Due to the ongoing meme coin frenzy, DEXs on the Solana network have taken up the majority of trading volume over the past 24 hours.

According to CoinGecko, Solana-based decentralized exchanges (DEXs) accounted for most trading volume over the past 24 hours. The top three were Raydium, Jupiter, and Orca. Raydium’s volume in the last 24 hours was $2.2 billion, almost double that of Uniswap V3 on Ethereum.

Weekly DEX volume on Solana has been increasing relative to Ethereum for nearly four months. Currently, the weekly DEX volume on Solana divided by the weekly DEX volume on Ethereum is 29.4%, down from 10.7% at the beginning of December 2023.

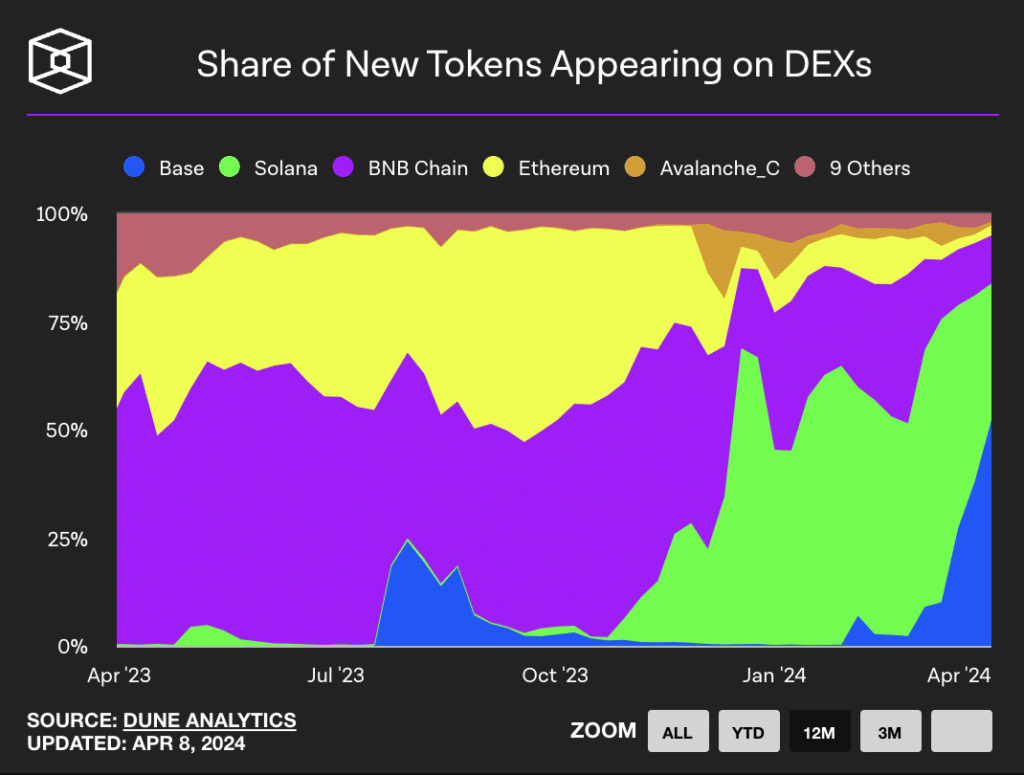

In addition, the number of new tokens on the Base and Solana networks has increased sharply in recent months. According to The Block, Base accounted for over half of all listed tokens on DEXs at the beginning of April. At the same time, Solana accounted for about 16,000 new tokens. On April 8, the number of new DEX tokens on Base was around 1,010 against a total of 1,650, one of the most significant shares.

Interest in Base and Solana has been growing since December 2023, primarily due to the excitement surrounding the emergence of many meme coins. Thousands of new tokens appear on Solana every day, the price of some of which is inflated by speculators several times over.

Solana’s low fees have made it the premier blockchain for launching meme coins. Users typically need to download a Solana-enabled wallet and use the SOL token for transactions. Amid the popularity of meme coins, the price of SOL almost doubled at the beginning of the year, exceeding the $200 mark for the first time since the end of 2021.