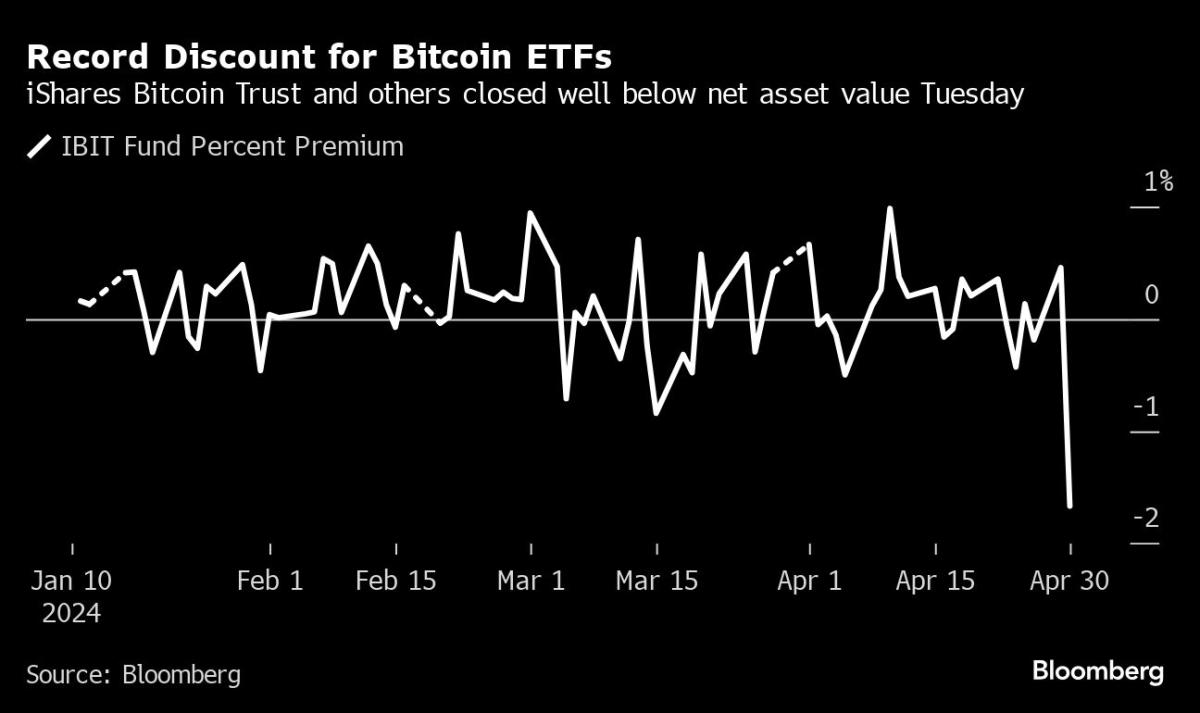

Bitcoin ETFs Flash Signs of Stress as Discounts Reach Records

05/01/2024 22:58

(Bloomberg) -- Signs of stress are flashing across spot-Bitcoin exchange-traded funds after the cryptocurrency sank to a two-month low.Most Read from BloombergTesla Axes Supercharger Team in Blow to Broader EV MarketNYPD Arrests Over 300 Protesters in Crackdown on College CampusesFed to Signal Delay of Interest-Rate CutsThe Ozempic Effect: How a Weight Loss Wonder Drug Gobbled Up an Entire EconomyLilly Soars as Forecast Boost Shows Weight-Loss Drugs’ PowerPrices of some of the largest ETFs track

(Bloomberg) -- Signs of stress are flashing across spot-Bitcoin exchange-traded funds after the cryptocurrency sank to a two-month low.

Most Read from Bloomberg

NYPD Arrests Over 300 Protesters in Crackdown on College Campuses

The Ozempic Effect: How a Weight Loss Wonder Drug Gobbled Up an Entire Economy

Lilly Soars as Forecast Boost Shows Weight-Loss Drugs’ Power

Prices of some of the largest ETFs tracking the token notched the steepest discounts to the value of underlying assets in their short history on Tuesday after Bitcoin slumped about 5%. Losses continued on Wednesday, with the original cryptocurrency dropping as much as 5.6%.

The $16 billion iShares Bitcoin Trust (ticker IBIT) on Tuesday closed about 1.7% below its net asset value — the largest dislocation since it began trading in January. The $9 billion Fidelity Wise Origin Bitcoin Fund (FBTC) saw a 1.1% discount while the $2.5 billion ARK 21Shares Bitcoin ETF (ARKB) and the $2 billion Bitwise Bitcoin ETF (BITB) both closed with discounts of more than 1.4%, also the biggest on record for each, according to data compiled by Bloomberg.

“That’s not a great look,” said James Seyffart, ETF analyst at Bloomberg Intelligence, adding that it would have been more concerning if the discounts were isolated to one fund. “It’s a little out of the ordinary in the fact that we’ve seen premiums and discounts in the range of -1% to +1% and this is bigger. But it’s not groundbreaking.”

Read: Bitcoin Hits Two-Month Low After Worst Stretch Since FTX Crash

The discounts may be a signal of the frictions inherent in overlapping the traditional market with Bitcoin, since shares in the funds can only be created and redeemed in exchange for cash rather than “in-kind” exchanges for Bitcoin itself, according to Seyffart.

Price deviations such as these tend to be short-lived due to the creation-redemption mechanism of ETFs. Still, the discounts underscore how Bitcoin’s volatility may pose larger risks to ETF investors than funds focused on traditional financial assets. At the same time, the volatility creates profitable opportunities for specialized trading firms known as authorized participants who are tasked with keeping the price of the funds in-line with their net asset values.

“We remain confident that the inherent underlying volatility of crypto as an asset class will drive sustained elevated opportunities in crypto ETFs,” Virtu Financial Inc. Chief Executive Officer Douglas A. Cifu said on a conference call last week to discuss the company’s earnings, which included record performance in crypto market-making operations.

Expectations for fund flows were exceeded after the ETFs were launched as the cohort broke one record after another in the more-than $8 trillion US industry. Hopes remain high that more institutions will adopt spot-Bitcoin ETFs as they establish a track record. But the price of Bitcoin has historically been affected by the macro-economic environment and a case is building for the Federal Reserve to signal a delay in rate cuts after officials conclude a policy meeting Wednesday. That’s generally a tough backdrop for speculative assets like digital tokens.

“It’s possible it stays at a discount if Bitcoin continues to slide, but that remains to be seen,” said Mohit Bajaj, director of ETFs at WallachBeth Capital.

--With assistance from Katie Greifeld and Sunil Jagtiani.

Most Read from Bloomberg Businessweek

Modi Is $20 Trillion Short on His Grand Plan for India’s Economy

AI Is Helping Automate One of the World’s Most Gruesome Jobs

©2024 Bloomberg L.P.