Ethereum: $4.2 million in liquidations will have this effect on ETH prices

03/21/2024 08:00

Over the course of the last 24 hours, the DeFi sector witnessed liquidations of ETH totaling $4.27 million.

- $4.27 million ETH liquidations occurred over the last 24 hours in the DeFi sector.

- Traders turned bearish as IV grew.

Over the last week, the price of Ethereum[ETH] has fallen tremendously coinciding with the correction in Bitcoin’s[BTC] price.

Bulls get punished

Based on Parsec’s data, DeFi saw over $5.4 million in collateral liquidated within the last 24 hours, with $4.27 million tied to ETH. Should ETH plummet to $3,008, an additional $24 million in collateral could face liquidation.

On-chain derivatives exchanges such as GMX, Kwenta, and Polynomial triggered liquidations totaling more than $52 million during the same period.

The recent surge in collateral liquidations, especially those associated with Ethereum carries significant implications for the price stability of the cryptocurrency.

As large volumes of collateral are liquidated, it exacerbates the already heightened price volatility within the Ethereum market. This increased volatility can trigger a cascade of sell-offs as liquidated assets are offloaded, further driving down ETH prices.

Consequently, investors and traders may become increasingly cautious and hesitant to engage with Ethereum, fearing further price declines.

Additionally, the negative sentiment resulting from the visible liquidations may undermine confidence in ETH, leading to prolonged periods of price suppression.

This volatility, coupled with the visibility of large-scale liquidations, may erode market sentiment surrounding Ethereum, undermining confidence in the platform’s stability and resilience.

Moreover, the Ethereum network may experience congestion during periods of high volatility and increased liquidations, resulting in higher transaction fees and slower processing times.

The congestion also could deter users from engaging with Ethereum-based applications and decentralized finance (DeFi) protocols, limiting the platform’s growth and adoption.

However, the put-to-call ratio for ETH increased, indicating that traders were turning bearish towards ETH.

More uncertainty on the way?

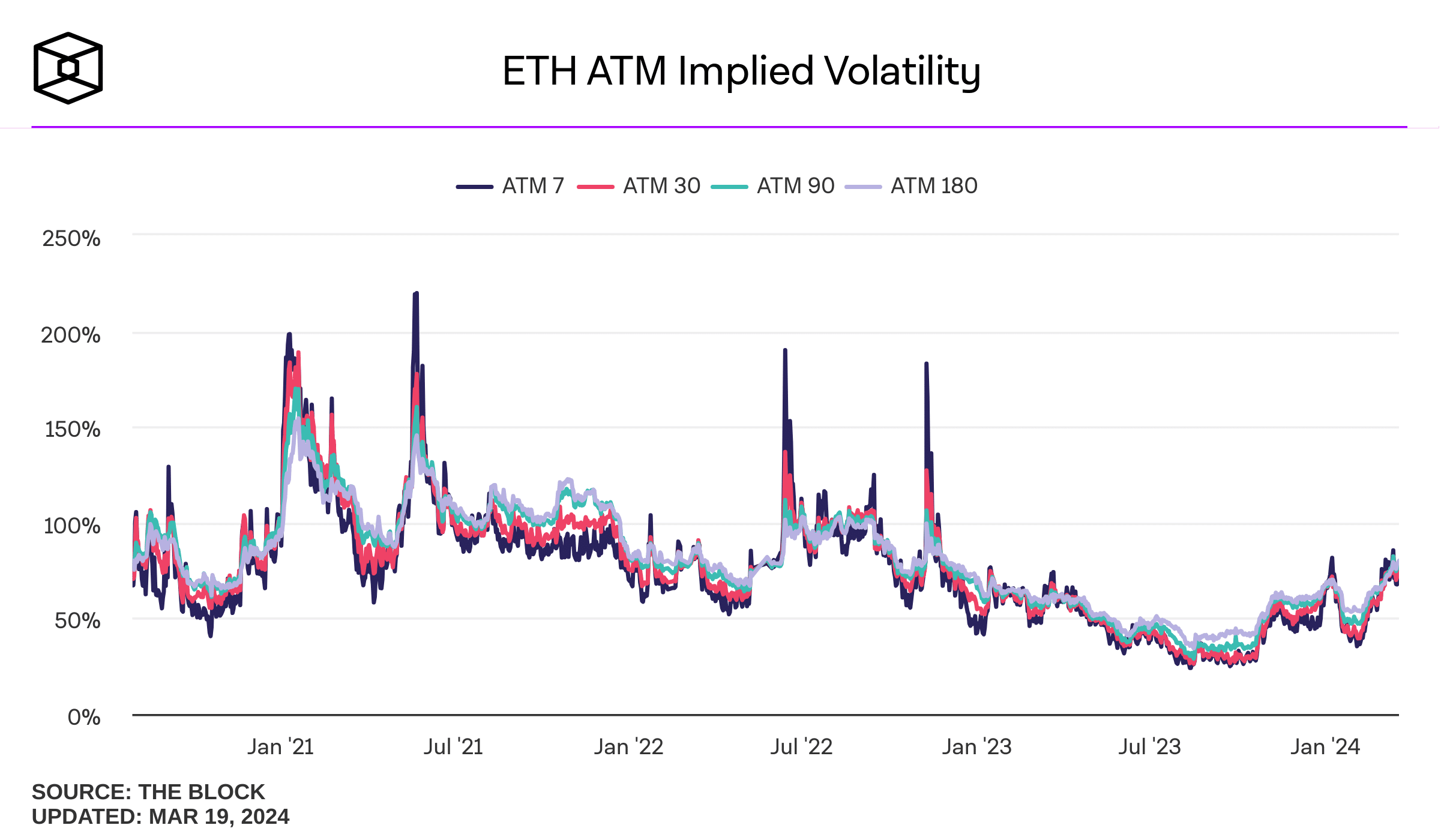

One of the reasons for the same would be the rising Implied Volatility(IV) for ETH. AMBCrypto’s analysis of ETH’s data revealed that the IV for ETH had surged significantly.

This signals increased price volatility, making it challenging for investors to accurately predict price movements. This can potentially result in higher trading costs and increased risk exposure.

How much are 1,10,100 ETHs worth today?

Moreover, elevated IV leads to higher option premiums, making it more expensive for traders to buy options contracts which reduces potential profitability.

This can deter investors from entering or maintaining positions in Ethereum, leading to reduced investor confidence and downward pressure on prices. At press time ETH was trading at $3,250.73 and its price had grown by $3,250.73 in the last 24 hours.