Staked Ethereum reaches weekly high: How whales played a part

03/27/2024 22:00

In three separate transactions. a whale sent 12,800 Ethereum [ETH] to the Beacon Chain on the 27th of March. According to Whale Alert

- Deposits on the chain have outpaced withdrawals this week.

- The number of ETH staked decreased as the price of the altcoin jumped.

In three separate transactions, a whale sent 12,800 Ethereum [ETH] to the Beacon Chain on the 27th of March. According to Whale Alert, the first transfer was 6400 ETH, valued at $23.05 million.

The subsequent ones were also with the same amount.

For the uninitiated, the Beacon Chain has been a key part of Ethereum since it transitioned to Proof-of-Stake (PoS). With the chain, users can participate in governance, act as validators, and also stake their ETH.

It’s raining interest on the chain

Previously, the Beacon Chain only allowed deposits via a contract. However, the 2023 Shanghai upgrade changed that and provided validators to withdraw their staked assets.

AMBCrypto’s evaluation showed that these transactions mentioned above have had a positive impact on the staking sector.

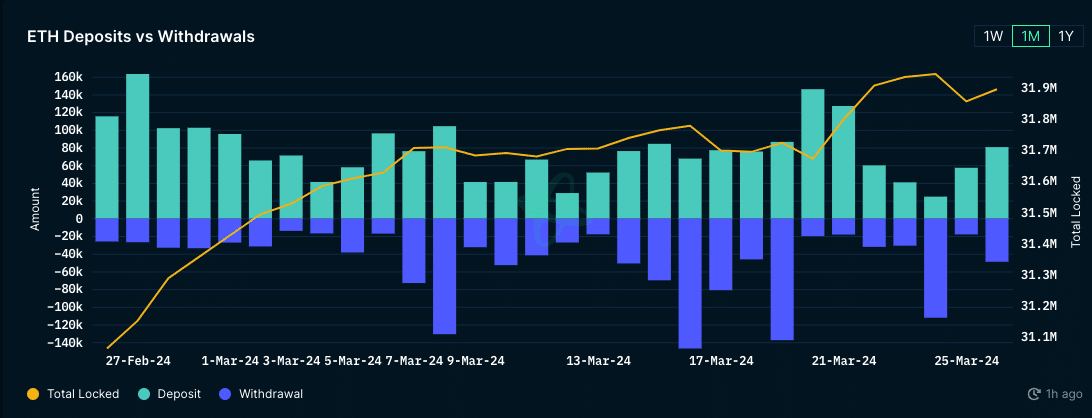

At press time, Nansen data showed that deposits since the beginning of the week tapped a new high.

Details from our examination showed that ETH deposits were as high as 80,463. However, withdrawals could not match up as the number was 49,101 ETH as of this writing.

This difference was proof that validators, who were to deposit a minimum of 23 ETH, trusted Ethereum to produce a good yield. In total, 23.9 million ETH has been deposited since Shanghai.

Withdrawals, on the other hand, have been lower at 10.1 million.

As expected, Lido Finance [LDO] led the top entities’ cohort. However, there has been a change in the supply of ETH staked. In a previous article, AMBCrypto reported how nearly 30% of the supply was locked.

Price increases drive withdrawals

But press time data showed that the ratio has declined to 26%. This decrease could be connected to the surge in withdrawals at different times.

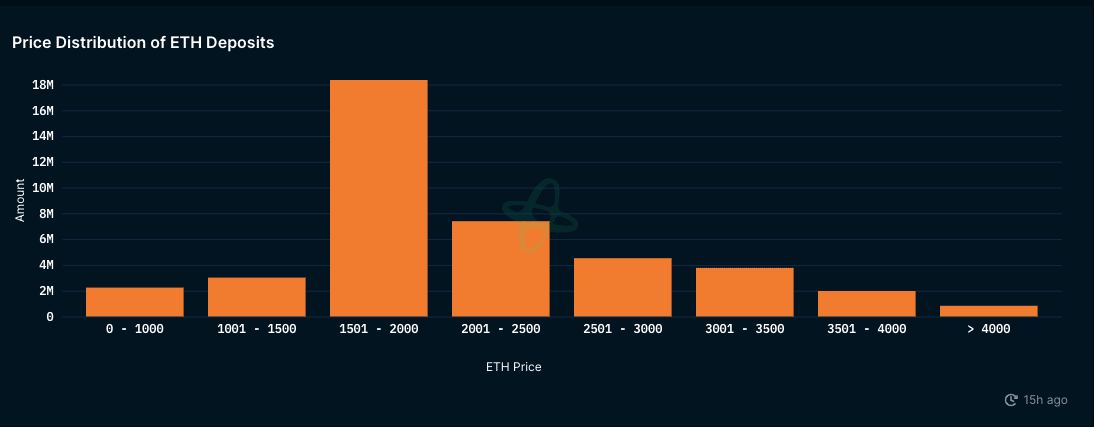

Furthermore, on-chain data showed that as the price of ETH increased, the deposits fell.

From the chart below, you can see that the amount of staking deposits when the cryptocurrency traded between $2,500 and $3,000 was higher than when the value was over $4,000.

This data explains that some validators were satisfied with the reward as those prices. If this trend continues, then deposits on Ethereum’s Beacon Chain might reduce as the price increases.

However, the sentiment might change considering what happened when ETH changed hands below $1,500 and when it traded above it.

In the meantime, ETH’s price was $3,585. This value was a 2.05% decrease in the last 24 hours. Despite the recent decline, there have been bullish predictions for the cryptocurrency.

Realistic or not, here’s ETH’s market cap in BTC terms

If these predictions come to pass, then it might instill confidence in validators waiting on the sidelines to lock their assets.

At the same time, those who have staked at a much lower value could view the hike as an opportunity to get their yield.