Ethereum’s latest ‘low’ – How ETH’s price action is affecting staking

05/11/2024 06:00

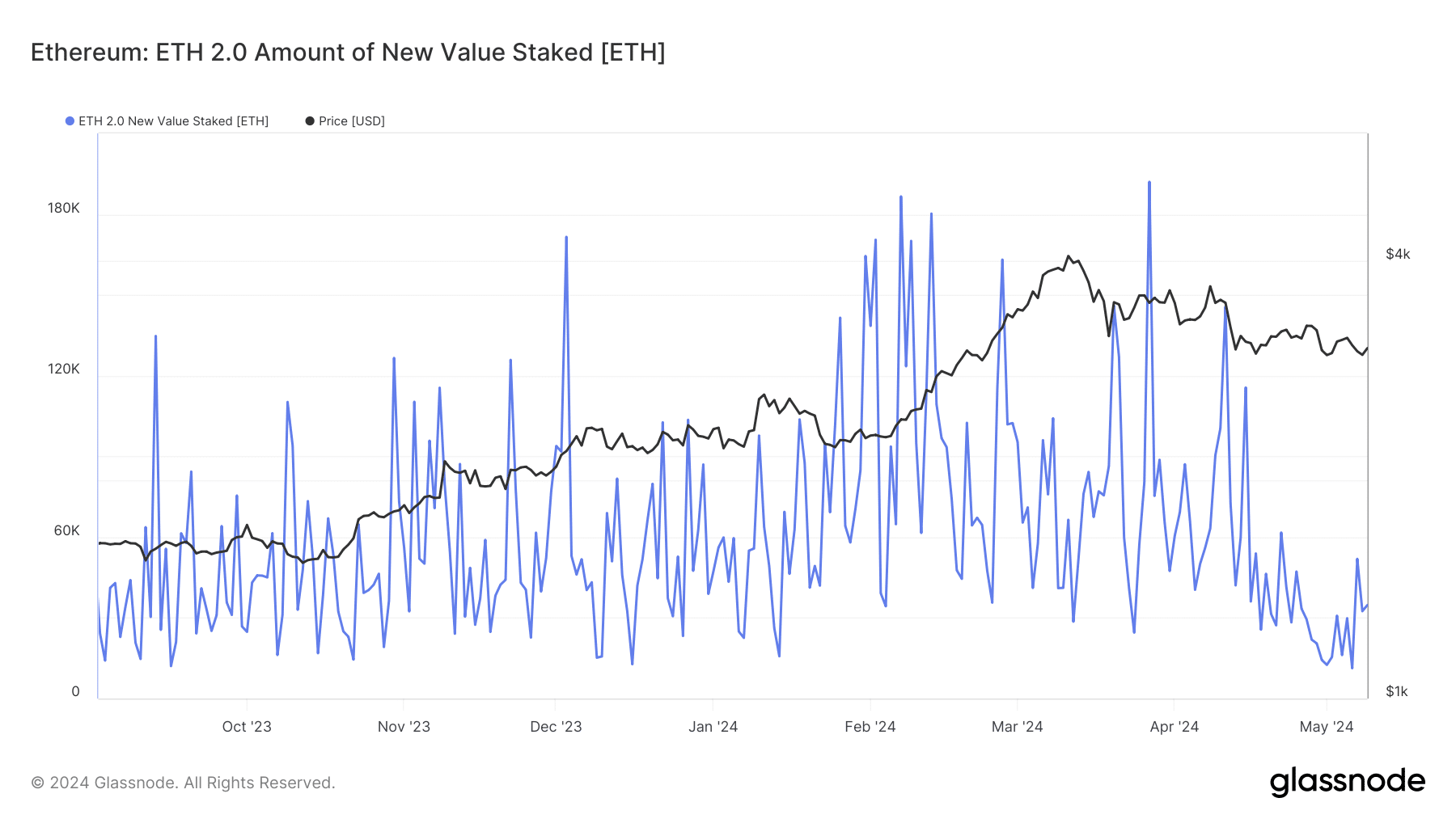

The daily amount of new Ethereum [ETH] staked fell to its year-to-date (YTD) low on 6 May, according to Glassnode’s data. This means ETH...

