March 2024 Report: Bitcoin vs. inflation, Ethereum NFTs, and April forecast

04/09/2024 00:15

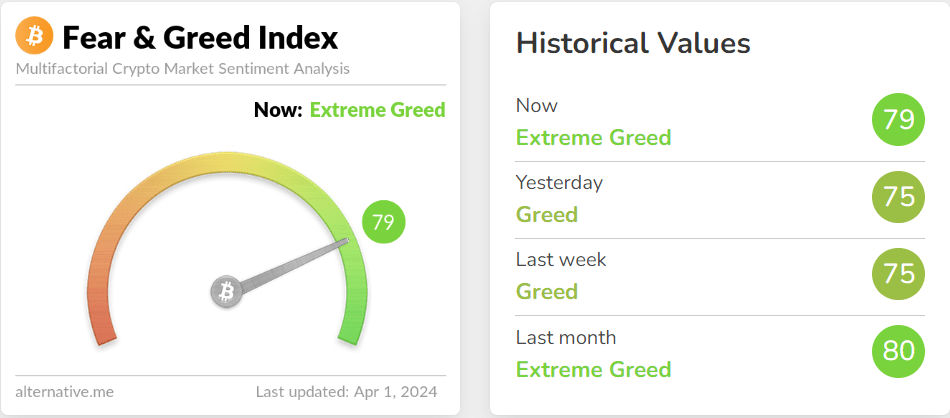

For more than three weeks now, the Crypto Fear & Greed Index has been above the 70-mark. A high value is a warning of market correction.

Context of the article

The global economy is recovering from the period of saturation, and major indices across the globe are booming. Though inflation has eased in most nations, policymakers warn that achieving the Central Banks’ target of around 2% will be quite hard. Indermit S. Gill, Senior Vice President and Chief Economist of The World Bank Group predicts advanced and developing economies—are set to grow more slowly in 2024 and 2025 than they did in the decade before COVID-19.

So, the pertinent question – 2024’s crypto boom: Is it a sign of recovery or a bubble in the making?

Let’s find out

For more than three weeks now, the Crypto Fear & Greed Index has been above the 70 mark. The index ranges from 0 (extreme fear) to 100 (extreme greed), a high value is a warning of a potential market correction. Over the past two months, there has been an unprecedented level of demand – something that the crypto market has never seen in its entire existence.

AMBCrypto’s research report for March 2024 reveals U.S. billionaires have been selling their stocks. Out of all the sales, the much-talked-about has been that of JPMorgan Chase & Co. CEO Jamie Dimon who sold $150 million worth of shares in the banking company for the first time in 18 years. Each billionaire has their own reasons, but it might have something to do with growing interest in cryptocurrencies from big money players.

What coins were the March Market Movers?

Bitcoin

- The king coin hit a new All-Time-High (ATH) at $73,797.35 on 14 March with its market cap surpassing that of Silver. While analysts have been predicting $100k as the next ATH, the AMBCrypto report argues Bitcoin hasn’t reached its ATH figure yet and investors are trading it with a false sense of achievement in mind.

- Interestingly, as soon as the coin crossed the $72k level, the Long-Term Holder cohort increased their overall distribution pressure. Consequently, the market saw over $2.6B/day in realized profit.

- Now, if BTC manages to turn the $70k level into strong support, New Yorkers will benefit most from the price surge. It’s important to note the $70k psychological level is a good liquidity area. It has already been tested as resistance multiple times. Thus, strengthening the case for the bulls.

- Meanwhile, the arrival of a Bitcoin spot ETF has been a major boost for the cryptocurrency, with inflows of roughly $12.1 billion by the close of the first quarter.

