‘As exciting as Bitcoin, Ethereum are,’ ETFs take the stage – Why?

04/28/2024 13:00

Amidst the market crash, Investors continue to show strong interest in Bitcoin, as evidenced by data from Bitbo.

- Bitcoin’s dominance persists amidst growing excitement for altcoins.

- Retail interest continues to remain significant and should not be overlooked.

2024 has been filled with unexpected twists and turns in the cryptocurrency realm. From the highly anticipated Bitcoin [BTC] halving to the relentless fluctuations in price, investors have experienced significant changes.

Regulatory scrutiny from bodies like the Securities and Exchange Commission (SEC) and now the Federal Bureau of Investigation (FBI) has added another layer of complexity to the landscape.

Despite these critical issues, investors have remained captivated by leading cryptocurrency Bitcoin, per AMBCrypto’s analysis of Bitbo data.

Remarking on the same, Zach Pandl, Managing Director of Research at Grayscale Investments, in a recent conversation with Anthony Pompliano, said,

“I am incredibly bullish on this asset class.”

Bitcoin or altcoins?

However, contrary to the above sentiment, Brett Tejpaul, Head of Coinbase Institutional, claimed,

“As exciting as Bitcoin and Ethereum are, the altcoin products to me are far more exciting.”

He added,

“I think that speaks to the resiliency of who is actually buying these products and the thought process that they have.”

This highlighted the increasing excitement and attention surrounding altcoin products in the cryptocurrency market.

Despite the ups and downs of the market, there has been consistent interest and investment in altcoins such as Uniswap [UNI], Cardano [ADA], Polkadot [DOT], and Solana [SOL].

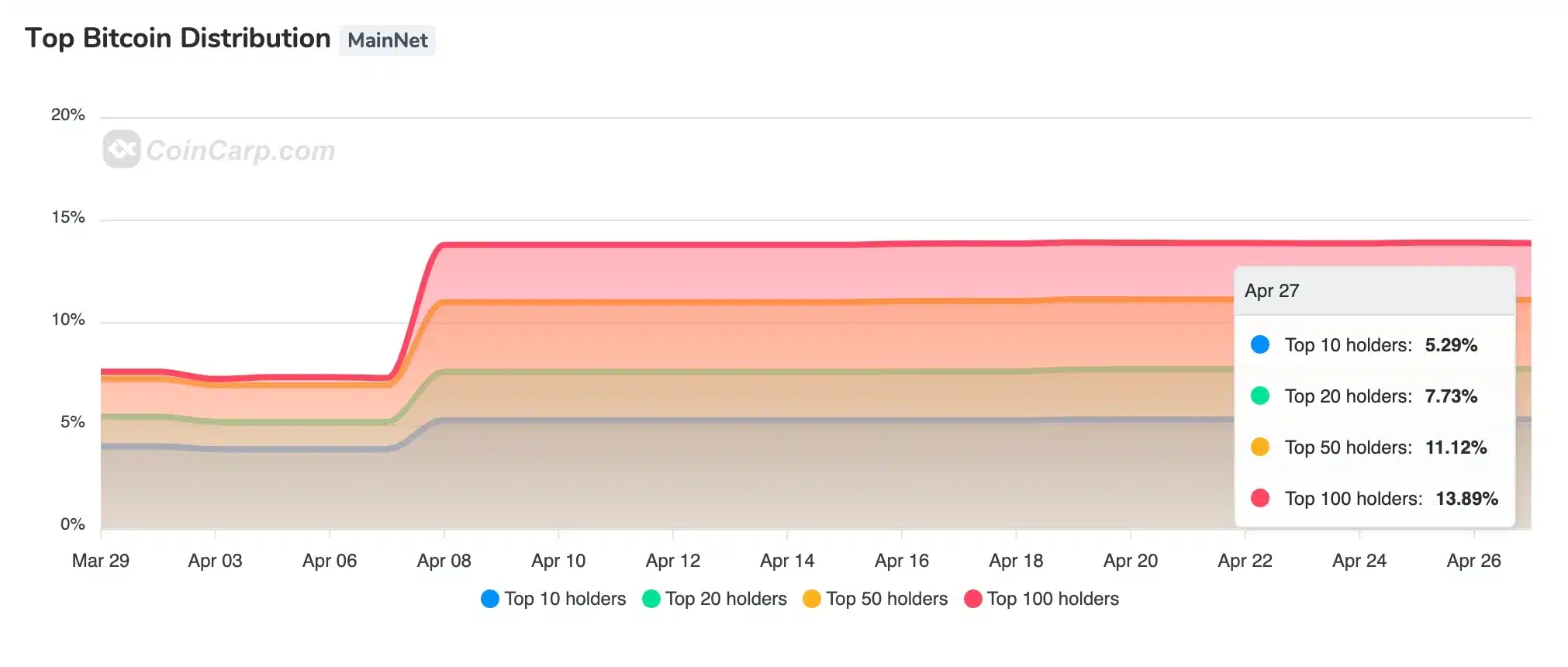

This was further confirmed by data from CoinCarp, indicating that the top 10 holders collectively possess only 5.29% of the total BTC supply.

