Ethereum April 2024 Headlines: What's Really Happening with ETH Price Action?

05/10/2024 20:51

In this report, we explore and analyze the Ethereum ecosystem and the ups and downs of ETH price action in April 2024.

Last updated: | 15 min read

In this report, we explore and analyze the Ethereum ecosystem and ETH price action in April 2024.

Key takeaways:

- ETH experienced significant price swings in April, reaching a high of $3,723 and a low of $2,863.

- Ethereum-based crypto investment products experienced negative outflows, indicating a shift in investor sentiment.

- The US SEC delayed making a decision on spot Ether ETF proposals from Franklin Templeton and Grayscale. At the same time, the Hong Kong Stock Exchange launched spot Bitcoin- and Ether-based ETFs, managed by China Asset Management, Harvest Global, Bosera, and HashKey.

- Ethereum staking hit a new all-time high, with over 27,1% of all Ether staked.

- According to VanEck, Ethereum Layer 2s will hit a $1 trillion market cap by 2030.

- Compared to March, Ethereum-based NFTs saw a decrease in sales volume of more than 100%.

What You’ll Find in This March Ethereum Analysis:

What is Ethereum?

Founded in 2013 by Vitalik Buterin, Ethereum serves as a distributed blockchain computing platform designed for the execution of smart contracts and decentralized applications (DApps). The network enables users to create and innovate extensively with smart contracts, catalyzing the emergence of various assets and industries such as decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), Web3 and beyond. At its core, Ethereum features an execution engine tailored for smart contract processing, known as the Ethereum Virtual Machine (EVM). In addition, Ethereum employs a proof-of-stake (PoS) consensus mechanism, which enhances its scalability and sustainability.

ETH Price Performance and Ethereum On-Chain Data Analysis

April saw a period of volatility for Ether (ETH). On April 8, the ETH price reached $3,723, but plunged 30% between April 9 and April 13, reaching a 50-day low of $2,863. While there was a partial recovery on April 14, a failed attempt to break the $3,200 resistance level indicated further weakness.

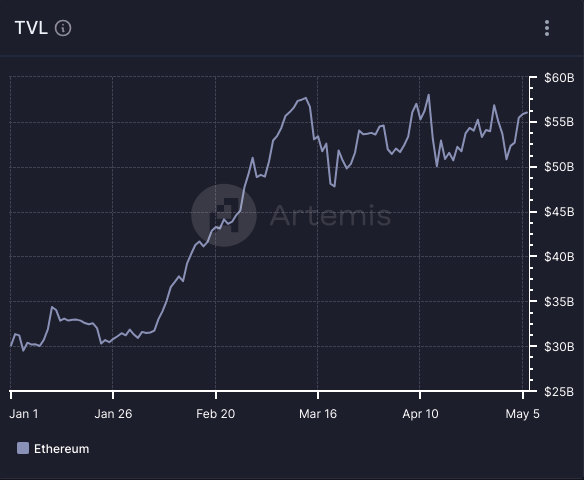

On April 23, the ETH price rose above $3,200, potentially fueled by increased demand for Ethereum DApps. This was further supported by a surge in the network’s total value locked (TVL) reaching its highest level since July 2022 ($58 billion on April 12 and $56,9 billion on April 28), indicating continued activity within the DeFi space.

However, the lack of clarity regarding the approval of spot Ethereum ETFs in the U.S., especially the upcoming SEC decision on VanEck’s proposal, could dampen investor interest. At the end of the month, the ETH price dropped again, reaching $3,000.

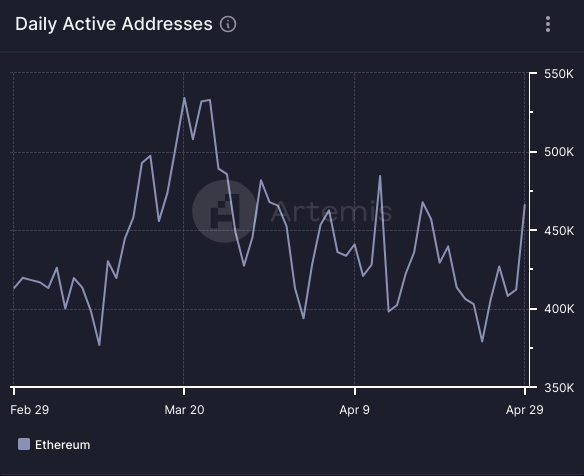

Additional data also reveals a decline in Ethereum’s network activity (in specific metrics) over the last month (especially compared to March). Daily active addresses on Ethereum dropped from 534k addresses on March 20 to 379k addresses on April 24, but this number increased at the end of the month and reached 474k on April 30. Ethereum also witnessed a decline in daily transactions in April – from 1.4 million on March 19 to 1.1 million on April 27.

Ethereum-based crypto investment products experienced negative outflows in April which saw $38 million, according to an April 29 report by CoinShares. This stands in contrast to most other altcoins like Solana, Litecoin, and Chainlink, which enjoyed positive inflows of $4 million, $3 million, and $2.8 million respectively during the same period.

