Is Ethereum behind Render’s 18% rally?

04/16/2024 02:00

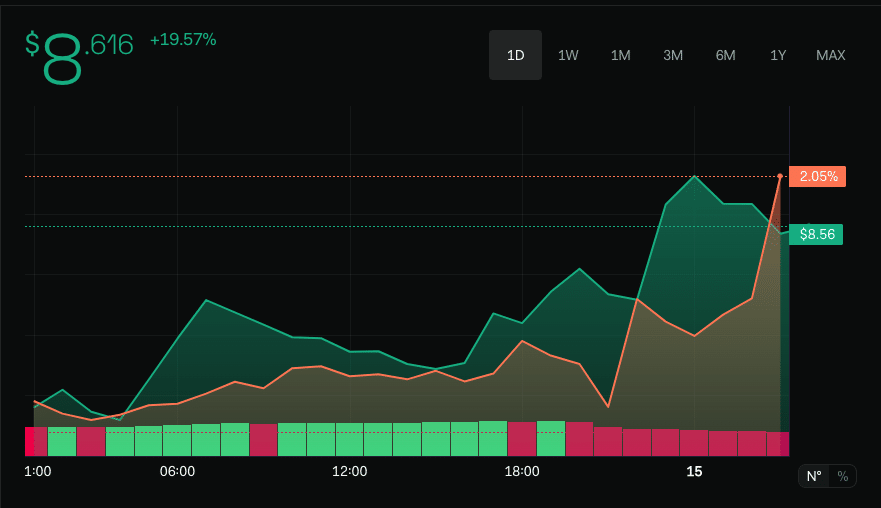

Render [RNDR], the native token of the distributed GPU network built on Ethereum [ETH] jumped by an incredible 18.85% in the last 24 hours

- The token’s value increased, and so did ETH.

- RNDR’s popularity grew among traders, suggesting a significant price hike in the long term.

Render [RNDR], the native token of the distributed GPU network built on Ethereum [ETH] jumped by an incredible 18.85% in the last 24 hours.

This performance made RNDR one of the top assets with the best recovery rate after the broader market experienced a drawdown. Interestingly, the bounce happened as ETH itself was able to reclaim $3,000 and rise above it.

However, there were other reasons the price of RNDR increased. The first thing AMBCrypto noticed was the increase in social dominance.

Did ETH “Render” help?

Analyzing data from LunarCrush, we observed that Render’s social dominance increased by a mind-blowing 116% within the same timeframe the value skyrocketed.

The increase in social dominance implied that the project’s popularity among traders surged. From our findings, traders were attracted to RNDR because of its fundamentals.

Anyone conversant with the market would have observed that many market participants are bullish on projects with the DePIN narrative. DePIN stands for Decentralized Physical Infrastructure Networks.

In the crypto space, projects built around this narrative like Render, use tokens to incentivize holders who utilize the protocol.

