APE to $1? As Ethereum NFTs fall to Bitcoin, here is the impact

04/18/2024 13:00

Apecoin continues to move dangerously close to its all-time low as the Ethereum-based token does not get support from its NFT collections.

- Ethereum loses more ground on Bitcoin in NFT volume.

- Apecoin continues to decline.

Ethereum [ETH] remains prominent in the NFT conversation; however, recent data indicates a reduction in its dominance.

ApeCoin [APE], the ecosystem token associated with Bored Ape Yacht Club (BAYC) – an Ethereum-based NFT collection – has experienced a decline in relevance, mirroring the recent downturn in BAYC’s floor price.

Ethereum NFT volume continues to slide down

NFTs were primarily associated with Ethereum in the past, given the multitude of projects hosted on the platform. However, the emergence of alternative platforms has disrupted this monopoly.

In recent months, Bitcoin has emerged as an unexpected competitor in the NFT space despite operating differently.

Analysis of NFT volume on Crypto Slam revealed that Bitcoin has surpassed Ethereum in volume over the last 30 days.

Specifically, the NFT volume on the Bitcoin network was over $455.59 million, whereas it amounted to $291.15 million on Ethereum.

Data indicated that Bitcoin collections occupy the top three spots in volume. In contrast, popular ETH collections like Bored Ape Yacht Club (BAYC) only rank sixth.

A look at how BAYC has trended

An analysis of the overall price trend of Bored Ape Yacht Club (BAYC) on NFT Price Floor showed a significant decline in the BAYC floor price over the past few months.

Particularly, in April, there has been a noticeable drop in the floor price.

At the time of writing, the floor price was around 10.89 ETH. The floor price represents the lowest price for the Ethereum-based NFT collection, and the chart indicates a decline of over 67% over the past year.

The decline in BAYC and other Yuga collections has also impacted ApeCoin, bringing it close to its lowest price.

APE close to ATL

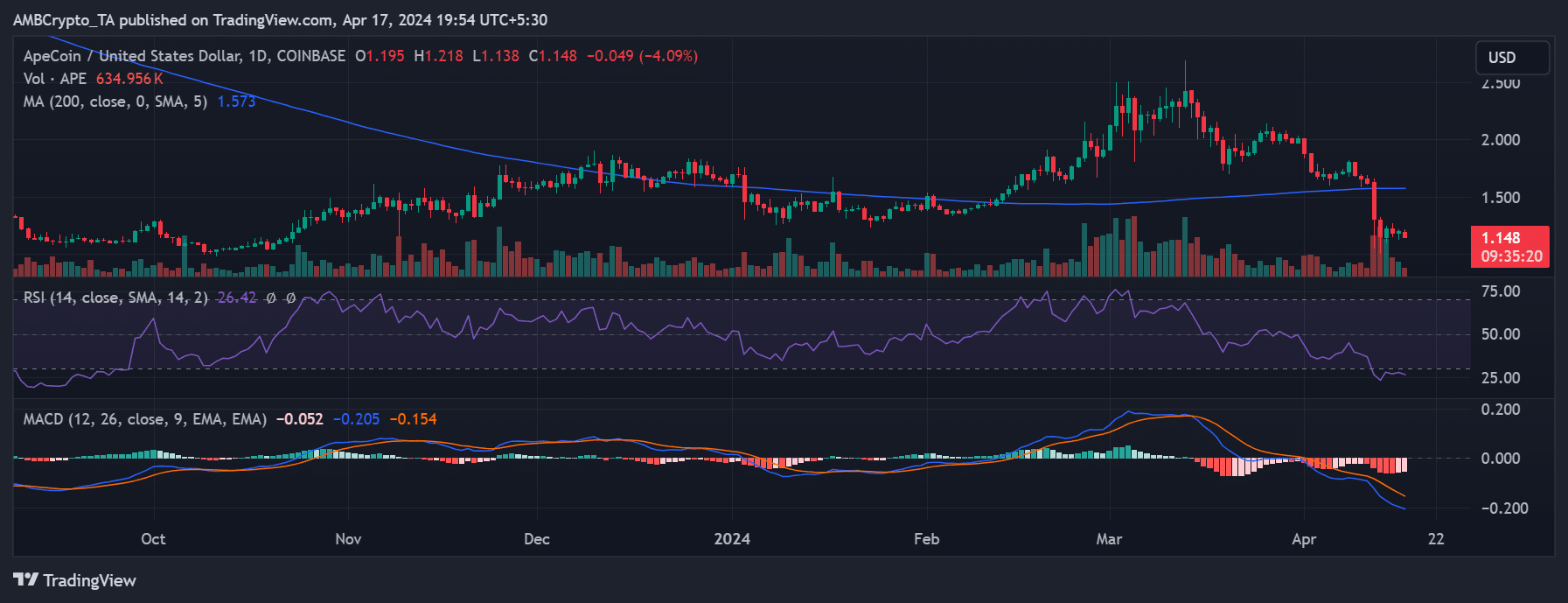

The analysis of ApeCoin indicates a negative trend for the de facto ecosystem coin of Ethereum-based collections. Examination of the Relative Strength Index (RSI) showed an oversold condition.

Realistic or not, here’s APE market cap in BTC’s terms

At the time of writing, the RSI was below 30, signaling a strong bear trend and an oversold state. Additionally, APE was trading around $1.15, reflecting a more than 4% decline.

Further analysis showed that APE’s all-time low was around $1.01, suggesting a further drop could bring the price to this region.