Ethereum whales dive in: Long-term recovery or short-term spike?

04/28/2024 22:00

Whales exhibited considerable interest in ETH, in addition to retail investors, as they both began accumulating large quantities of ETH.

- Whales began to show massive interest in ETH along with retail investors.

- The price of ETH gained significantly, and short positions were liquidated.

Ethereum [ETH] stagnated for quite some time below the $3,200 level mark, however, a recent resurgence in interest has pushed ETH past its previous price levels.

Whales move in

As per Lookonchain’s data, a significant whale persisted in purchasing ETH and entering long positions in the ETH/BTC trading pair.

The investor borrowed 2301 WBTC (equivalent to $119.75M) from AAVE and converted it into 41,947 ETH at a rate of 0.055, following the launch of the Bitcoin ETF on the 10th of January.

Within the last three days, the whale expended 35 million USDC to acquire 10,952 ETH at $3,196.

A significant investor with substantial capital placing a big bet on ETH can boost overall confidence in the cryptocurrency.

This can attract other investors who might be on the fence, leading to a snowball effect of buying pressure.

It wasn’t just whales that were showing interest in ETH, retail investors’ demand for Ethereum was also observed to be growing.

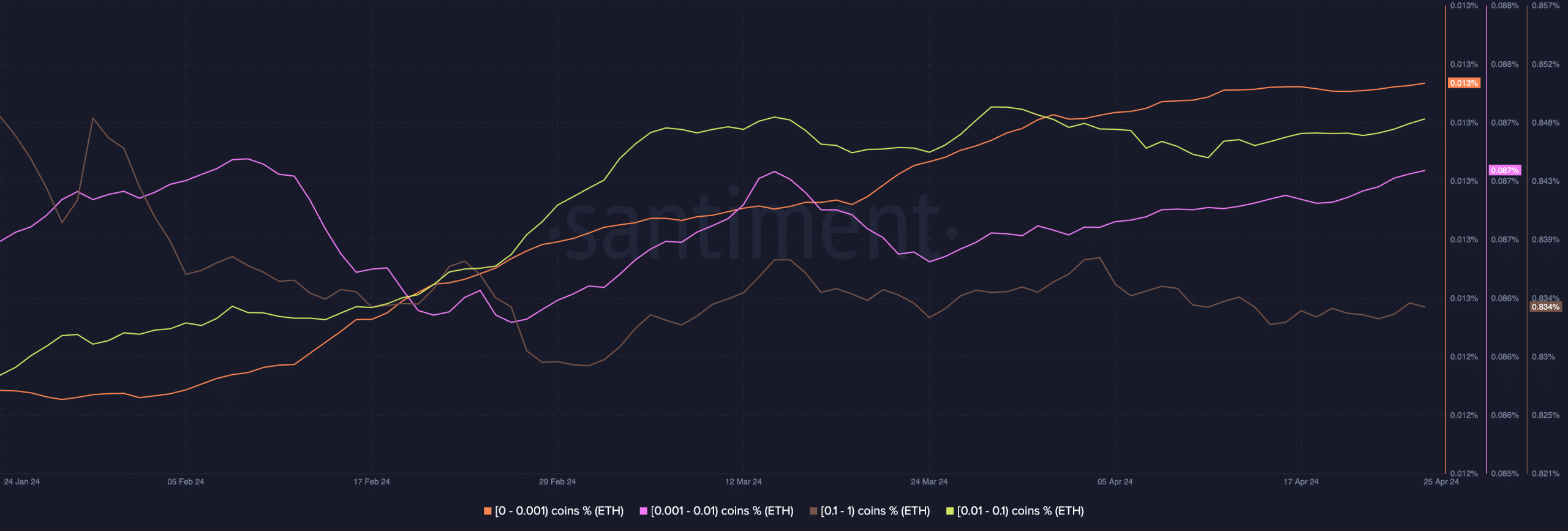

Addresses holding anywhere between 0.001 to 1 ETH had started to accumulate large amounts of ETH, according to AMBCrypto’s analysis of Santiment’s data.

The interest showcased in ETH from both whales and retail investors suggested that sentiment across all sectors of the crypto market is relatively bullish around ETH.

Due to these factors, the price of ETH surged significantly. At press time, ETH was trading at $3,311.78 and its price had surged by 6.08% in the last 24 hours.

How are holders doing?

This move led to more bullish speculation around ETH ETF’s which added more momentum to ETH’s rally.

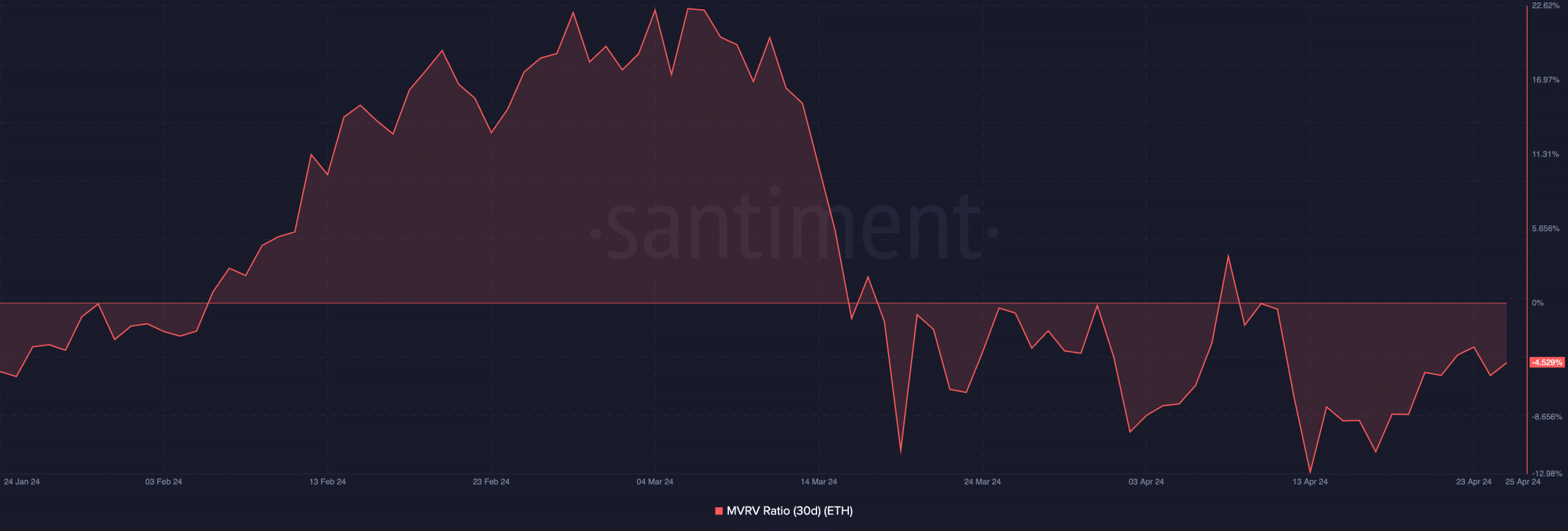

Surprisingly, despite the recent surge in price, the MVRV ratio for ETH remained negative, indicating that most holders remained unprofitable.

Read Ethereum’s [ETH] Price Prediction 2024-25

It can be safe to assume that these holders might wait for prices to appreciate further before indulging in profit taking.

The sudden uptick in ETH’s price also caused a large number of short positions to get liquidated amounting to $33.02 million.