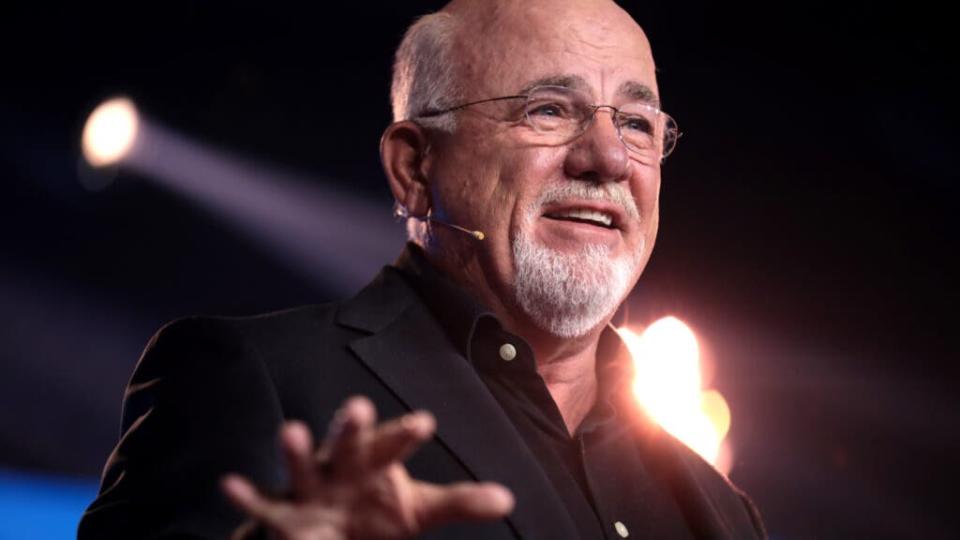

'They're Just Awful,' Dave Ramsey Snaps At Millennials And Gen Z Living With Their Parents — 'Can't Buy A House Because They Don't Work'

04/09/2024 07:47

In an interview with Fox Business on April 3, personal finance icon Dave Ramsey addressed criticisms from millennials and Gen Z amid discussions on social media and recent coverage by The Wall Street Journal (WSJ). The WSJ piece highlighted a trend among people younger than 40, suggesting a significant portion believes Ramsey's financial advice does not align with their economic realities. This sentiment is echoed on platforms like TikTok, where the hashtag #daveramseywouldn'tapprove is being us

In an interview with Fox Business on April 3, personal finance icon Dave Ramsey addressed criticisms from millennials and Gen Z amid discussions on social media and recent coverage by The Wall Street Journal (WSJ).

The WSJ piece highlighted a trend among people younger than 40, suggesting a significant portion believes Ramsey's financial advice does not align with their economic realities. This sentiment is echoed on platforms like TikTok, where the hashtag #daveramseywouldn'tapprove is being used to showcase decisions that deliberately counter his financial guidance.

Don't Miss:

The average American couple has saved this much money for retirement — How do you compare?

Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

During the conversation, co-host Dagen McDowell pointed to the growing trend of public dissent among younger generations toward Ramsey's teachings. Despite this, Ramsey emphasized the positive attributes of these generations, calling them "excellent generations." He lauded many millennials and Gen Zers for their diligence, financial savvy and adherence to principles of saving, investing and supporting the free enterprise system. Ramsey mentioned the young employees at Ramsey Solutions, describing them as hardworking people who exemplify the virtues of financial responsibility and independence.

Ramsey also offered a critique of a segment of these younger cohorts. He expressed his frustration, saying, "Then there's a segment of them that just sucks. They're just awful. I mean, their participation trophy, they live in their mother's basement, and they can't figure out why they can't buy a house because they don't work, you know, stuff like that." These are the attitudes and work ethic he perceives as problematic among the younger generations.

Trending: Breaking records, mortgage loans generated $12.25 trillion of household debt nationwide – What are the other major categories of debt?

Despite facing backlash and skepticism on social media and in articles, Ramsey defended his 35-year record of providing financial advice. He acknowledged the role of social media in amplifying dissent but also recognized its capacity to spark meaningful conversations about personal finance. "I'm really good clickbait," he said.

According to Bank of America Corp.'s annual Better Money Habits survey, 85% of Gen Zers identify at least one obstacle on their path to financial success, with the rising cost of living being the primary concern for 53% of these respondents. The data offers a window into the strategies that young people employ to navigate the financial challenges of today's economy.

The financial challenges faced today span across generations — they're not confined to Gen Z and millennials. Rising living costs, inflation and job security concerns are universal issues affecting many people's ability to maintain financial stability. Recognizing that these struggles are widespread is the first step toward addressing them constructively.

Seeking guidance from a financial adviser can be an essential move for anyone striving to improve their financial situation. These professionals offer personalized advice to help people navigate financial planning, budgeting, saving and investing.

Read Next:

Americans got swindled out of $24.6 billion in the last 3 years – here’s how millionaires protect their assets.

For many first-time buyers, a house is about 3 to 5 times your household annual income – Are you making enough?

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 'They're Just Awful,' Dave Ramsey Snaps At Millennials And Gen Z Living With Their Parents — 'Can't Buy A House Because They Don't Work' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.