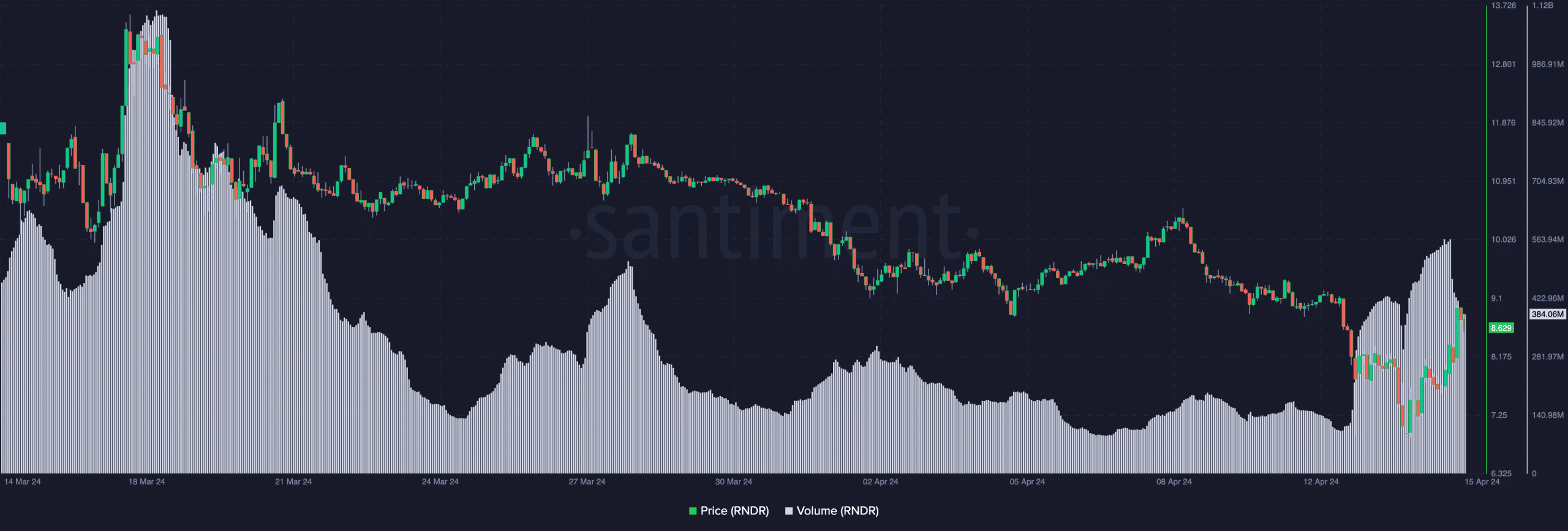

Furthermore, AMBCrypto observed another proof of the interest in RNDR. This time, it was the trading volume. According to Santiment, Render’s trading volume rose to 556.65 million on the 14th of April.

This increase represented a 37.72% jump from the value on the 13th. However, the volume decreased slightly at press time, indicating that RNDR might not have a solid backing to continue its upswing.

Sentiment stays the same

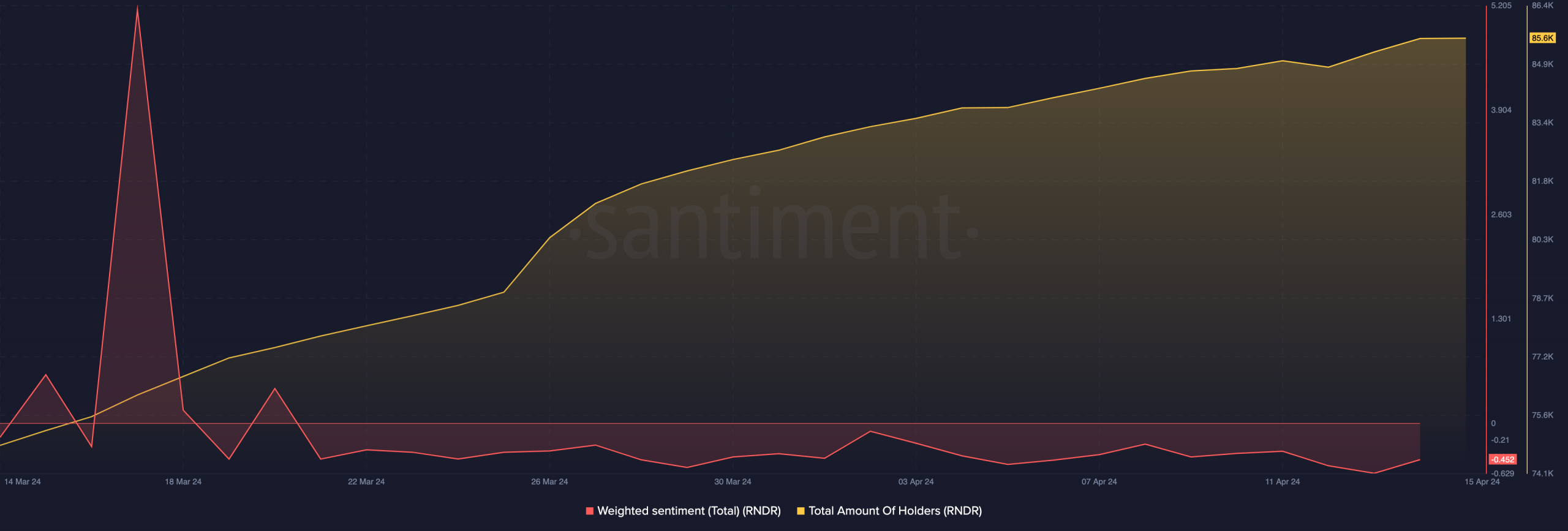

Despite RNDR’s potential, it seemed traders were not yet convinced about its short-term performance. This was evident from the Weighted Sentiment analyzed on-chain.

The metric tracks the average positive or negative comment about a project. If the reading is positive, it means most market participants have a bullish view. On the other hand, a negative reading suggests a bearish perception.

At press time, Render’s Weighted Sentiment was -0.45. With this position, demand for RNDR might decrease in the short term. Should this be the case, the price of the token might fall below $9.

But that does invalidate the long-term optimism around the project. AMBCrypto concluded this after checking the amount of holders.

On the 25th of March, the total amount of RNDR holders was less than 80,000. However, that figure had increased to 85,600 at press time.

Realistic or not, here’s RNDR’s market cap in ETH terms

An increase in the number of holders was a sign of traction on the network and adoption of the token. If this continues, RNDR’s price could head to new highs.

However, it is important to note that there might be corrections in the process. But as long as the DePIN narrative remains relevant in the market, the token might be destined for a higher value.