‘Cheap’ Solana can flip Ethereum ‘this week’ – Analyst

05/09/2024 13:00

The Solana vs Ethereum debate resurfaces as the gap between the two chains gets smaller on the transaction fees, MEV and DEX fronts.

- Solana is quickly catching up to Ethereum on the fees front.

- However, the Ethereum ecosystem still commands investors’ trust.

The Solana [SOL] vs. Ethereum [ETH] debate resurfaced again on Crypto Twitter following reports that the former could soon flip the latter on the fees front.

According to on-chain analyst Dan Smith, Solana was quickly closing in on Ethereum on transaction fees. Smith claimed that,

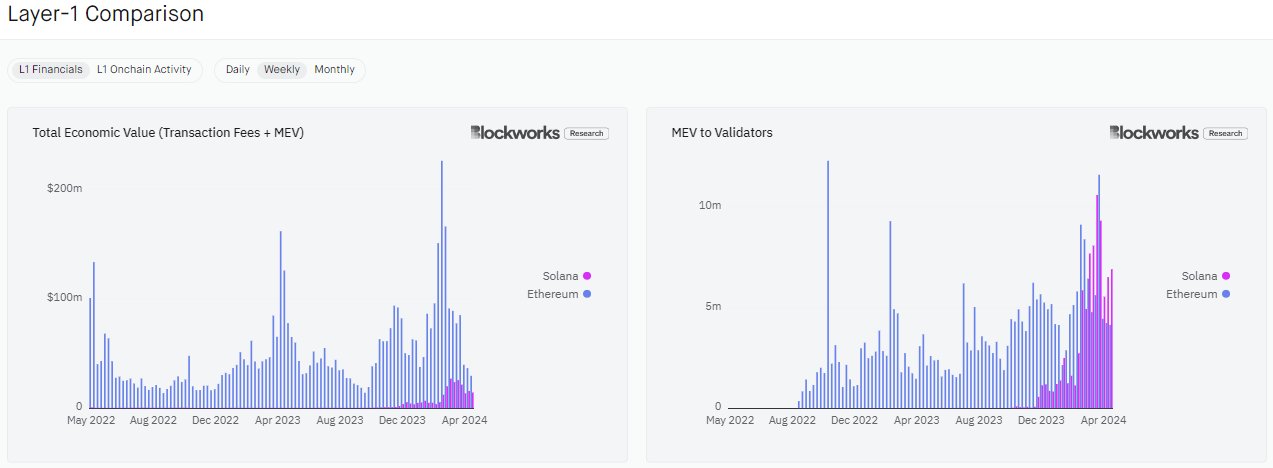

“Solana will flip Ethereum in transaction fees + captured MEV this month, maybe even this week”

Transaction fees refer to charges linked to network activity, while MEV means validators’ highest value derived by maximizing block production or ‘confirmation.’

Solana vs Ethereum: fees and other fronts

Smith backed his argument with data, noting that there was about a $300K difference between Solana and Ethereum’s fees.

The chart showed Solana recorded a significant surge in 2024, closing most of the gap with Ethereum.

