Bitcoin (BTC) Whales' Holdings Skyrocket by 6,900% Amid Price Dip

04/03/2024 17:09

Bitcoin (BTC) witnesses crazy 6,900% increase in whale activity worth $2 billion, but surprising Silk Road twist emerges

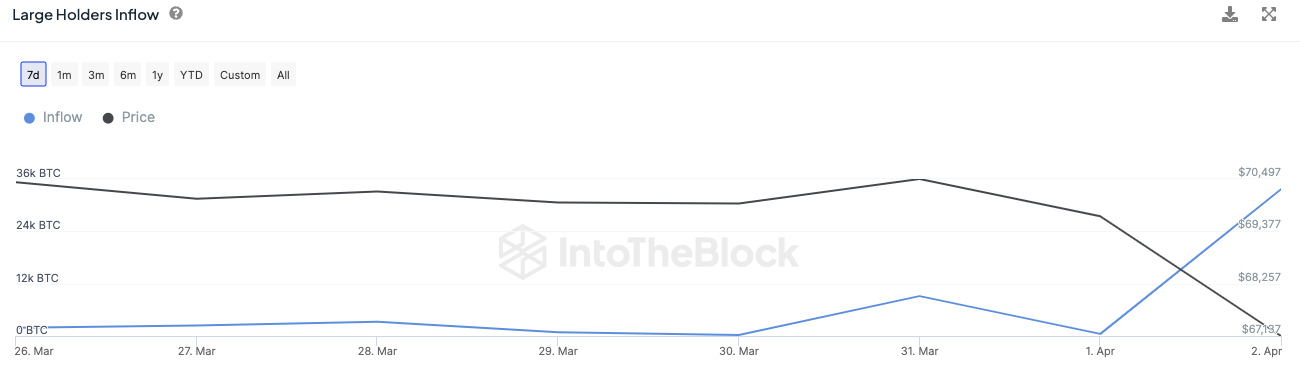

Data from IntoTheBlock's Large Holders Netflow metric has revealed a staggering surge in Bitcoin accumulation by whales during the recent market downturn. Wallets holding at least 0.1% of the total Bitcoin supply seized the opportunity to bolster their holdings by adding nearly 33,000 BTC to their stacks in a single day, translating to a whopping $2 billion investment.

Delving into the figures, the net flow of Bitcoin into the wallets of these large holders witnessed a remarkable turnaround. On April 1, outflows exceeded inflows by 3,530 BTC. However, by April 2, the tide had shifted dramatically, with a net inflow of 32,750 BTC into these whale addresses.

This surge marked a staggering 6,900% increase in Bitcoin flow, indicating what may be a significant shift in accumulation patterns among major investors.

Silk Road's Bitcoin on move

While some attributed this surge to market optimism and strategic accumulation, others offered a contrasting perspective. Thus, it was suggested that the sudden spike in Bitcoin movements could be linked to the U.S. government's actions regarding confiscated assets.

— Spot On Chain (@spotonchain) April 2, 2024The Silk Road BTC address (linked to the US government) moved 2K $BTC ($131M) to Coinbase Prime and 29.8K $BTC ($1.95B) to a new address 1 hour ago.

This is likely an OTC deal and does not directly affect the BTC spot price, but BTC has dropped 4.6% in 24 hours.

They still hold… pic.twitter.com/XxZ5r9SYvP

Specifically, attention was drawn to the Silk Road BTC address, associated with U.S. authorities, which recently executed substantial transfers. Notably, 2,000 BTC, valued at $131 million, were sent to Coinbase Prime, while a significant sum of 29,800 BTC, worth $1.95 billion, was relocated to a new address.

Although these transactions are likely part of an over-the-counter (OTC) deal and may not directly influence spot prices, they coincide with a decline in BTC value over the past 24 hours.