April 2024 Report – BTCFi dominance, Ethereum’s fall, and May forecast

05/01/2024 22:30

The 7-day moving average of Bitcoin’s market cap to transaction fee ratio fell below that of Ethereum in April.

- Runes on Bitcoin’s blockchain can save traders from massive losses in the coming months.

- Staking on the Ethereum blockchain is on the rise, raising concerns about its future as “money.”

Ahead of the FOMC meeting (Federal Open Market Committee) of May 2024, the crypto-market saw a significant decline. Bitcoin dropped to $56,494 – A level last seen on 28 February 2024. Market sentiment skewed towards the side of fear as investors rebalanced their portfolios in expectation of no rate cuts.

Bitcoin’s MVRV Ratio (7-D) fell to -8.099%, at press time. On average, Bitcoin holders were underwater. It suggested that the market value was significantly lower than the price at which most acquired BTC.

It could also be taken as a sign of undervaluation. According to AMBCrypto’s market report for the month of April, Bitcoin will continue its downward journey for the majority of trading sessions in May.

However, the report discusses three factors (Related to BTCFi, Options ETF, and Solana) that could reverse the king coin’s trajectory. Investments through BTC ETFs will have a bigger impact on price, compared to the fed rate cut anticipation or geopolitical strains.

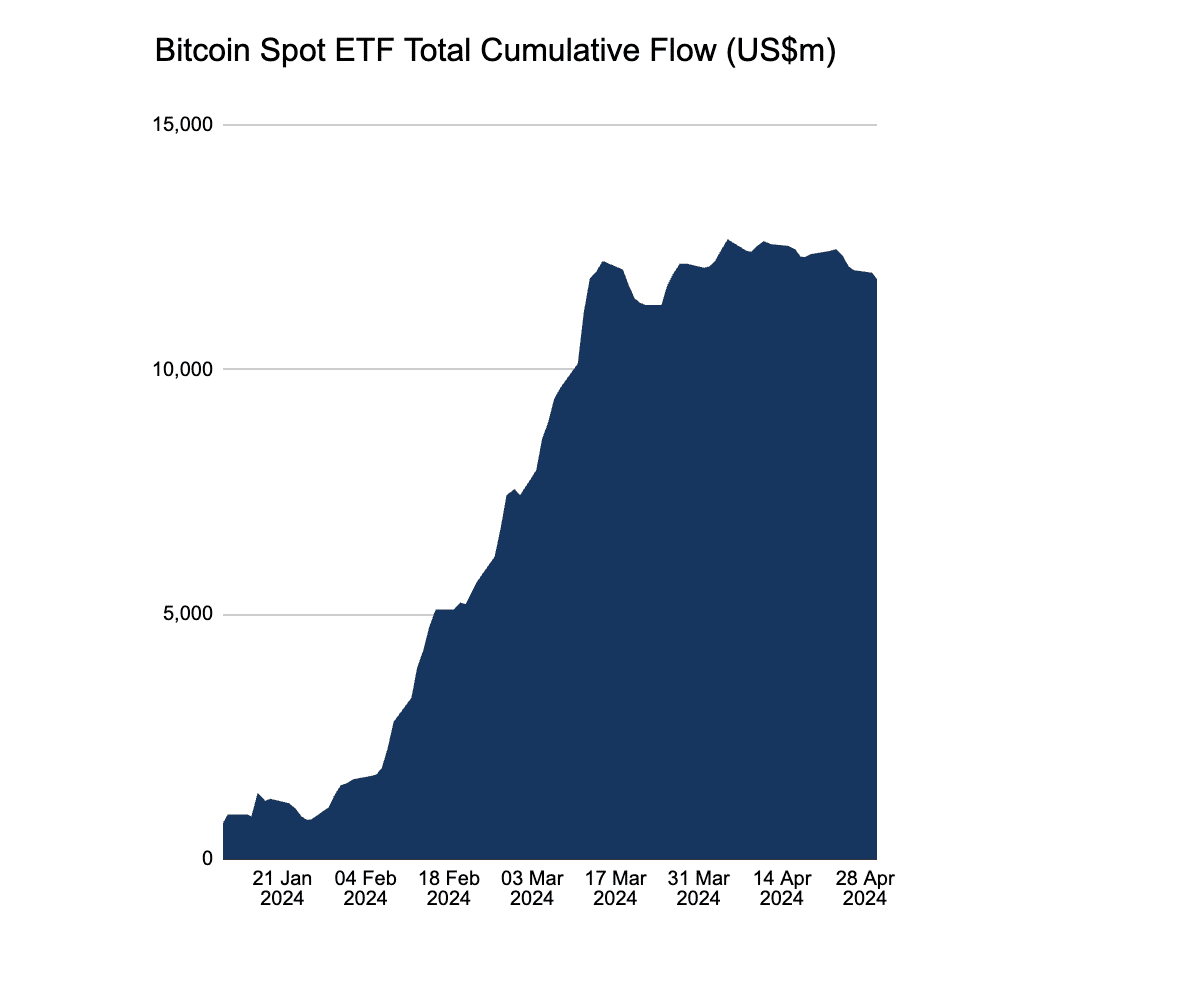

Since 24 April, BTC ETF outflows have been outweighing the inflows. On 30 April, a $161 million outflow was registered – The highest in the last three days.

AMBCrypto’s report throws light on a fresh perspective though – It reveals numerous institutions are seeking approval for Bitcoin ETFs. If these ETFs are green-lit in May, it could lead to a significant hike in demand, potentially driving the price north.

Bitcoin’s savior – Runes

The rise of DeFi on the Bitcoin blockchain could save traders from registering massive losses in the coming months (AMBCrypto’s report dives into its full details).

Interestingly, the 7-day moving average of Bitcoin’s market cap to transaction fee ratio fell below that of Ethereum. It highlighted a huge surge in activity on the Bitcoin network since the launch of the Runes protocol. Basically, this ratio indicates how much money is flowing into a cryptocurrency relative to the transaction fees being paid.

Altcoins’ performance in April

Following Bitcoin’s footsteps, the price of other cryptocurrencies also fluctuated by a significant degree. April was a volatile month for most altcoins. The broader market witnessed a downturn due to geopolitical tensions and inflation fears. However, some sectors thrived, like gaming tokens.

As per AMBCrypto’s report, Ethereum’s dominance has been challenged by Solana, whose DeFi market share has been surging steadily. Meanwhile, an Ethereum ETF is still pending SEC approval, and staking on the Ethereum blockchain is on the rise, raising concerns about its future as “money.”

Take a look at AMBCrypto’s Market Analysis – April 2024 Edition

Dive into April’s market trends, valuable data, and exclusive insights to help yourself navigate through May’s market movements.

The report delves deep into key topics like –

- Rising popularity of DeFi on Bitcoin

- America’s love for memecoins

- Fall in USDT’s dominance

- Solana’s TVL masterstroke

- NFT market’s recovery

- Market forecast for May

You can also download the full report here.