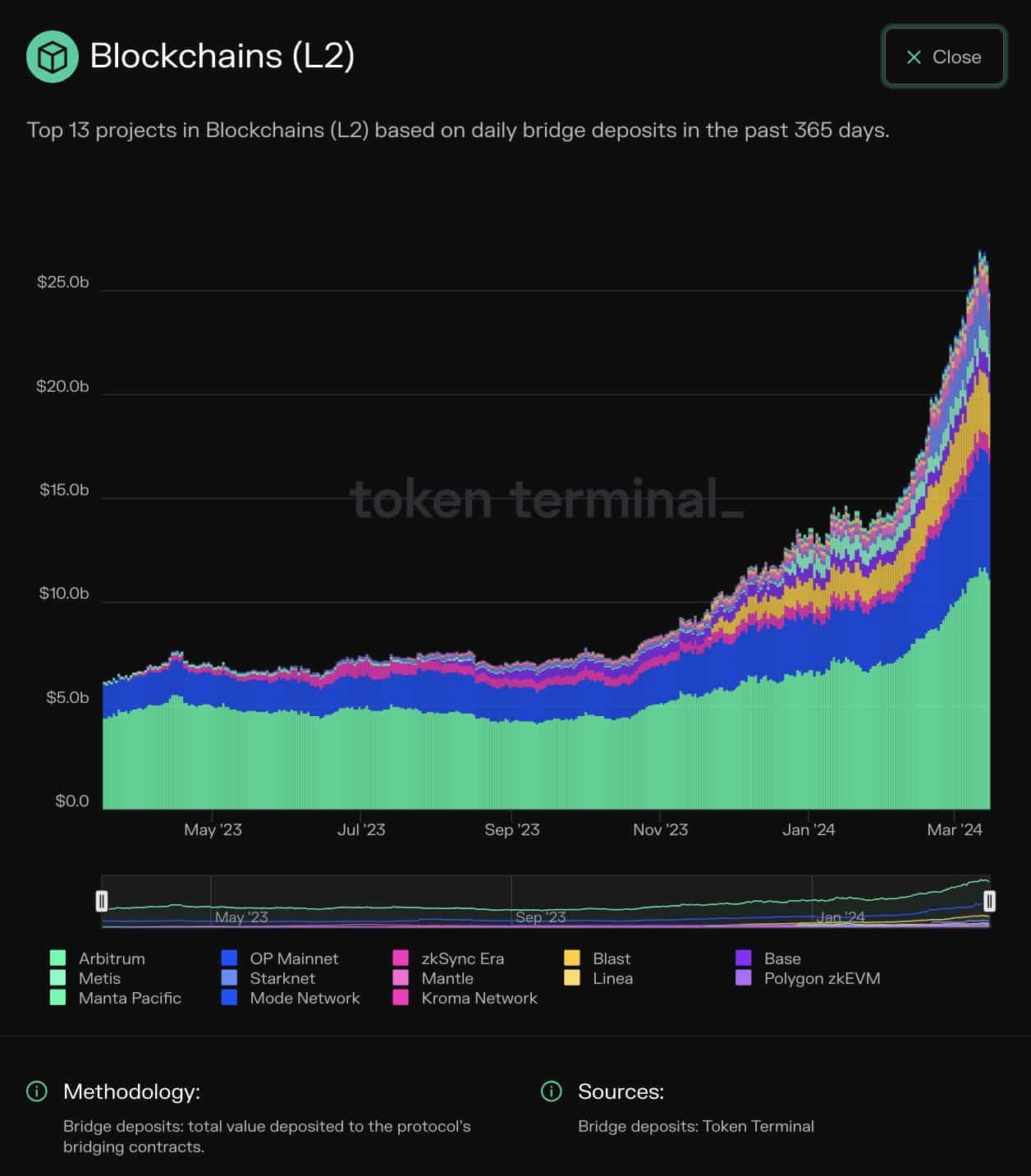

The volume of assets bridged from Ethereum to the L2s has jumped dramatically in the first three months of 2024.