Bitcoin leads the market

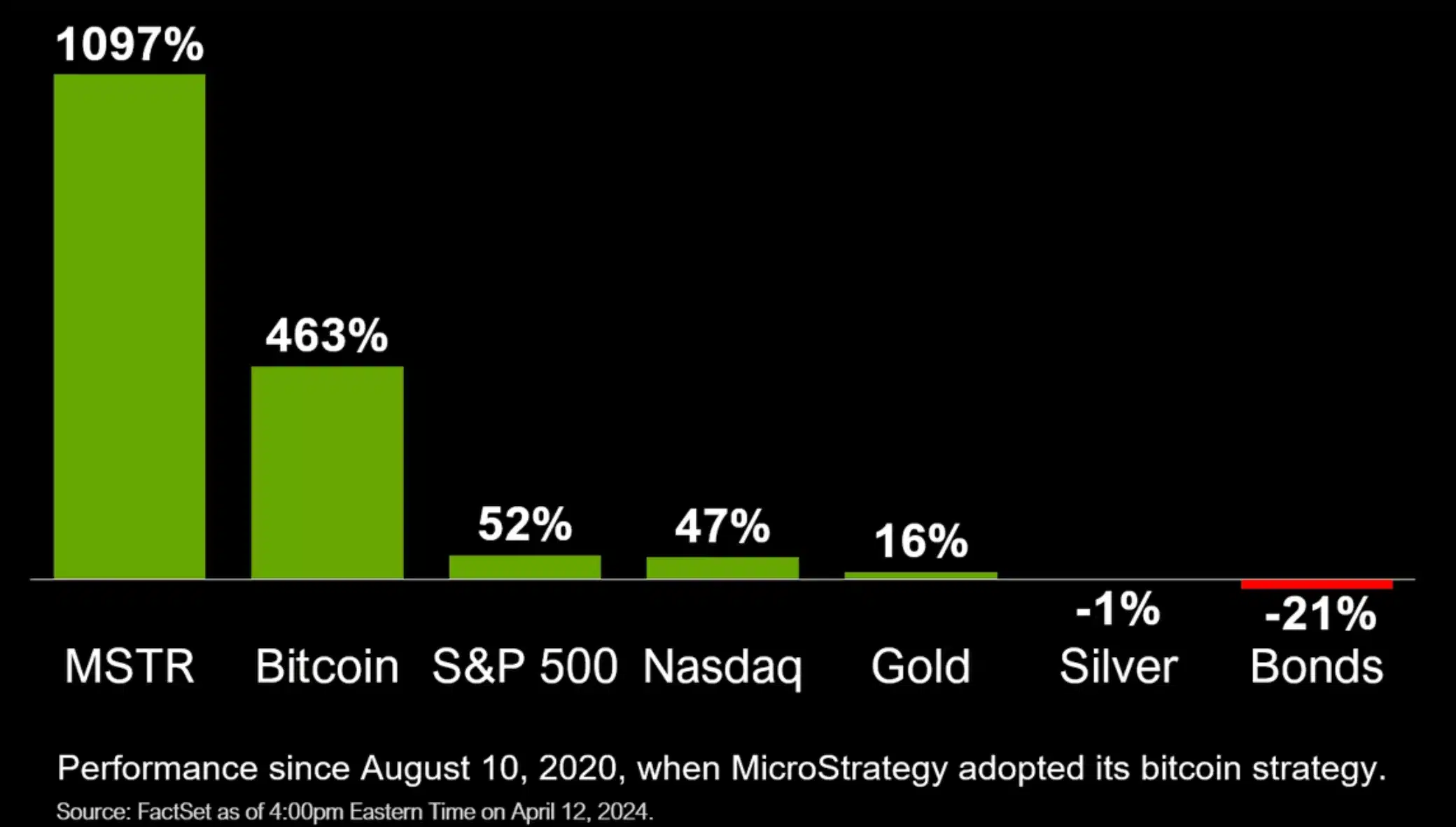

Contrary to Tejpaul’s perspective, Michael Saylor remained optimistic on the king coin. Through a chart shared on X (formerly Twitter) post, he illustrated how BTC has been profitable for his company.

As of the 19th of March, MicroStrategy owned 214,246 BTC.

In 2021, institutional demand boosted Bitcoin’s rise, setting a new precedent.

Now, with BTC Exchange Traded Funds (ETFs) in 2024, institutional interest surged again, highlighting their crucial role in driving demand and price.

Role of retail investors

Amidst the buzz surrounding institutional entry into crypto via ETFs, it’s crucial to recognize the significant role played by retail investors.

Reiterating the same, Russell Star, Head of Capital Markets at Defi & Valour added,

“Well the ETF welcomes a combination of institutional and retail as a starter.”

In conclusion, while ETFs provide additional liquidity for institutions, it’s essential to recognize that early adopters already possess direct cryptocurrency investments.

Therefore, while ETF approval marks a crucial milestone, it may take time for institutional inflows to fully materialize.