Ethereum: Is it time you ignore the noise and HODL ETH for dear life?

03/26/2024 15:00

Holding Ethereum [ETH] when it reached $4,200 to $3,445 could have been an extreme sport for some. But long-term market participants

- The MDIA and MCA indicated that ETH was far below this cycle’s top.

- Those who purchased the altcoin recently were at a loss, but more upside could be coming.

Holding Ethereum [ETH] when it reached $4,200 to $3,445 could have been an extreme sport for some. But long-term market participants who have seen the bulls and bears of the ecosystem seem unfazed.

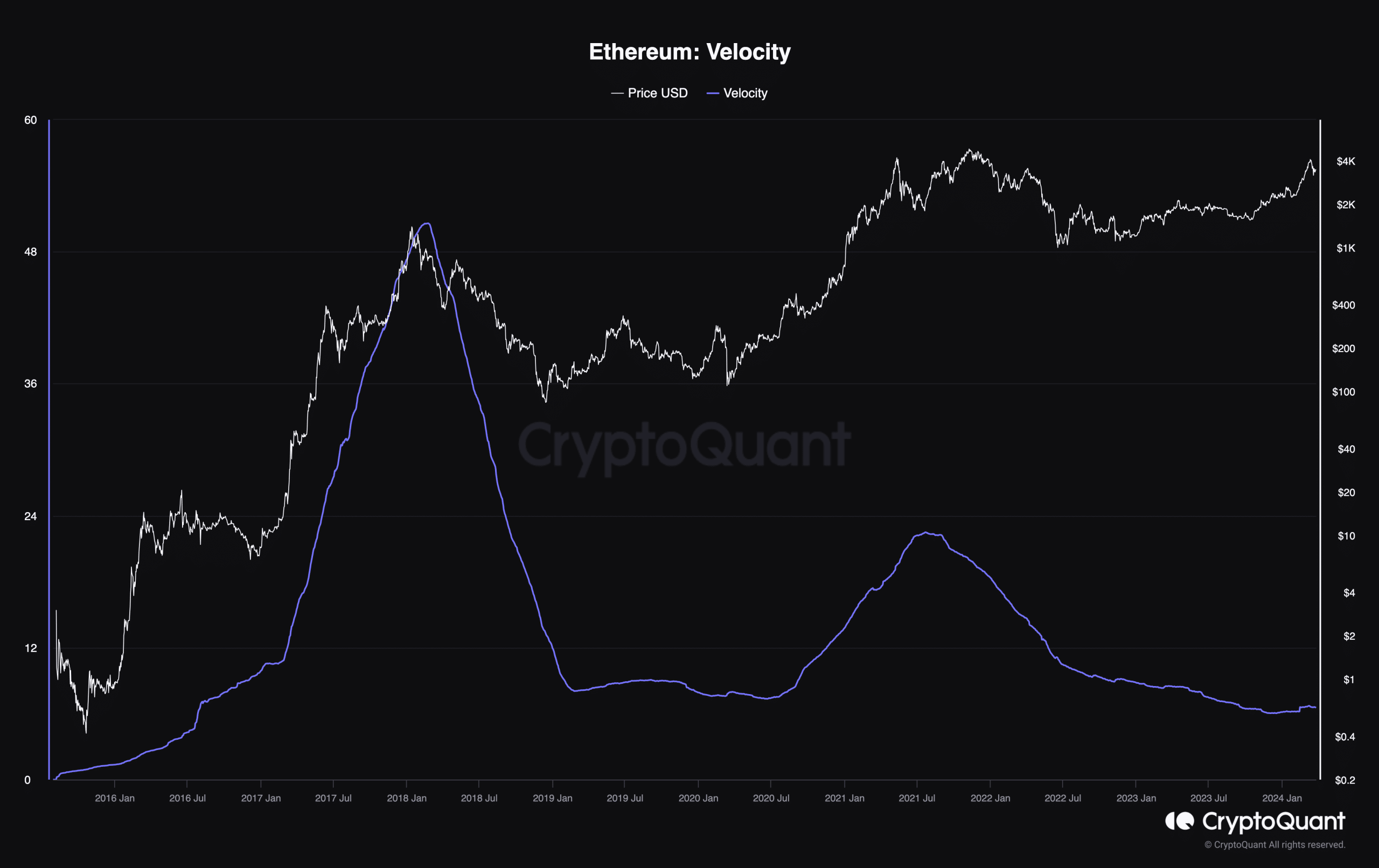

AMBCrypto got wind of this information after analyzing the velocity. Velocity is the rate at which coins are circulating in the crypto economy. If velocity spikes, then it means coins are circulating at a rapid pace.

