Grayscale Ethereum Trust discount drops to -20% as hope dwindles for spot ETF in May

Markets • March 20, 2024, 8:30AM EDT

Published 1 minute earlier on

Quick Take

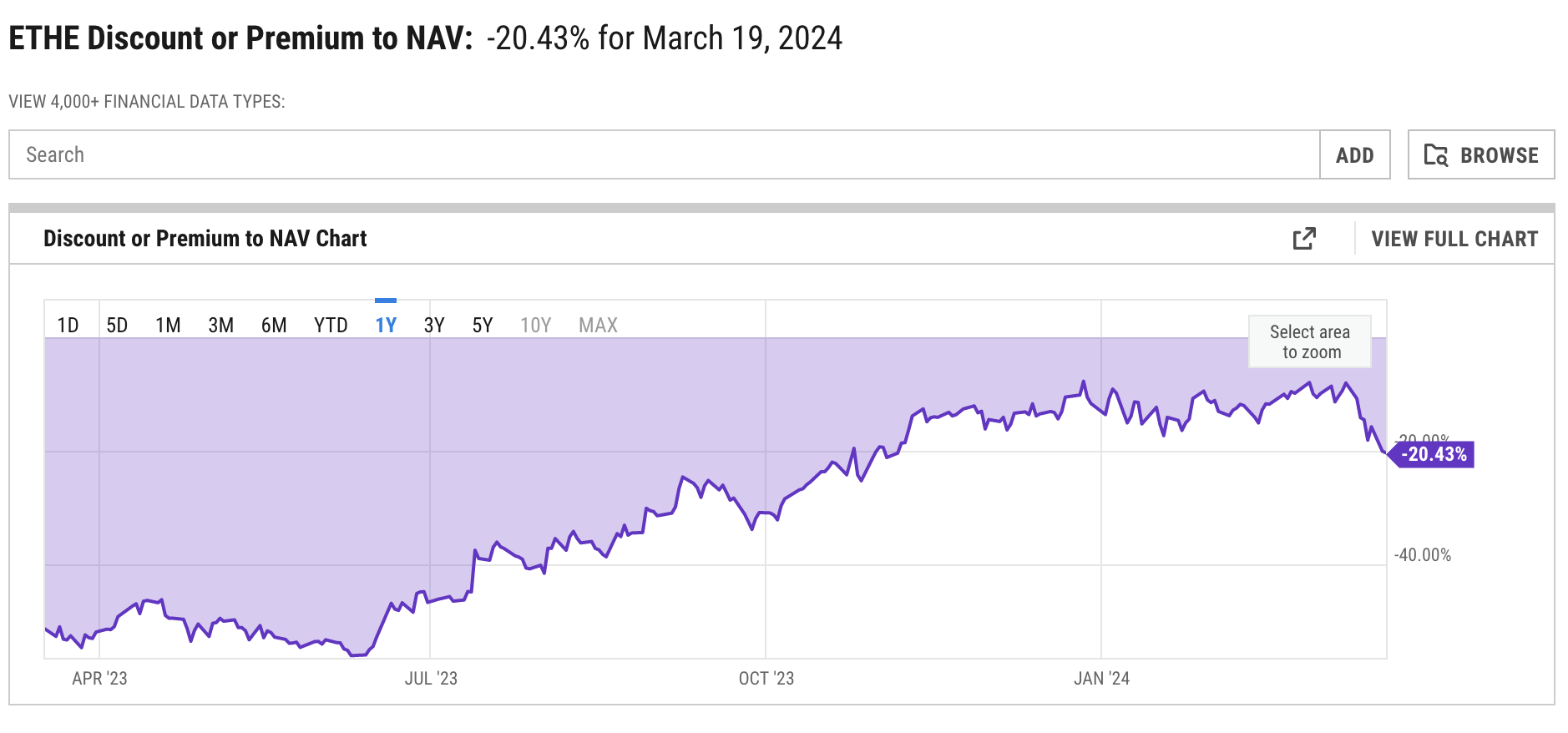

- The Grayscale Ethereum Trust discount has slid to its lowest level since November 2023.

- This comes as pundits become more doubtful that a spot Ethereum ETF will find approval by May.

The Grayscale Ethereum If a spot Ethereum ETF were approved, Grayscale’s Trust would be converted into one — as happened with its Bitcoin Trust. This would allow holders to redeem the underlying ether and practically eliminate the discount. However, the declining discount suggests that traders are not anticipating an approval, and therefore a conversion, anytime soon. The Grayscale Ethereum Trust discount has fallen over the last few days. Image: ycharts. This matches the general sentiment in the industry, where pundits have largely abandoned hope for an approval by May. While some analysts were optimistic just a few months ago, the sentiment these days is much worse. For instance, Bloomberg ETF analysts dropped their chances from 70% to 30%, aligning with current prediction markets. "With the market consensus on the Ethereum ETF approval turning negative, ETH has taken a bigger correction than Bitcoin. Everyone is looking at the May 23 approval date as the critical date, but now with much less hope," said Bernstein analysts Gautam Chhugani and Mahika Sapra in a note to clients today. That said, the analysts still anticipate a 50% chance of a spot Ethereum ETF this year. "Further, we don’t believe the industry will give up the ETH ETF battle without a fight, pushing SEC to come up with a ‘really solid and creative’ reason to deny," they added. "Particularly, given the success Blackrock and Fidelity have had with the Bitcoin ETF (Blackrock IBIT at $15Bn AUM). The fight for ETH ETF is worth it for the industry.” While approval by May seems unlikely, not everyone sees this as a bad thing. Bitwise CIO Matt Hougan said on March 19 that he hopes the ETFs aren’t approved by May. He argued that Wall Street needs time to digest the bitcoin ETFs before it will be ready to focus on a new one. He anticipated that a later approval might result in even more assets. Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures. © 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice. ETH

+2.27%

Trust discount has dropped to -20%, its lowest level since November 2023. This comes on the back of falling optimism for a spot Ethereum ETF approval by May.

ETH

+2.27%

Trust discount has dropped to -20%, its lowest level since November 2023. This comes on the back of falling optimism for a spot Ethereum ETF approval by May.

RELATED INDICES

About Author

Tim is the Editor-In-Chief of The Block. Prior to joining The Block, Tim was a news editor at Decrypt. He has earned a bachelor's degree in philosophy from the University of York and studied news journalism at Press Association Training. Follow him on X @Timccopeland.