Robert Kiyosaki Says No to Spot Bitcoin ETF Investments

04/13/2024 04:17

Robert Kiyosaki, the famous author, expressed his disinterest in investing in Bitcoin ETFs and other Wall Street financial products.

Last updated: | 2 min read

On April 12, Robert Kiyosaki, the renowned author of the “Rich Dad, Poor Dad” book, expressed his lack of interest in investing in spot Bitcoin exchange-traded funds (ETFs) and any other “Wall Street financial products.”

The New York Times best-selling author, who has been a stoic supporter of Bitcoin over the years, noted that he favors direct ownership of physical assets due to his entrepreneurship pathway.

Robert Kiyosaki Claims Bitcoin ETFs Are For Institutions

In an X post, Robert Kiyosaki shared his opinion that spot Bitcoin ETFs and other asset-backed “ETFs are best for most people and institutions.”

Q: Will you buy the Bitcoin ETF?

A: No. Just as I own gold and silver coin and mines and own apartment houses I do not own gold or silver ETFs or REITS, real estate ETFS. ETFs are best for most people and institutions. Personally I am an entrepreneur and prefer to stay as far…— Robert Kiyosaki (@theRealKiyosaki) April 12, 2024

Having invested in a mix of assets like gold, silver, Bitcoin, and real estate, which he said are bargains today, Kiyosaki is sticking to his guns. He believes in making his own financial moves that align with his entrepreneurial spirit.

However, the renowned author reiterated that investors should always choose what is best for them, noting that his stance against Bitcoin ETFs works best for him. If he makes a mistake, he has no one else to blame but himself. Kiyosaki might not be interested in Bitcoin ETFs, but that hasn’t stopped institutions from loving these products.

Meanwhile, the Bitcoin ETFs market is at an all-time high, with tokenization of real-world assets picking up pace.

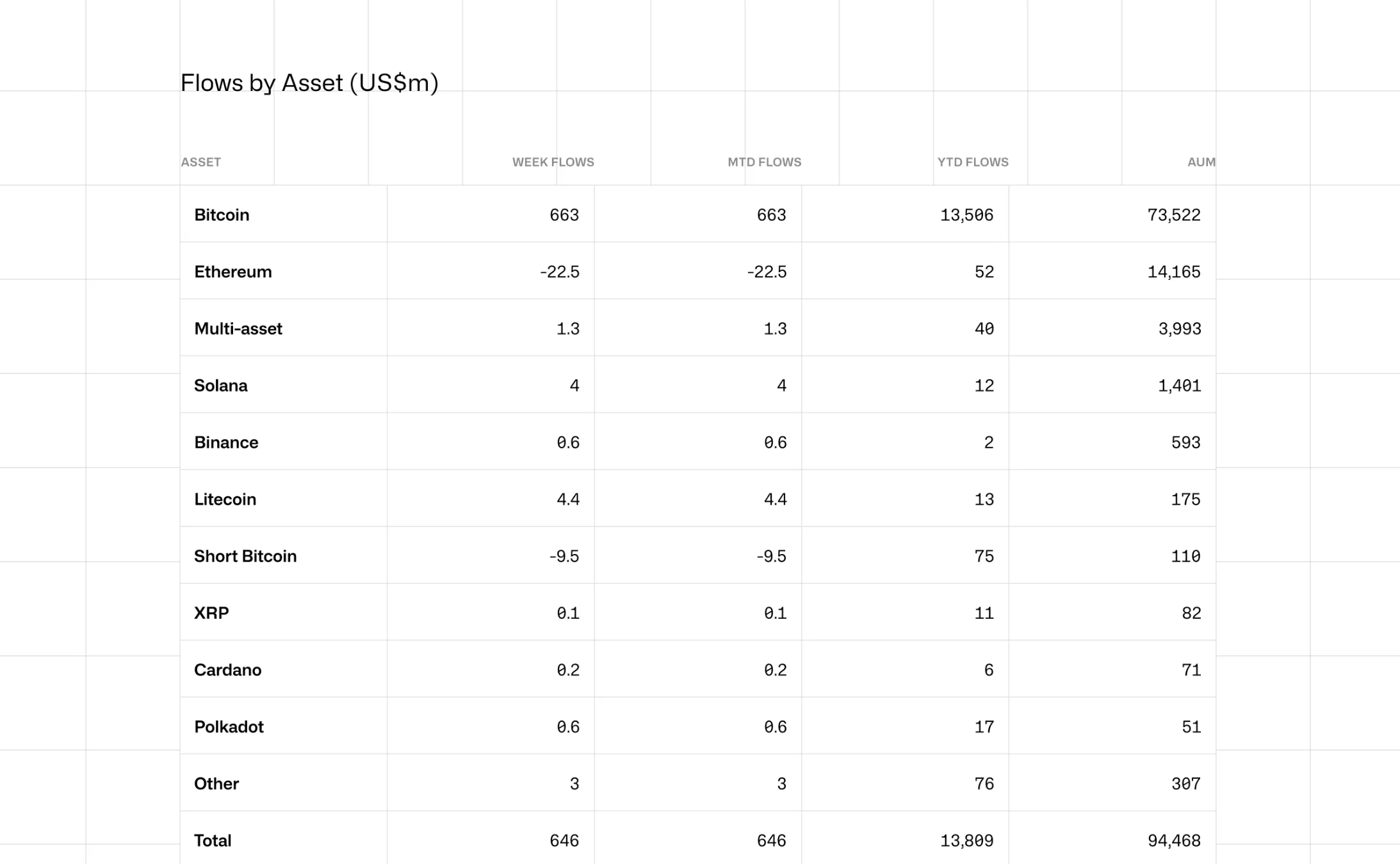

CoinShares data showed that cryptocurrency investment products, including Bitcoin ETFs, recorded positive sentiments. Total inflows were $646 million on April 8, and the year-to-date (YTD) inflow was $13.8B, the highest volume ever recorded.

Howard Lutnick, the CEO of Cantor Fitzgerald, predicted an upward shift towards the tokenization of real-world assets, such as bonds on blockchain technology, during a Chainalysis Links Conference held in New York.

Robert Kiyosaki Endorse Cathie Woods BTC Price Prediction

The remarks of Robert Kiyosaki, who has always been bullish on Bitcoin, came on the heels of the bullish price prediction made by Cathie Woods, the founder of Ark Invest asset management firm, who has been optimistic about the prospect of spot Bitcoin ETFs encouraging institutions to invest in Bitcoin.

During the Bitcoin Investor Day conference in New York on March 22, Wood stated that the BTC price could soar to $2.3M per token

NEW: "Cathie Wood guarantees #Bitcoin will hit 💵 $2.3M per #BTC.

Do I believe her? Yes I do.

Cathie Wood is very smart. I trust her opinion," says Robert Kiyosaki. pic.twitter.com/GpHokUfd6N

— Bitcoin News (@BitcoinNewsCom) April 11, 2024

While Wood’s prediction generated criticism for being unreasonable, Kiyosaki praised her and highlighted his trust in her opinion.

He noted, “Kathie Wood guarantees Bitcoin will hit $2.3 million per BTC. Do I believe her? Yes, I do. Kathie Wood is very smart. I trust her opinion. Could she be wrong? Yes, she could be. So what? The more important question is ‘What do you believe?’ What if Kathie is right? What if Kathie is wrong? And most importantly, ‘How many Bitcoin do you own?’ If Kathie is right, I will wish I bought more.”

While Kiyosaki and Cathie Wood might disagree on ETFs, they both see immense potential in Bitcoin. Their optimism sparks discussions about the asset’s future trajectory and place in the investment space.