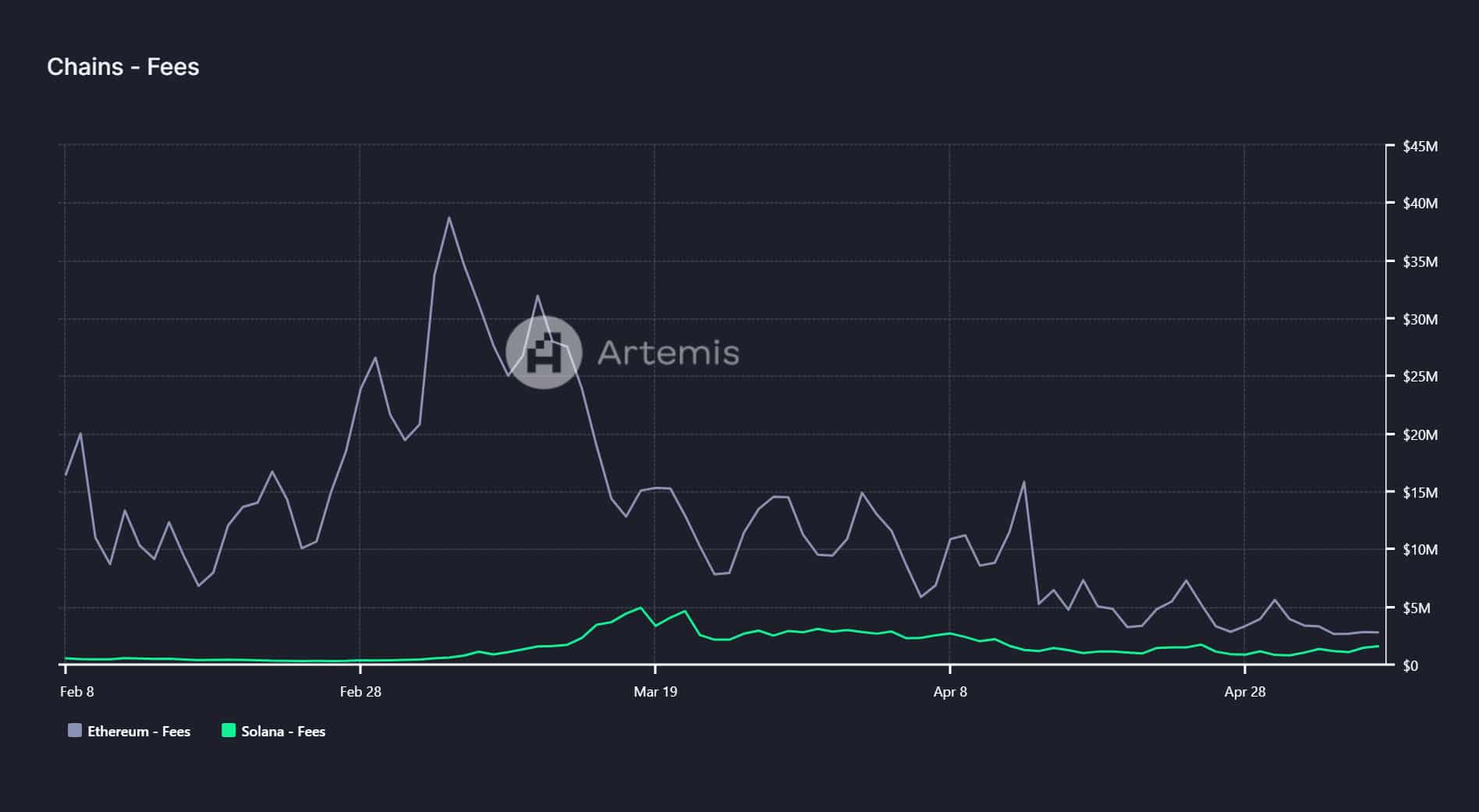

AMBCrypto’s evaluation of Artemyz’s data confirmed the trend on the fees front. The data showed that Ethereum network fees had dropped significantly since the end of February.

On the 7th of May, Ethereum fees hit $2.8 million, while Solana had $1.6 million.

However, other market watchers argued that Ethereum transaction volume should include all L2 to capture its “real value.” To which, Dan Smith responded,

“The question is whether or not pushing activity to L2s where ETH, the asset is used as a currency, drives enough value back to the L1 to compensate for the loss of L1 activity”

Despite its network challenges, Solana, on average, has cheaper transaction charges than Ethereum.

Reacting to Smith’s projection of SOL eclipsing ETH, crypto analyst Ansem wondered,

“And it is still 100x cheaper to transact on for users, really think about this & explain to me in detail why ETH is still worth 5x more by market cap”

Things are also hitting up on the DEX (Decentralized Exchange) front after Solana’s Jupiter exchange outperformed Ethereum’s Uniswap on the Unique Active Wallets (UAW) front.

Like Ansem, most market watchers underscored SOL as grossly undervalued, especially after last week’s pullback.

Nevertheless, Ethereum had a commanding lead on TVL (Total Value Locked) and overall token value on price charts.

Solana had $4 billion in TVL, while Ethereum’s reading stood at $53.3 billion at press time, underscoring that Ethereum had more investors’ trust.