10x Research Founder Who Predicted Bitcoin’s Pre-Halving All-Time High Turns Bearish

04/16/2024 23:59

10x Research Founder Markus Thielen who predicted Bitcoin’s recent pre-halving rally to all-time highs has turned bearish on risk assets such as 10x Research Founder Markus Thielen who predicted Bitcoin's all-time highs has turned bearish.

Last updated: | 2 min read

10x Research Founder Markus Thielen who predicted Bitcoin’s recent pre-halving rally to all-time highs has turned bearish on risk assets such as technology stocks and cryptocurrencies.

In a CoinDesk interview in February 2024, Theilin stated that “Bitcoin rallies an average of 32% in 60 days ahead of the halving”. Citing it to be upheld as strong inflows into US-based ETFs indicated optimism among traditional investors.

This was supported by significant RSI indicators which historically “presaged accelerated uptrends” and would see Bitcoin produce an average gain of 54% in the following 60 days in a “rally to 74,611 by April 11, 2024,” according to 10x Research.

https://x.com/10x_Research/status/1768085626178720022

This played out, with Bitcoin hitting an all-time high of $73,000 on March 14th, more than a month before the upcoming halving on April 20th – just short of the prediction.

10x Research is also credited with predicting Bitcoin’s bottom. in November 2022, proving them to be consistent and reliable.

We Sold Everything – 10x Research Blames Inflation

Last night, 10x Research expressed their outlook on the current state of the market saying “We are bearish on risk assets (stocks + crypto),” as addressed in a newsletter.

Thielen announced the decision to sell all of 10x Research’s tech stocks at the open last night. “Only a few high-conviction crypto coins” remain in their portfolio.

“Our growing concern is that risk assets (stocks and crypto) are teetering on the edge of a significant price correction,” Thielen stated.

This conclusion was primarily influenced by “persistent inflation,” a prevalent issue challenging the space and the cause of Bitcoin’s step back from its all-time high.

Bond markets now project less than three cuts and 10-year treasury yields are surpassing 4.5%, indicating a “crucial tipping point for risk assets.”

A 25 basic point rate cut is a tool used by the Federal Reserve to combat inflation, raising federal funds by 0.25%. This raises interest rates on lending products.

Traders have recently scaled back pricing for 25 basis point Fed rate cuts this year to less than three from six at the beginning of the year, data from CMEGroup show.

The 10-year Treasury yield has been pushed up 40 basis points to 4.61% this month, the highest since November 2023. This significant rise has reduced the appeal of investing in high-risk, high-reward assets such as tech stocks and cryptocurrency.

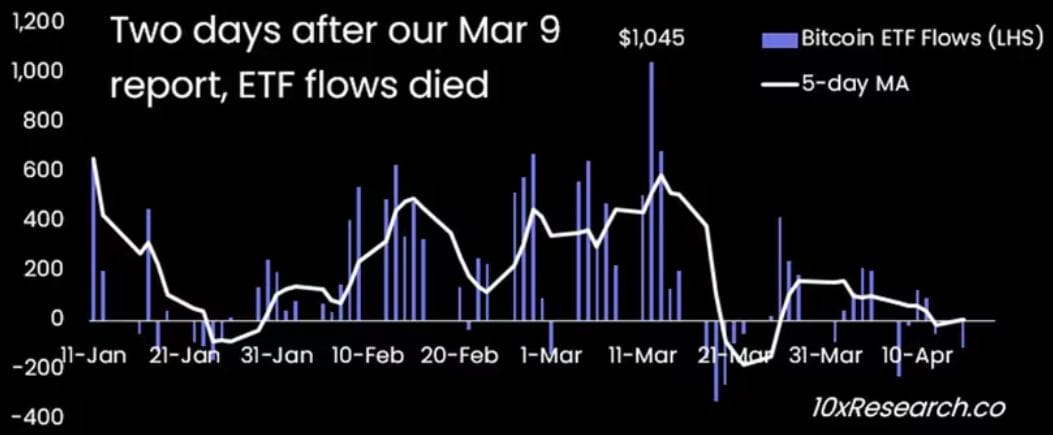

Thielen noted that the rally that led to Bitcoin’s all-time high was “driven by the expectation that interest rates would be cut, and this narrative is being seriously challenged now.” Adding that “inflows into the previously thriving spot exchange-traded funds (ETFs) have dried.”

10x Research Says Bitcoin ETFs are Losing Hype

Following the SEC greenlighting spot Bitcoin ETFs in January, the cryptocurrency gained a whole new audience, allowing investors to gain exposure to Bitcoin without the need to directly own it.

Since then, these ETFs have gained widespread adoption, with roughly $12 billion flowing into them. The majority of this inflow occurred last quarter, resulting in a surge in the Bitcoin price to new all-time highs. However, they had lost momentum by April.

Thielen commented on this, saying that after “initial novelty hype, ETF flows tend to run out unless prices continue increasing—which they have not done since early March.”

The correction is expected to take effect after the hype surrounding the upcoming bitcoin halving subsides, which will see the per-block currency emission halve to 3.125 BTC from 6.25 BTC, creating artificial scarcity, hence driving demand.