Bitcoin, Ethereum Come Roaring Back—These Alts Are Faring Even Better - Decrypt

03/21/2024 18:57

The positive market trend extends beyond crypto, too—major global indices are showing bullish signs.

Feeling bullish? Crypto traders today woke up and chose to hit the “buy” button, with 90% of the top 100 coins by market capitalization jumping in price in the last 24 hours.

Bitcoin and Ethereum are up today by around 5% and 7%, respectively, and many other top altcoins are doing even better. It’s all the more impressive when you consider it comes after a brief period of panic, during which Bitcoin experienced its worst day since November 9, 2022, falling 14.4% in 24 hours.

Leading the charge among alts today is ONDO, the best-performing cryptocurrency in the top 100, with a staggering 36.51% increase in the last 24 hours. ONDO is the governance token of the Ondo DAO, which currently focuses on boosting the Flux Finance ecosystem, a DeFi lending protocol that allows users to borrow against tokenized U.S. Treasury bonds.

Other coins that are doing well today include Conflux (CFX), the native token of the eponymous layer-1 blockchain that features a Tree-Graph consensus mechanism, combining proof and work and proof of stake (+27%); JasmyCoin (JASMY), the native token of the internet-of-things (IoT) provider Jasmy Corporation (+21.78%); and Kaspa (KAS), the native token of the Kaspa layer-1 blockchain that aims to be extremely efficient and fast via its GhostDAG protocol (16.32%).

But even the worst-performing token among the top 100, Render, was in the green most of the time today. However, a small intraday correction brought its price down by 3.5% in recent hours. Render is the token for a distributed GPU rendering network built on top of the Ethereum blockchain.

Notably, all tokens in the green zone have experienced a price increase of more than 1% today.

This rebound comes after a short-lived panic episode that saw Bitcoin flash crash by 80% for a few minutes on BitMEX, leading to a massive sell-off. However, the leading cryptocurrency has since rebounded, increasing by more than 5.7% in the last 24 hours to its current price of $66,539.

Ethereum, the second-largest crypto asset by market cap, has also experienced a significant surge, with a price increase of roughly 7% to its current price of just over $3,400.

Memecoins have also reacted positively to the overall rebound. Floki, the third best-performing token, has seen a growth of 26.92% to its current price of $0.000227. Bonk, while being the "worst" performer among the memecoins, still experienced a substantial 11.97% growth to its current price of $0.00002355.

The overall crypto market capitalization has grown from $2.36 trillion to $2.53 trillion in the last 24 days, with trading volume fluctuating above the $150 billion mark during most of the time, a high historical threshold that reflects how hot the crypto market is among traders right now.

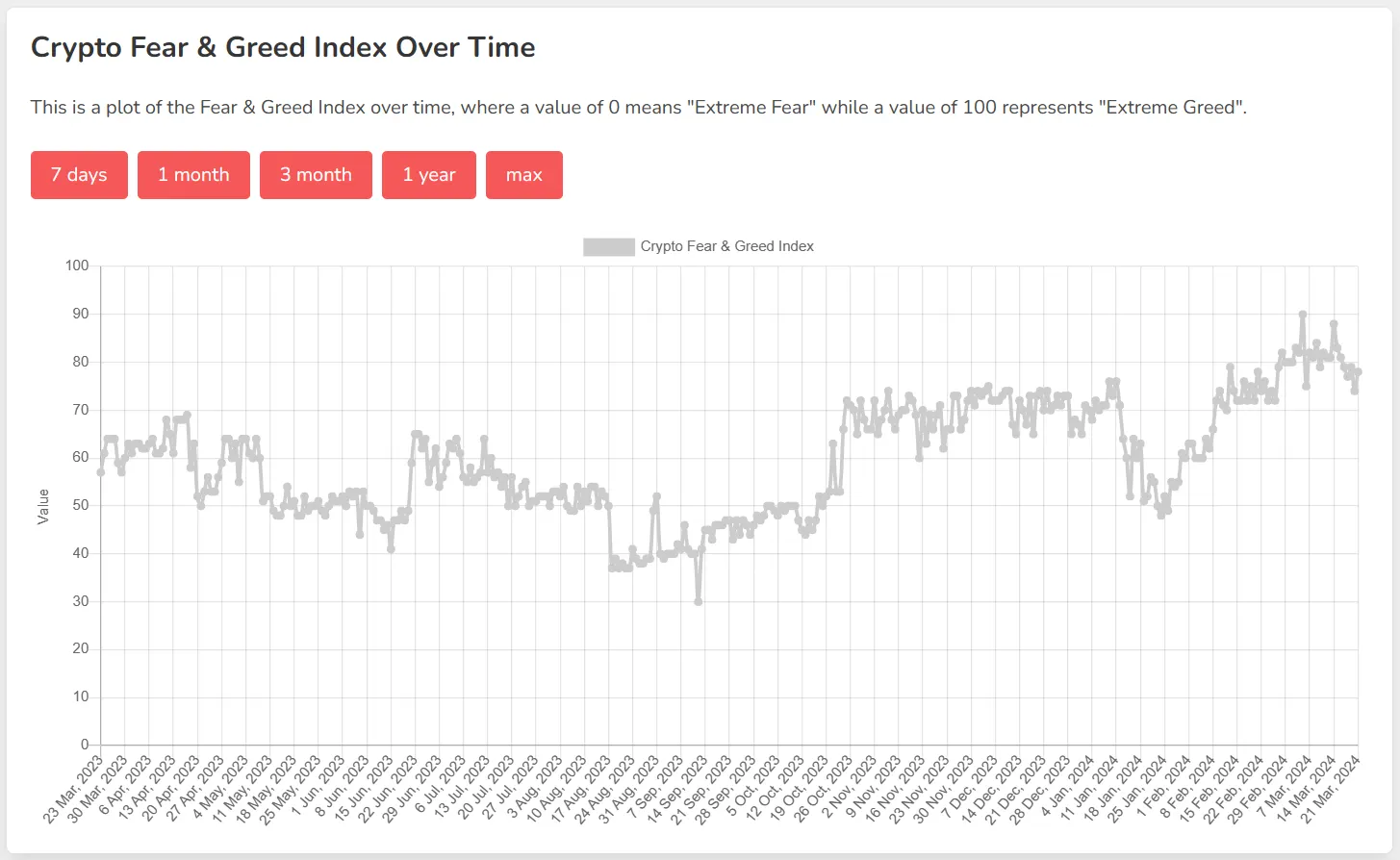

The Crypto Fear and Greed Index, a tool that measures investor sentiment and emotions, currently indicates a state of extreme greed among cryptocurrency enthusiasts. This suggests a high level of optimism and risk-taking appetite in the market, which could be contributing to the current rally.

The positive trend extends beyond the cryptocurrency market, with the overall stock markets also showing signs of recovery. The Fear and Greed sentiment index indicates a state of extreme greed, a recovery from last week's "greed" status. Most of the largest global indices are in the green, with the exception of China and Brazil, which are slightly down.

In the U,S, the S&P 500 is up +0.6%, the Nasdaq spiked 0.78%, and the Russell 2000 is up +1.23%. In Europe, the STOXX 600 is up 0.9%, UK’s FTSE100 is up +1.88%, France’s CAC40 jumped 0.22% and Germany’s DAX spiked 0.9%. Meanwhile, markets in Asia also saw a pretty good day with the Nikkei spiking over 2% in Japan, South Korea’s Kospi growing over 2.4%, and the Taiwan stock market being up 2.10%.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.