Glassnode examined how the latest trend towards restaking protocols could impact Ethereum’s role as a monetary asset.

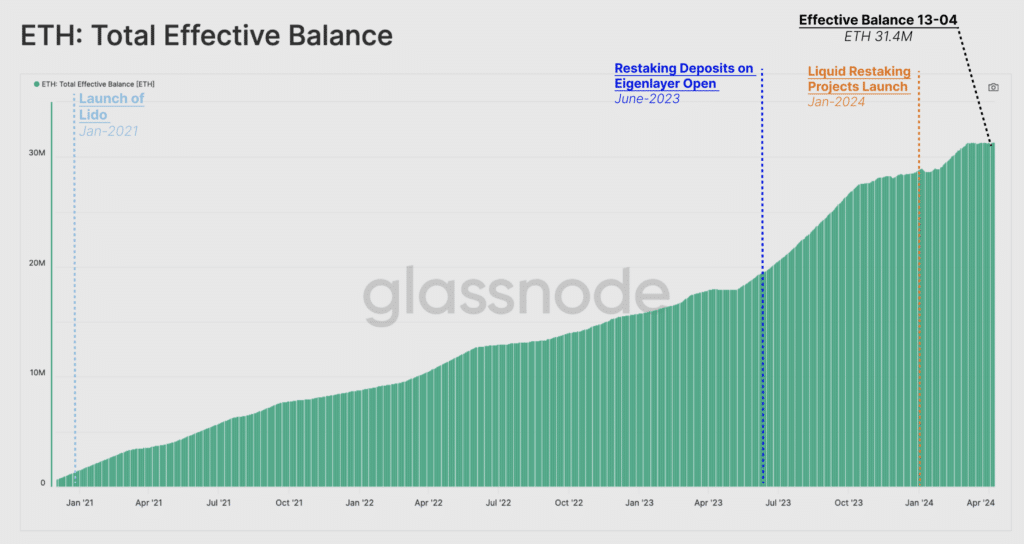

The emergence of the EigenLayer and LRT staking protocols increased ETH’s share of staking to 26% of the total supply. Analysts also recorded an increase in the overall growth in coins staked to 31.4 million Ethereum (ETH) as of April 13.

Even though more ETH reduces non-validator rewards, the total amount of rewards paid could still contribute to inflation if there are a significant number of locked assets, Glassnode suggests.

After The Merge, the share of new coins in the total Ethereum supply reached 1.01%. During this period, about 3.55% of ETH was withdrawn from circulation.

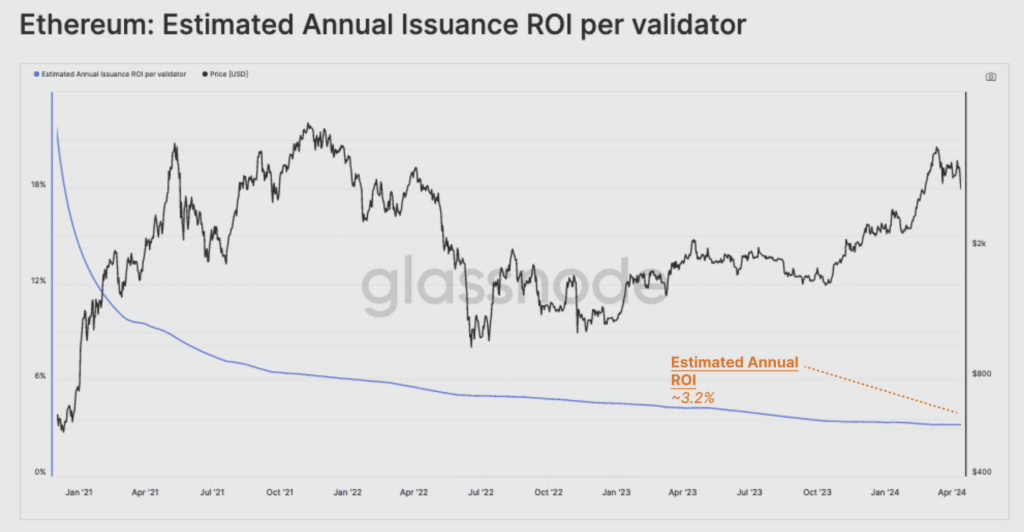

As a result of the metric increase, the remuneration level for ensuring network security per each validator dropped to 3.2% per annum.

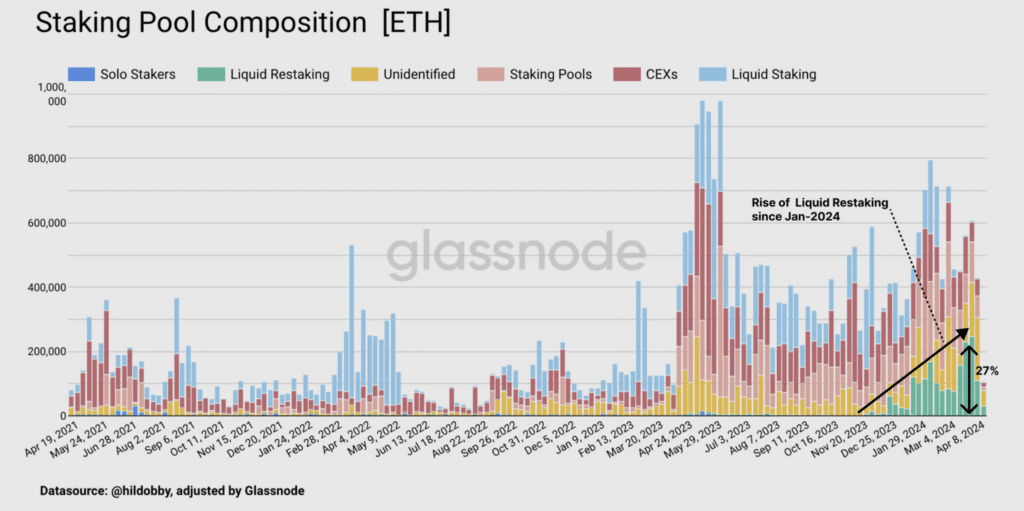

In addition, innovations like MEV, liquid staking, restaking, and liquid restaking have led to increased staking needs beyond the original intent, according to experts. Liquid restaking protocols account for 27% of the coins sent to the deposit contract.

As more ETH is staked, the effects of inflation begin to affect fewer and fewer holders of the asset. In other words, there is a transfer of wealth to participants who generate additional income from maintaining the network’s security.

Experts pointed out that over time, the real yield component could make ownership of ETH less attractive and negate Ethereum’s function as a monetary asset in the Ethereum ecosystem.

Restaking allows users to stake their assets multiple times on the main blockchain and additional protocols. Since the beginning of the year, the restaking sector has been actively growing.

At the beginning of April, the total value locked (TVL) in the restaking protocols exceeded $8 billion. The leader was the ether.fi project with $3.2 billion.