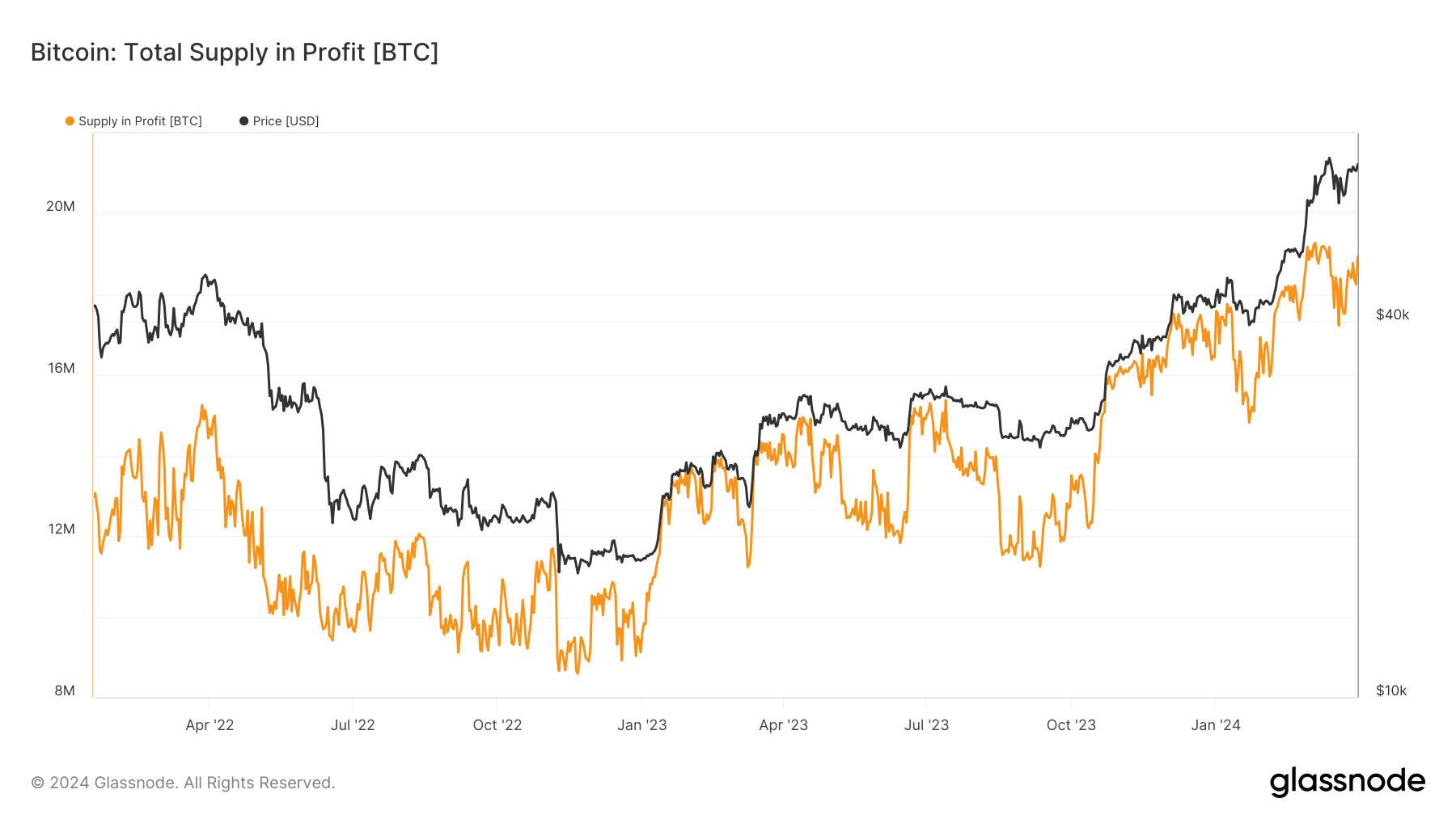

- The good news is most of the investors holding BTC in their portfolios are profitable, at the moment. As per the Supply in Profit metric, on 1 April, 18M addresses were in profit, this was an increase of 3M from its cycle-low of 15M.

Ethereum

- With the Dencun upgrade going live in March, Ethereum unlocked a new level for developers’ growth as the scalability-related challenges and gas fees issue were addressed.

- Ethereum’s price has successfully maintained its $3500 support. It reached $4000 recently, the highest point in nearly two years. This could be attributed to various factors, including increased DeFi activity and anticipation of the Dencun upgrade.

- AMBCrypto’s research report reveals that the outlook ahead for Ethereum is positive and the anticipation of a spot ETH ETF could shape its future rally.

