NEAR hits $7.51 – Why Ethereum can be in danger

04/24/2024 09:00

Not only has NEAR Protocol's [NEAR] price beaten Ethereum [ETH] hands down in the last seven days, but it has also surpassed the blockchain

- Active addresses on the protocol were six times that of Ethereum.

- NEAR’s price might continue to outclass ETH despite the difference in developments.

Not only has NEAR Protocol’s [NEAR] price beaten Ethereum [ETH] hands down in the last seven days, but it has also surpassed the blockchain on many other fronts.

At press time, NEAR’s price changed hands at $7.51, representing a 39.06% increase in the last seven days. ETH, on the other hand, traded at $3,171. This was a 6.02% decrease in the last 30 days.

But it did not end there. According to Artemis data, active addresses on the Ethereum blockchain were 406,200 as of this writing and had remained in the same region.

ETH is not the L1 maestro: Who is?

For NEAR, it was an entirely different story. As of the 7th of April, active addresses on the protocol were less than one million.

However, data from the developer analytics platform showed that the metric was 2.3 million.

NEAR operates on the same Proof-of-Stake (PoS) consensus as Ethereum. However, it seemed that users and developers alike preferred the chain abstraction stack provided by the former.

Apart from this, there are not many layer-1 projects that possess the kind of scaling power like NEAR. As such, users can make faster and cheaper transactions without waiting for the layer-2s on Ethereum.

With the kind of momentum, the protocol has shown, ETH might find it hard to match up to the token in terms of its price. Another catalyst fueling the token’s hike in the buzzing narrative around AI.

The result of this is an incredible surge in market cap. Some months back, the protocol’s market was not in the top 25. But as of this writing, the project is ranked number 17, with a market cap of $7.36 billion.

Wins for both sides on different ends

Furthermore, the last 30 days have seen fees on the network jump by 51%, with an average of $42,000. While this might help NEAR surpass ETH’s market cap, it could drive its revenue very close to Ethereum’s.

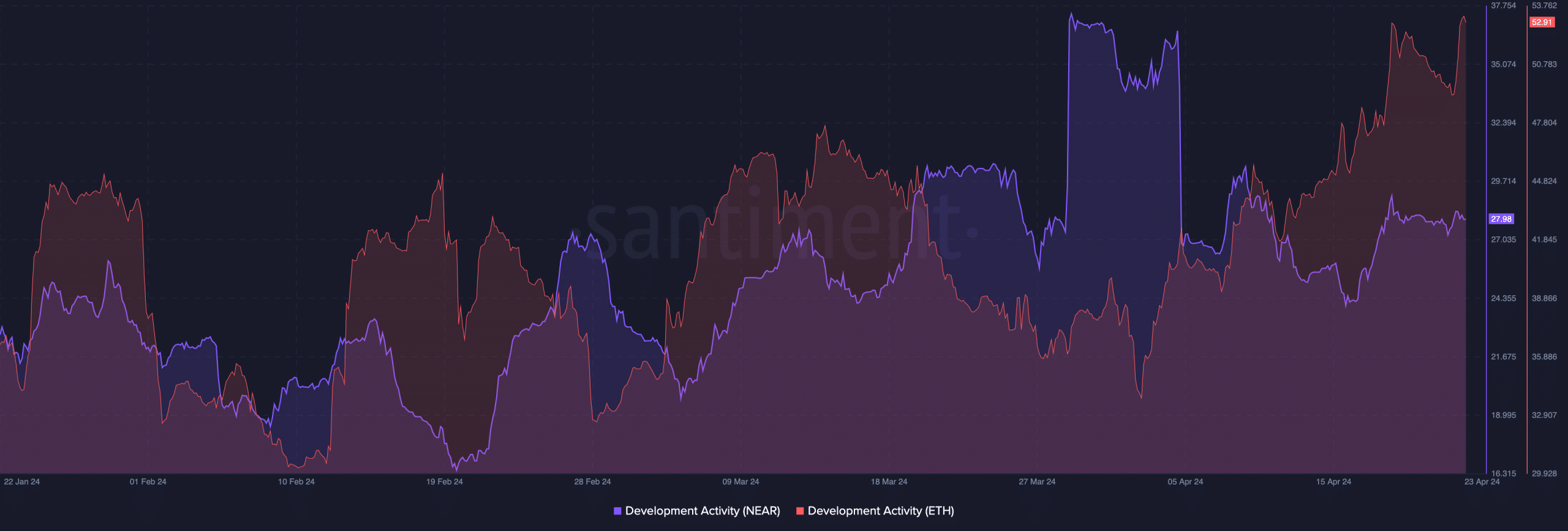

Another metric AMBCrypto looked at was development activity. According to Santiment, development activity on NEAR Protocol was 27.98. This was a significant increase from what the reading was on 16 April.

For Ethereum, the metric was 52.91, indicating that code committed to the blockchain’s new features and security was more than NEAR.

With this data, NEAR might not be able to outpace Ethereum when it comes to public GitHub repositories. However, it might be a different encounter with their respective prices.

Realistic or not, here’s NEAR’s market cap in ETH terms

For instance, ETH has been lagging for a while. If this continues in the short term, the price action might not be able to compete with NEAR’s growth.

However, in the long term, the circumstances might change if ETH starts moving. But within the next few weeks or months, NEAR might continue to outpace Ethereum’s metrics on-chain as well as its price.