- ETH’s total value deposited surpassed $25 billion.

- The heightened demand likely stemmed from the anticipation of the Dencun upgrade.

Over the past year or so, scaling solutions have played a substantial role in boosting demand for the Ethereum [ETH] ecosystem.

Built atop the base layer of Ethereum, these so-called layer -2 (L2) chains were envisioned to address Ethereum’s scalability problem.

It was planned that over time, these L2s would handle the majority of low-value transactions, with the base layer taking care of security and decentralization.

Well, the vision appeared to be becoming a reality.

According to a recent post by on-chain analytics firm Token Terminal, the number of assets bridged from Ethereum to L2s has jumped dramatically in the first three months of 2024.

Users capitalize on L2 benefits

Bridging, as you might already be aware, is the process of transferring funds from L1 to L2. This is done to take advantage of the high-speed and low-cost capabilities of the L2s.

As seen from the data above, the total value deposited has surpassed $25 billion as of the 16th of March, representing a 5x jump from the same time last year.

Arbitrum [ARB] attracted 42% of the total deposits, followed by OP Mainnet [OP].

Dencun was the main driver

The heightened demand in 2024 likely stemmed from the anticipation of the Dencun upgrade, which went live last week.

The deployment has resulted in a sharp drop in gas fees on L2s, in some chains by as much as 90%. Consequently, users scurried to get their funds transported to enjoy the cheaper costs.

Win-win for ETH?

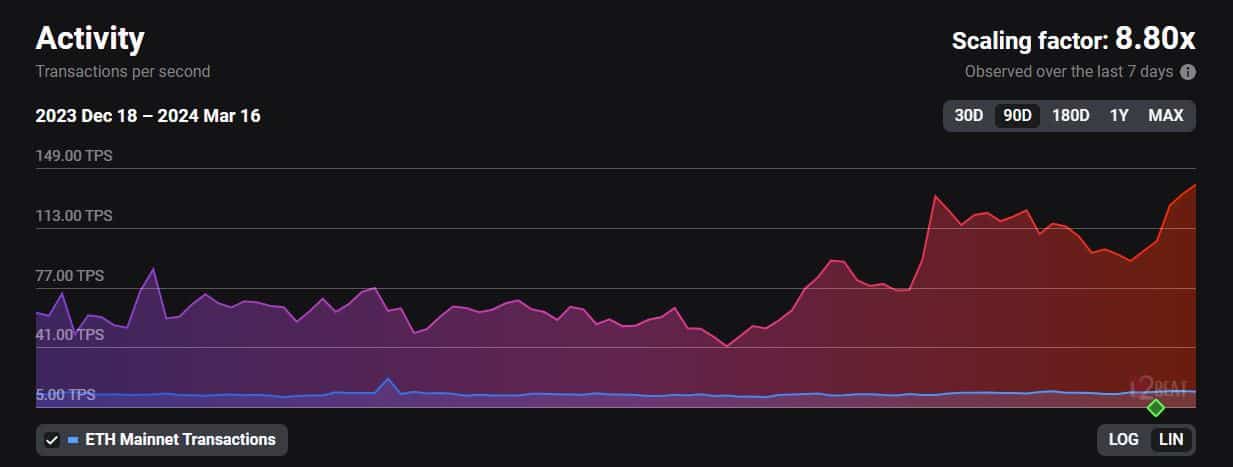

The growing demand has also spiked on-chain activity, with L2s settling more than eight times the transactions at press time, AMBCrypto noted using L2Beats data.

Note that after validation, L2s batch the transactions and send a compressed version to the base layer for settlement.

Is your portfolio green? Check out the ETH Profit Calculator

For each transaction sent by an L2, the Ethereum network burns a small percentage of the total ETH supply. As a result, high network activity on Ethereum L2s directly accrues value to ETH.

As of this writing, ETH was exchanging hands at $3,570 with a fall of 4.56% in the last 24 hours, according to CoinMarketCap.