- The number of new ETH staked daily has dropped on the charts

- This can be attributed to the altcoin’s meek price performance

The daily amount of new Ethereum [ETH] staked fell to a year-to-date (YTD) low on 6 May, according to Glassnode’s data.

Information from the on-chain data provider revealed that the number of coins transferred to the staking deposit contract address on that day totalled 11,285 ETH (valued at approximately $34 million). This figure marked a 92% decline from the YTD peak of 192,008 ETH coins staked on 28 March.

Assessed using a 30-day moving average, the amount of new ETH staked initiated its downtrend on 29 February, with the same since down by over 85%.

Fall in ETH’s price to be blamed?

The crash in the daily amount of new ETH staked can be attributed to the altcoin’s price action. In fact, according to CoinMarketCap’s data, ETH was valued at $3,033 at press time, having shed 14% of its value in just 30 days.

When ETH holders “lock” up their coins, their rewards are typically paid out in ETH upon maturity or expiration of the staking period. Therefore, if ETH’s value declines, the dollar value of those rewards to which they are entitled also falls.

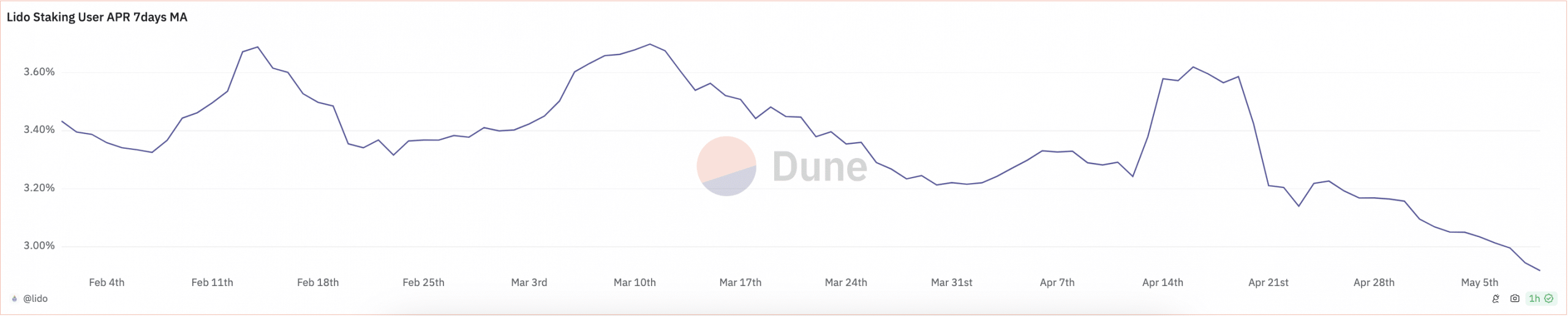

For example, on the leading liquid staking platform Lido Finance [LDO], its staking Annual Percentage Rate (APR) has trended south since 19 April. With a reading of 2.9% at the time of writing, this has dropped by 19% since the aforementioned date, according to data from Dune Analytics.

This can make staking a less attractive venture to new investors seeking returns.

Also, the coin’s short-term holders, known to be the major drivers of day-to-day price action, are often paper-handed. This means they are willing to sell at any sight of “trouble.” As such, they may be discouraged from staking their holdings if ETH’s price continues to drop, and they may opt to sell their coins instead.

Read Ethereum’s [ETH] Price Prediction 2024-25

Network validators are unmoved by low price action

Despite ETH’s current performance, voluntary exits by its network validators have continued to fall. According to Glassnode’s data, after rallying to a YTD peak of 2000 on 2 April, the daily count of validators that have left the network has dropped by 61%.

Due to this, the number of active validators on the network has continued to surge. At press time, there were 994,000 active validators on the Ethereum network.