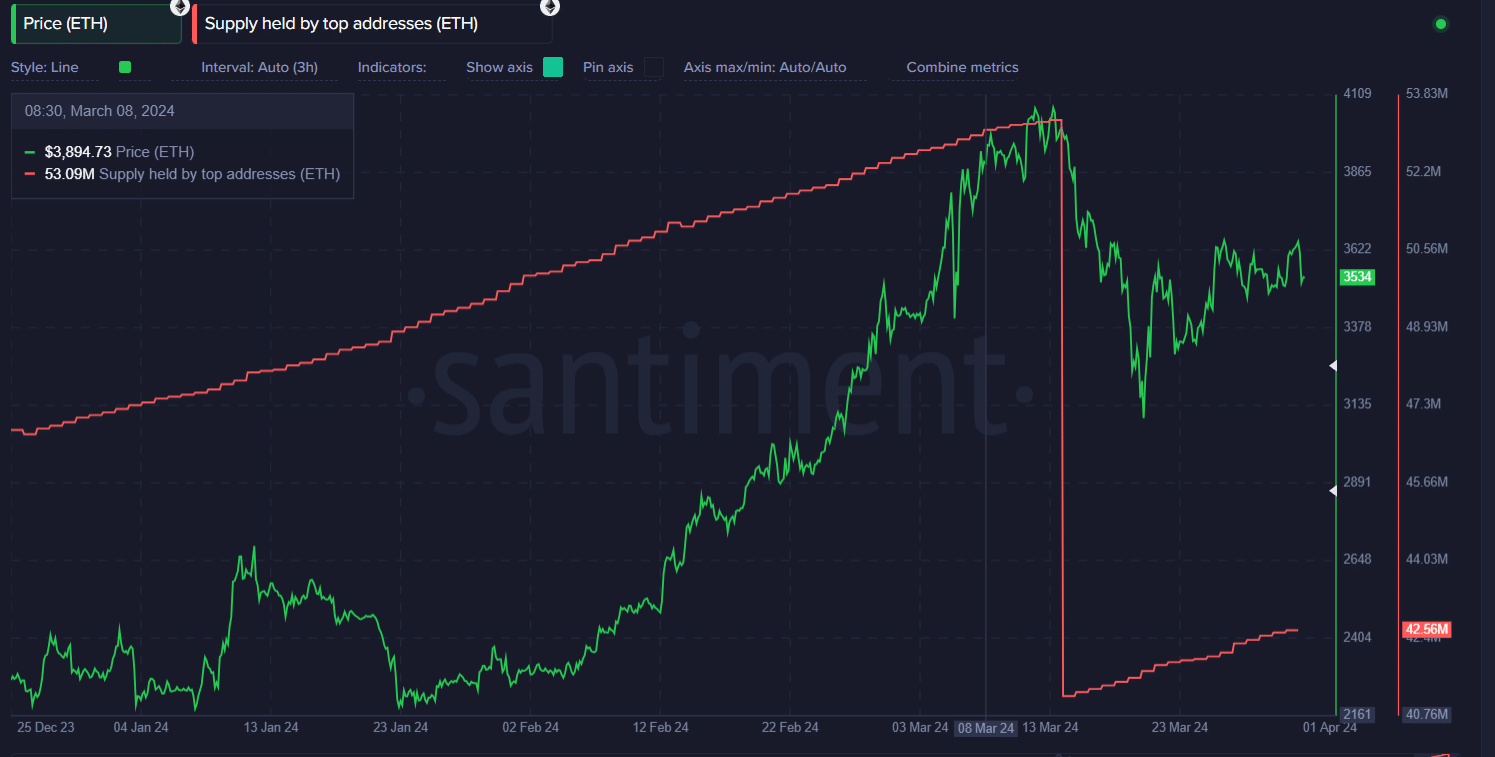

- Notably, after a big sell-off on 14 March, the top 10,000 richest wallets bought 42.56 million ETH. This buying spree is expected to help Ethereum have a good start in April 2024 for two main reasons. First, these big investors have a lot of power over the price of Ethereum and can affect how regular people invest too. Second, these wallets usually plan to keep their holdings for a long time, which could mean April might not see a lot of sell pressure.

Memecoins and DePIN sector

- In the past month, meme coins like WIF, PEPE, and FLOKI saw a big surge in their prices, doing even better than popular ones like DOGE and SHIB. Many traders saw their investments surge by triple digits. The trading activity, consequently, reached a peak last seen in November 2021. According to AMBCrypto’s report, many of these traders were hoping to make enough money from meme coins to buy Bitcoin later on.

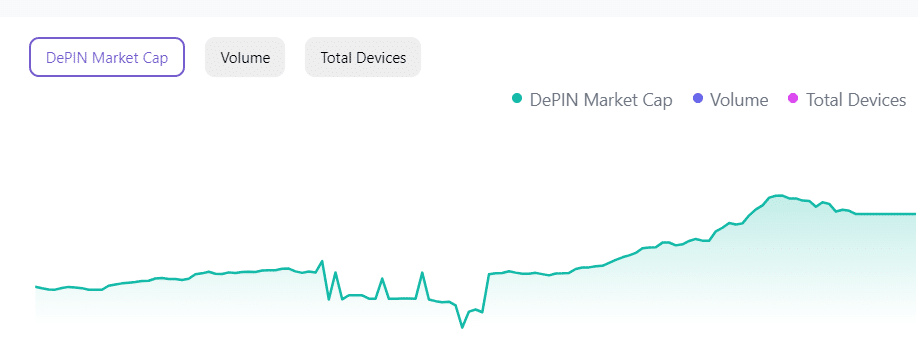

- During every big surge in the crypto market, there are popular stories that catch everyone’s attention. For example, in 2017, people were excited about ICO coins and privacy coins. Then, in 2021, DeFi, NFTs, and layer 1s became the big things. Now, analysts predict that during 2024-25, DePIN will be the most important trend in the crypto world.

- Since the start of 1 January 2024, DePIN Market Cap has grown by $35,370.826 million. Solana saw the most significant rise in trading volume among major DePIN projects, with a notable increase of 52% over the past 30 days.

The biggest loser

According to Alex Casassovici, founder of Web3 streaming project Azarus, we are witnessing the first real bear market for NFTs. Indeed, the NFT Sales Volume in the last 30 days has fallen by 8.50% while the NFT transactions have declined by 45.79%. NFT sellers, on the other hand, have increased by 45.25%. Thus, painting a very bleak picture for the overall market.

Interestingly, AMBCrypto’s report reveals a surprising outperformance by Bitcoin NFTs compared to their Ethereum counterparts.

Read Bitcoin’s [BTC] Price Prediction 2024-25

About Crypto Market Report – March 2024

AMBCrypto’s latest report is a comprehensive analysis of March’s market trends and it offers valuable insights for predicting market movements in April.

The report dives into key topics like –

- Bitcoin vs. inflation

- BTC’s next ATH projection

- Ethereumization of Bitcoin

- ETH’s price potential

- NFT market dynamics

- Market forecast for April

You can download the full report here.