Not the time to book profits

However, AMBCrypto’s analysis using CryptoQuant showed that Ethereum’s velocity was down to 6.57. The decline in velocity suggests that long-term holders of the cryptocurrency are not distributing.

If they did, ETH’s price might have declined much more than it has done.

Furthermore, the metric’s status was also a signal that participants were convinced of ETH’s bullish future. Two other metrics we considered were the Mean Coin Age (MCA) and the Mean Dollar Invested Age (MDIA).

The MDIA is the average investment into a cryptocurrency at any given time. Conversely, the MCA is the average purchase age of an asset. A combination of these two can signal when to buy and when to sell.

If the MDIA drops, then it means market participants have bought at an expensive price. When this happens, the price of the cryptocurrency falls.

On the other hand, an increasing MDIA is a sign that accumulation is going on and prices are cheap.

Accumulating ETH may be the right call

At press time, the MDIA increased, and the MCA also did the same. Historically, the uptrend is a good indicator that prices have not topped yet.

Therefore, ETH’s price might be considered to be trading at a discount. Going forward, this might be followed by a significant price increase.

Should the readings of these metrics continue to rise, Ethereum might have a first stop at $3,800. After that, the price might retest $4,000 within a short period.

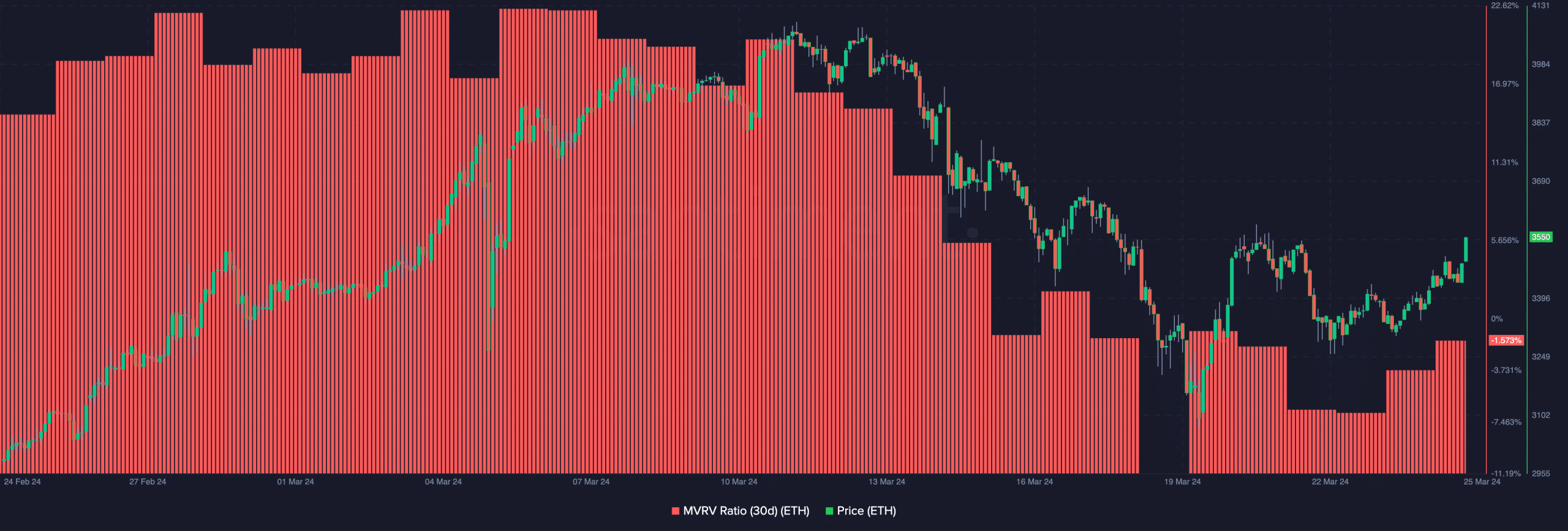

To confirm if the altcoins offered a buying opportunity, AMBCrypto looked in the Market Value to Realized Value (MVRV) ratio direction.

This metric tells if a cryptocurrency is undervalued, overvalued, or at a fair value.

At press time, the 30-day MVRV ratio was -1.573%. This means that every Ethereum holder who decides to sell their coins now would make an average loss of 1.573%.

When we consider history, this MVRV reading looks great for accumulation. In bull cycles when ETH hit a local top, the ratio was well over 40%.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Therefore, one can assume that ETH has not hit half its potential this cycle.

If we go by the historical data, then the price of the cryptocurrency might hit five figures before the bull market ends. But that is also subject to unforeseen events which might come into play.