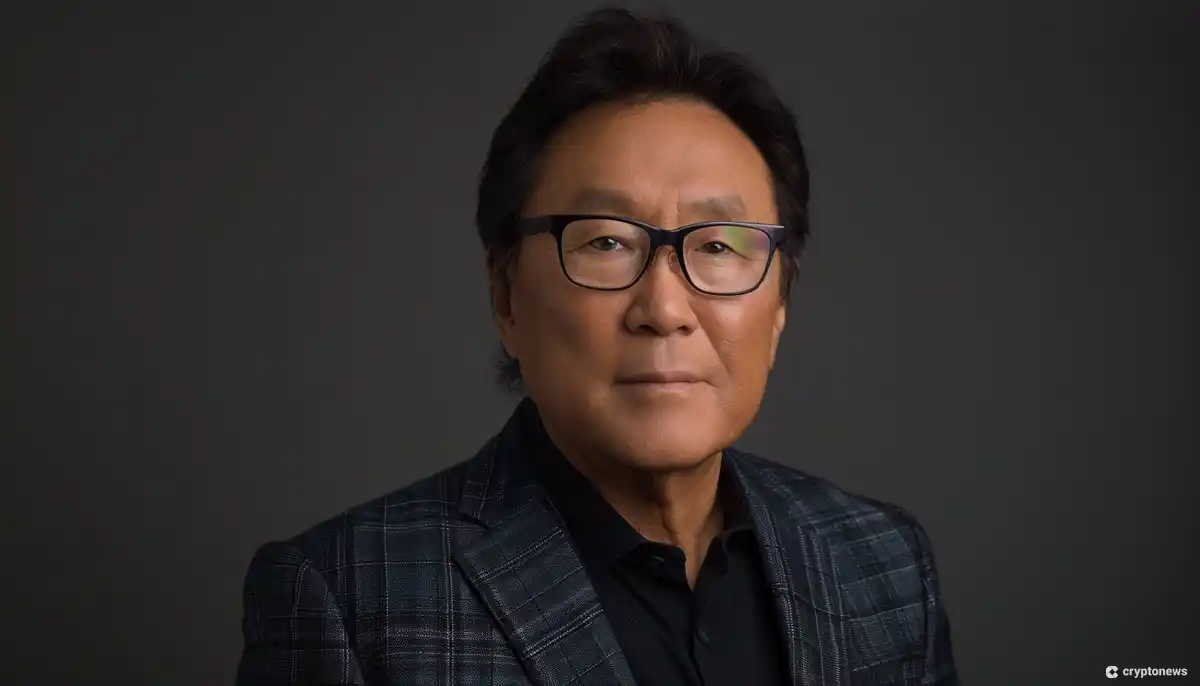

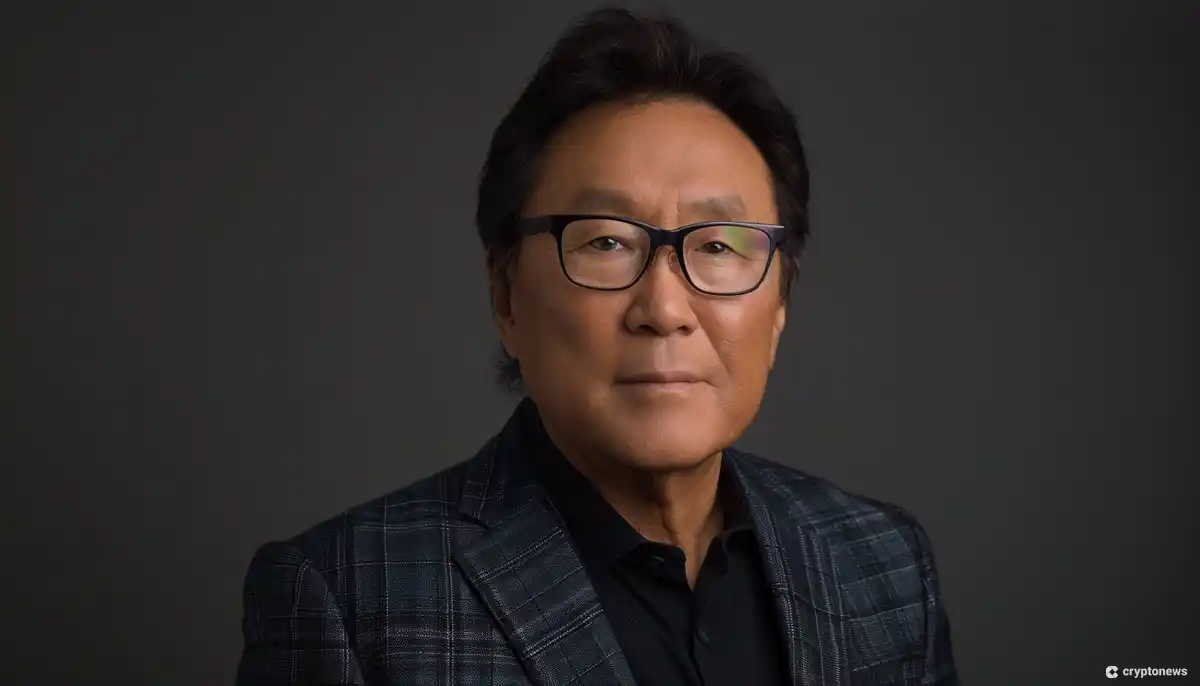

'Rich Dad, Poor Dad' Author Suggests Bitcoin Could Be a Scam, But Doesn't Dismiss Its Potential

03/27/2024 02:35

Robert Kiyosaki has expressed support for bitcoin as a major asset but cautions about the possibility of a scam.

Last updated: | 2 min read

Robert Kiyosaki, best known for his book “Rich Dad, Poor Dad” has voiced his support for Bitcoin. On March 26, he described Bitcoin as “the perfect asset at the right time” but noted that it could be a scam or a Ponzi scheme.

The New York Times best-selling author, who has maintained a bullish stance on Bitcoin over the years, clarified that the potential of a Bitcoin scam is no more than any other fiat currency, including the US Dollar.

Robert Kiyosaki Tags US Dollar and Other Fiats as “Giant Ponzi Schemes”

Kiyosaki shared his concerns in an X post, arguing that Bitcoin could be a Ponzi scheme that might as well fall to zero. According to him, Bitcoin has the same tendency to depreciate as fiat currencies.

Q: Are you a Bitcoin Bull?

A. Yes. Bitcoin is the perfect asset at the right time. I love Bitcoin. Wish I had bought more earlier.

Q: Is it possible that Bitcoin is a scam, a Ponzi scheme?

A: Yes. It is possible Bitcoin is a scam and a Ponzi scheme.

Q: Aren’t you…

— Robert Kiyosaki (@theRealKiyosaki) March 26, 2024

The author affirmed his undeterred support for Bitcoin by likening his optimism about the crypto asset to Metcalfe’s Law, a rule that states that the value of a network increases with the square of the number of its users.

In this instance, the “number of users” in the law are retail and institutional traders who use and adopt Bitcoin, making its network valuable.

It could be recalled that Robert Kiyosaki had predicted the price of Bitcoin to scale as high as $100,000 by the end of 2024.

BITCOIN on fire. The biggest mistake you can make is to procrastinate. Important to start, even if only for $500. Next stop $300,000 per BC in 2024

