Ethereum price predicted to hit $4000 again – Here’s why

03/28/2024 02:00

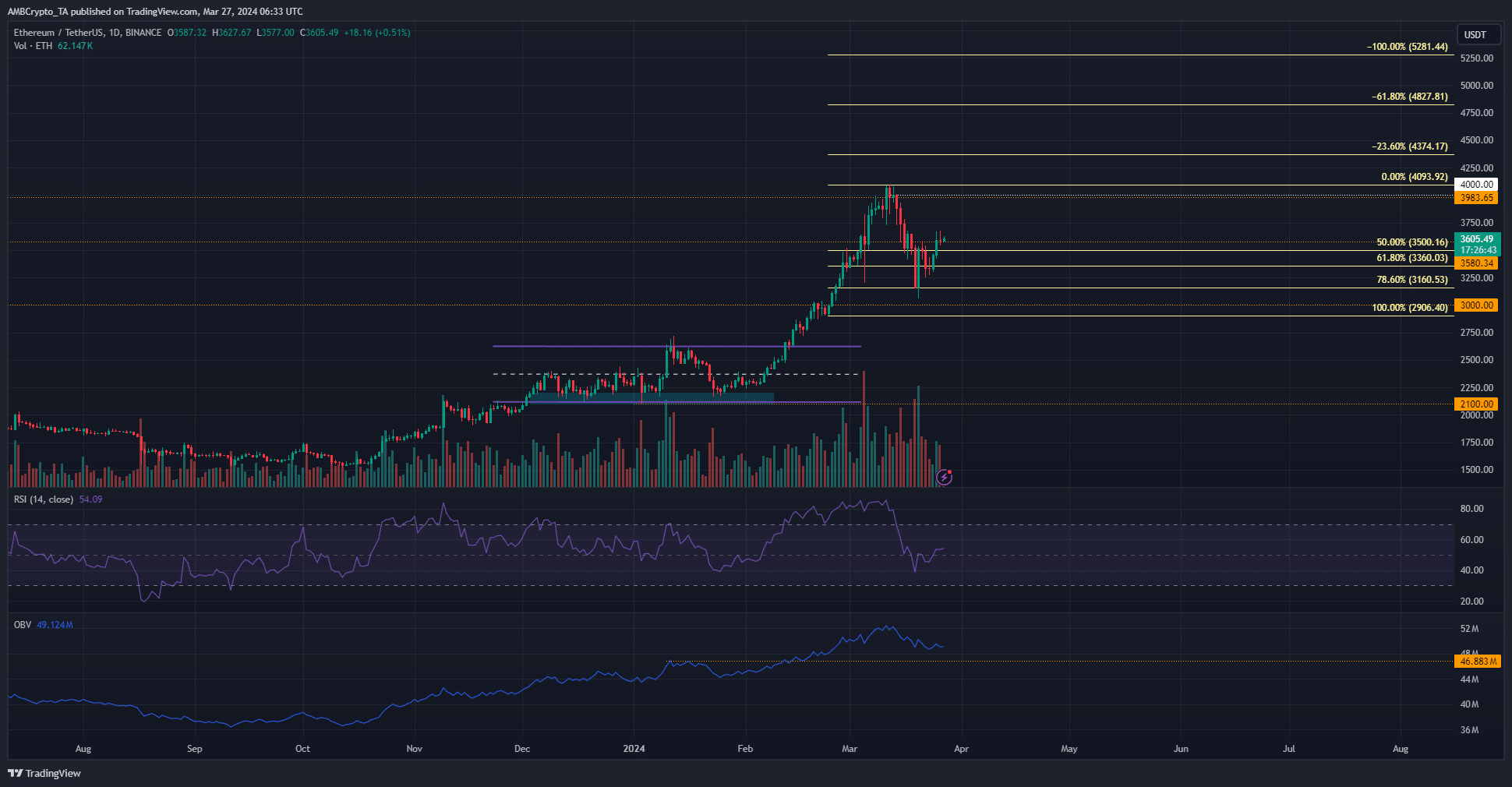

Ethereum soared above the $3580 resistance after a shockingly deep retracement that nearly fell below $3000- but a recovery was underway.

- Ethereum displayed a bullish market structure on the 1-day chart.

- However, buyers were fighting for control and winning at press time.

Ethereum [ETH] witnessed a negative Coinbase Premium after the recent retracement from $4.1k.

The complications surrounding an Ethereum ETF could explain why U.S. investors have grown less bullish on the asset in March.

Another AMBCrypto report highlighted that long-term ETH holders were not selling their tokens. Technical analysis also outlined a bullish outlook.

The retest was perfect in hindsight

The 1-day chart of Ethereum formed a swing low at $3056 on the 20th of March. Despite the deep retracement, the market structure remained bullish on the daily timeframe.

The RSI, which sank below 50, was at 54 at press time.

This indicated that bearish momentum briefly held sway, but the bulls were fighting for control once again. Meanwhile, the OBV did not test the mid-February resistance as support.

Therefore, buying pressure remained stronger in the long term.

The selling volume in March was significant, but not enough to overthrow the buyers. The Fibonacci retracement levels (pale yellow) showed that the $3160 was a critical support level.

Prices bounced from this level without closing the 1-day candle below it.

Additionally, the $3580 resistance was on the verge of being breached. The evidence at hand suggested more gains were likely to arrive.

The argument for an ETH move past $4000

The move to $3000 wiped out an estimated $8 billion in liquidation levels. Further losses could have resulted in greater losses for the bulls, but prices reversed and began to climb higher.

Realistic or not, here’s ETH’s market cap in BTC’s terms

To the north, the $3940 and $4150 were the next areas of interest to watch. They have a high number of liquidation levels concentrated around them.

ETH could decide to collect this liquidity and reverse, or breakout, depending on sentiment around both Ethereum and Bitcoin [BTC].

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.