Israel-Iran Conflict Triggers Momentary Bitcoin Price Dip Below $60,000

04/19/2024 12:00

Bitcoin price dips below $60,000 as Israel retaliates against Iran, causing a momentary ripple in the crypto market.

Bitcoin (BTC) experienced a momentary decline below $60,000 on Friday morning Asia market time after news that Israel had launched retaliatory missile strikes against Iran. ABC News cited a senior US official who confirmed the strikes.

This latest escalation in the Israel-Iran conflict temporarily rattled the crypto market.

Geopolitical Tensions Impact the Crypto Market

Israel’s missile strikes come as a response to an Iranian attack last Saturday, where Iran reportedly launched over 300 drones and missiles toward targets in Israel. Israeli officials state that all but a handful of these were successfully intercepted by Israel and its allies, including the United States.

The recent developments in the Israel-Iran conflict caused a momentary dip in the value of Bitcoin (BTC), dropping to $60,000. However, at the time of writing, Bitcoin has rebounded and is now valued at $62,500.

Along with Bitcoin, Ethereum (ETH), the second largest cryptocurrency, experienced a momentary drop in value, reaching as low as $2,876. Yet, similar to Bitcoin, ETH has also rebounded and is currently trading at $3,000.

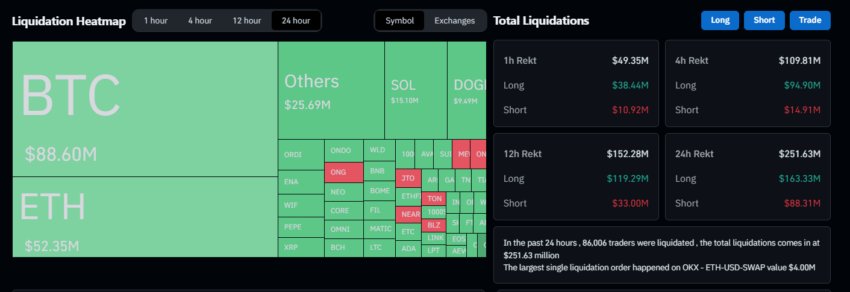

Additionally, according to data from Coinglass, the total crypto liquidation amount within the last hour is a modest $49.35 million, primarily stemming from long positions. However, in the past 24 hours, more than $250 million has been liquidated.

Read more: Bitcoin Price Prediction 2024/2025/2030

Furthermore, these events are notably unfolding as Bitcoin’s halving is nearing. Based on NiceHash data, the current block height is 839,871, with roughly 129 blocks remaining until the halving event. Despite the momentary market fluctuation, experts remain bullish about Bitcoin’s long-term price trajectory, particularly post-halving.

A recent report from Glassnode and Coinbase Institutional explains one of the fundamental reasons.

“Daily miner Bitcoin issuance now competes with substantial absorption by Bitcoin ETFs … Given these factors, ETFs are key players in the market whose activities could overshadow the historical impact of the halving,” they wrote.

However, it’s important to note that inflows and outflows of ETFs can significantly impact Bitcoin’s price stability and market sentiment.

Read more: Bitcoin Halving Countdown

Separately, Deutsche Bank’s analysts also anticipate sustained high Bitcoin prices. They attribute this to “the potential approval of spot Ethereum ETFs, expectations of central bank rate cuts, and regulatory changes.”

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.