Ethereum (ETH) Secures $3,000, Cardano's (ADA) Dramatic Drop Irrelevant, Will Shiba Inu (SHIB) Recover After 30% Plunge?

04/16/2024 07:30

Market took unexpected and brutal blow

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

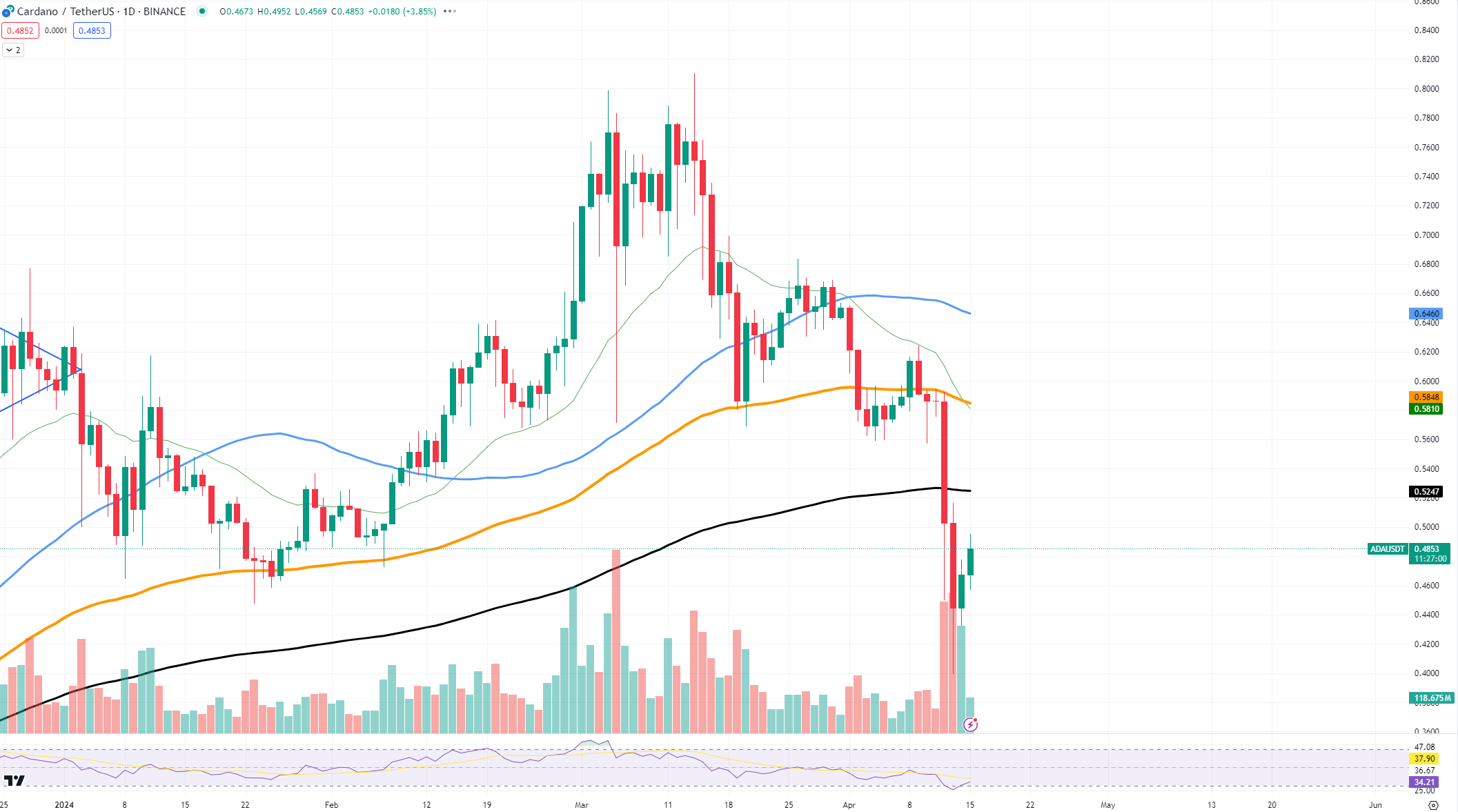

Cardano has witnessed a substantial drop to the $0.4 region, suppressing the price by over 20%. Despite the dip, the ascent suggests a potential rally through the 200 EMA, challenging the downtrend with limited volatility and apathetic trade volume.

Cardano's price action has been a roller coaster, with its recent plunge to the $0.4 support level and a subsequent bounce back. At the time of writing, ADA has seen its value soar above $0.48, instilling a fresh wave of inflows into the market.

It is noteworthy that the descent has not influenced the coin’s longer-term trend, which has been bearish with an absence of significant volume — a hint that the market is still in search of a solid direction. However, the surge above the 200 EMA will push the coin into the bullish zone once again.

If ADA fails, the $0.4 level remains a crucial bastion of support, and its endurance will be critical in preventing further declines. However, if the marketwide recovery continues, there is a good possibility of a prolonged continuation of the rally.

Shiba Inu takes hit

Shiba Inu has seen a sharp 30% decline. But one way or another, the only question in most holders' minds is: "Will Shiba Inu really recover?"

The token's dip to the $0.00002165 mark has been met with a mixture of concern and anticipation. A rebound from this level could signal a strong support base, potentially pivoting SHIB back into an uptrend.

As for the chart, the Bollinger Bands have been preceding the drop as their narrowing was a strong signal of an upcoming price surge. Now, with SHIB having slipped below the crucial 50-day moving average, the only thing left is to wait for a return above this aforementioned level.

The trading activity is pretty quiet, which shows that people are not too confident about SHIB right now. The RSI is suggesting that selling pressure prevailed over buys on the market, pushing the value of the token down.

SHIB will face its first big test at the $0.00002880 level. If it can go beyond that, we might see the price move up toward $0.00003.

As for what's next for SHIB, it is really tough to say, considering the lack of fundamental development around Shiba Inu. However, there is always the possibility of a further price reversal and the return of the buying power on the market in general, which is going to push the value of tokens like Shiba Inu further up - especially if the risk appetite among investors returns.

Ethereum's comeback

Ethereum has made a strong and sufficient comeback, easily returning above the $3,000 threshold. The pivot suggests that Ethereum could continue its path upward despite this minor setback.

Following the dip that moved the market, the price action has been affirmative, reclaiming the $3,000 mark with conviction. This level now forms a bedrock of support, cementing the current price range.

Specifically, the key support at approximately $2,700 is highlighted, a level where the asset has previously beaten the substantial buying pressure. The resistance can be found around the $3,600 zone.

As the price started rising, the volume started moving up, showing a lot of interest on the market. This rise in trading, along with the clear increase in price, has helped the upward trend to gain strength.

The intersection of technical indicators with market sentiment heralds a bullish scenario, where the previous peak at approximately $3,950 is not unreal.

However, the most recent surge of volatility on the market might not go unnoticed, and it is important to avoid any risky moves that might drastically affect your portfolio.