Ethereum vs BNB: 5 key differences in crypto futures this April

04/11/2024 22:00

Binance Coin [BNB] is showing signs of weakness in the perpetual futures market. Coinglass' data showed that this month, it...

- BNB’s funding rate has been mostly negative since the beginning of the month.

- BNB accumulation remains steady in the coin’s spot market.

Binance Coin [BNB] is showing signs of weakness in the perpetual futures market. Coinglass’ data showed that this month, it has experienced the most negative funding rates of the top five leading crypto assets.

Information retrieved from the data provider revealed that between the 4th and 8th of April, the coin’s funding rate across exchanges was negative.

Funding rates are used in perpetual futures contracts to ensure that an asset’s contract price stays close to its spot price.

When an asset’s contract price is higher than its spot price, traders who have placed bets on a price rally (long traders) pay a fee to traders anticipating a decline (short traders). When this happens, the asset’s funding rate will be positive.

Conversely, when the contract price is lower than the spot price, short traders pay a fee to traders holding long positions, resulting in negative funding rates. When an asset’s funding rate is negative, more traders are holding short positions than there are traders expecting a price rally.

Ethereum vs BNB

In comparing Ethereum and BNB, particularly in the volatile arena of crypto futures this April, several key differences emerge. Firstly, Ethereum’s funding rates have remained more stable compared to BNB’s dramatic shift from negative to positive within days.

Secondly, while BNB showed a significant 29% increase in futures open interest, Ethereum’s growth in this area has been more consistent, reflecting its broader market acceptance.

Thirdly, BNB’s quick rebound in the futures market contrasts with Ethereum’s steadier, more predictable market movements. Fourthly, the negative funding rates experienced by BNB highlight a market sentiment that differs markedly from Ethereum, which typically enjoys a more balanced view among traders.

Finally, the comparison of key momentum indicators, such as the Relative Strength Index (RSI) and Money Flow Index (MFI), would likely show differing trends between the two, with BNB recently witnessing a surge in accumulation not necessarily mirrored by Ethereum.

These differences underscore the unique dynamics and investor sentiment driving each cryptocurrency, providing insightful perspectives for traders navigating the futures markets.

Separately, according to Coinglass, BNB’s futures market sentiments have improved in the past four days, as the funding rate has remained positive. This has also been accompanied by a rally in the coin’s futures open interest.

At $747 million at press time, BNB’s futures open interest has increased by 29% since 8th April.

The market steadies

As of this writing, BNB exchanged hands at $611. Per CoinMarketCap’s data, its value has grown by 5% in the last week.

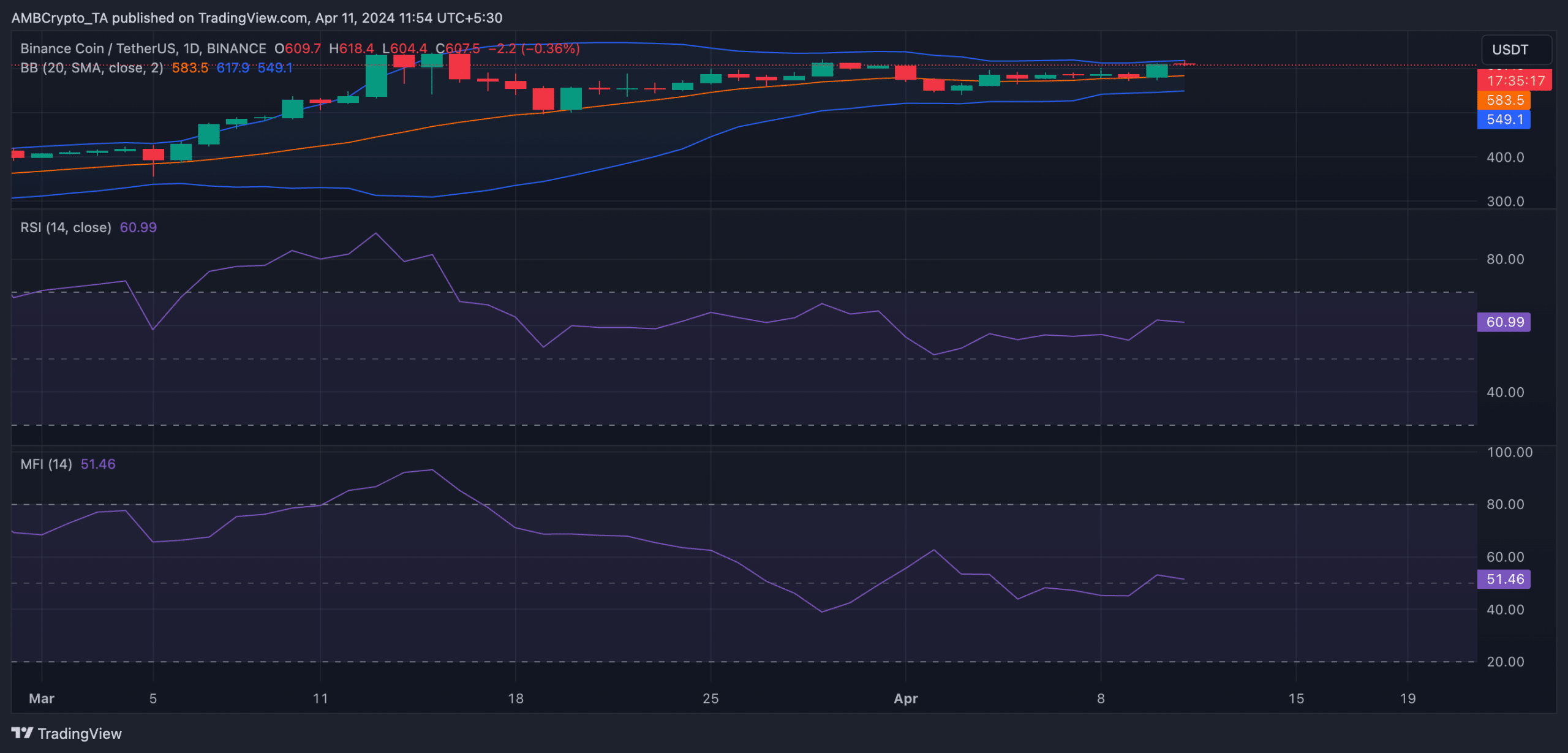

As the coin attempts to consolidate within a range, market volatility has reduced significantly. An assessment of BNB’s Bollinger Bands showed a narrow gap between the upper and lower bands that make up the indicator.

When the gap between these two bands is narrow, the market experiences low volatility. However, traders also interpret this as a signal that a breakout or significant price movement may occur in the short term.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Further, BNB’s key momentum indicators rested above their respective center lines at the time of writing. Its Relative Strength Index (RSI) was 61.19, while its Money Flow Index (MFI) was 51.44.

These values showed that BNB accumulation persisted among market participants.