Ethena (ENA), the synthetic U.S. dollar protocol built on the Ethereum network, recorded a notable plunge as the market witnessed bearish sentiment.

ENA is down by 17% in the past 24 hours and is trading at $0.84 at the time of writing. The asset’s market cap fell to the $1.2 billion mark, making it the 68th-largest cryptocurrency.

Quite similarly, Ethena’s daily trading volume decreased by 14.5%, currently hovering at $618 million.

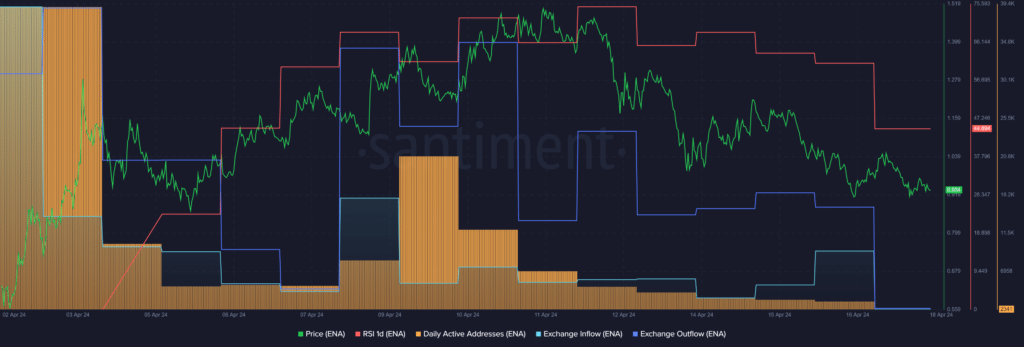

According to data provided by Santiment, Ethena recorded a net outflow of 9.18 million tokens from all exchanges over the past day. The daily exchange inflow declined by 73.5% — falling from 72.89 million ENA to 19.28 million ENA.

Per the market intelligence platform, the exchange outflow witnessed a 44% drop — declining from 50.72 ENA to 28.46 million ENA.

This pattern shows that the amount of traders and investors taking profits has declined impressively, and lower price volatility is usually expected.

According to Santiment, the number of daily active addresses has been consistently dropping over the past nine days — declining from 20,922 on April 9 to 2,341 active addresses per day at the reporting time.

The ENA Relative Strength Index (RSI) plunged from 60 to 44 over the past 24 hours, per Santiment. The indicator shows that Ethena is slightly undervalued at this price point and an upward acceleration could potentially trigger bullish momentum.

For ENA to stay in the bullish zone, its RSI would need to remain below the 50 mark.