— Robert Kiyosaki (@theRealKiyosaki) March 6, 2024

Meanwhile, the concerns and optimism for Bitcoin came in the wake of his recent announcement to purchase 10 more BTC before Bitcoin halving in April – which is expected to slash block rewards to 50%.

I am buying 10 more Bitcoin before April. Why? The “Having.” If you can’t afford a whole Bitcoin you may want to consider buying 1/10 of a coin, via the new ETFs or Satoshi’s.

If the Bitcoin process works as designed you may own a whole Bitcoin by the end of this year.

I…

— Robert Kiyosaki (@theRealKiyosaki) March 25, 2024

Halving will reduce the amount of BTC that will be mined daily from 900 to 450 to drive the BTC value to a moonshot.

Kiyosaki also believes that most of the digital assets from the Ethereum network will cease to exist because they fail Metcafe’s law due to their lack of a strong network.

Bitcoin Scores All-Time-High Price Mark

While Bitcoin volatility is a major consideration for retail and institutional investors, Robert Kiyosaki’s measured outlooks and Metcafe’s concept underpin the growing confidence in Bitcoin’s long-term viability as an investment asset.

At press time, BTC trades at $69.700K per coin, recording 30.85% gains in the past 30 days.

Interestingly, the asset has gained further traction due to spot Bitcoin exchange-traded funds (ETFs). While there have been recent outflows worth $942M, inflows are still strong at $12.3B. The soaring inflows of Bitcoin ETFs and speculations surrounding the upcoming Bitcoin halving have driven BTC to an all-time high price of $73,750 on March 14, 2023.

We are here.

At the same spot as in November 2020.

ATH breakout and re-test before Bitcoin printed a real rally.Stop creating so much drama. pic.twitter.com/WRiC2JBrkW

— Bloodgood (@bloodgoodBTC) March 19, 2024

As the cryptocurrency market continues to mature, Kiyosaki advised traders and investors to look out for valuable insights from experts on how to leverage new opportunities in the digital asset space, but most importantly, find answers.