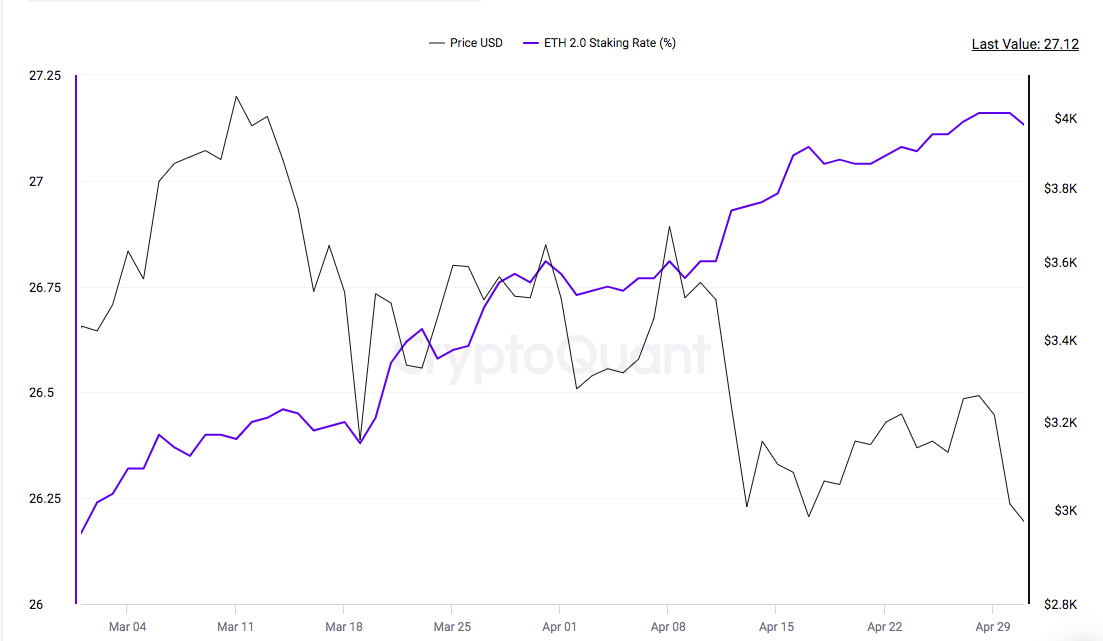

At the same time, Ethereum’s on-exchange supply also continued to decline throughout April, at a faster rate than Bitcoin. This indicates a decreasing supply of Ethereum available for trading, suggesting a potential shortage. This behavior aligns with the trend of investors holding Ethereum for longer periods, incorporating it into their long-term portfolios. Other indicators, such as the high staking ratio, further support this hypothesis.

Data from @Glassnode shows a steady decline in #Ethereum's supply on exchanges, which is falling faster than #Bitcoin.

Investors are filling their long-term #ETH bags.

It's becoming increasingly plausible that Ethereum could lead the upcoming crypto rally! pic.twitter.com/YdsUd8bgnn

— Leon Waidmann | On-Chain Insights🔍 (@LeonWaidmann) April 29, 2024

In April, gas fees on the Ethereum network dropped to their lowest level in six months following the Dencun upgrade on Ethereum on March 13. This drop in gas fees could be a harbinger of an upcoming rally for altcoins, according to analysts at crypto data platform Santiment. Santiment’s data, shared in an X post on April 28, shows that the average cost of an Ethereum transaction fell as low as $1.12 on April 27.

🤑 #Ethereum's average fee level has dipped to just $1.12 per network transaction, the lowest average cost in a day since October 18th.

Traders historically move between sentimental cycles of feeling that #crypto is going "To the Moon" or feeling that "It Is Dead", which can… pic.twitter.com/8b8rLMLyIf

— Santiment (@santimentfeed) April 28, 2024

Spot Ether ETFs Face Regulatory Uncertainty

The future of spot Ether exchange-traded funds (ETFs) in the US remains shrouded in uncertainty.

Over the past two months, Ether has significantly underperformed Bitcoin. This trend intensified in April after Jan van Eck, Chief Investment Officer of VanEck, expressed concerns about possible rejections of US spot Ether ETF applications in May.

This news came on top of the SEC’s inaction on the seven pending spot Ether ETF applications, further dampening investor sentiment. In April, the SEC announced a delay in its decision on Franklin Templeton’s proposed spot Ether ETF, extending the deadline to June 11, 2024. The SEC also delayed a similar proposal for the Grayscale Ethereum Trust. Other issuers that have filed applications for Ether ETFs include BlackRock, 21Shares with Ark, Fidelity and Invesco, as well as Galaxy and Hashdex.

While Bitcoin enjoyed a relatively smooth path to spot ETF approval in January, the outlook for spot Ethereum ETFs seems less certain.

In March, Bloomberg ETF analyst Eric Balchunas estimated a significantly lower chance (around 35%) for SEC approval of a spot Ether ETF in May, effectively moving the needle of the ETH price as well. This pessimism stems from the SEC’s noticeably less engaged approach compared to the Bitcoin ETF application process. Additionally, SEC Chair Gary Gensler’s refusal to clarify whether Ether is considered a security in an April 18 hearing on oversight of the SEC adds another layer of uncertainty to the decision-making process.

Yeah our odds of eth ETF approval by May deadline are down to 35%. I get all the reasons they SHOULD approve it (and we personally believe they should) but all the signs/sources that were making us bullish 2.5mo out for btc spot are not there this time. Note: 35% isn't 0%, still… https://t.co/QWQOGZjDC5

— Eric Balchunas (@EricBalchunas) March 11, 2024

Fellow analyst James Seyffart also expressed concern over the SEC’s inaction, questioning the reasons behind the lack of communication when the applications were anticipated.

Beyond the immediate impact on spot ETFs, the ongoing regulatory disputes cast a shadow over the entire Ethereum ecosystem. Adding fuel to the fire, Uniswap Labs, a developer of the software on which Uniswap – a widely used DEX – facilitates trading, announced on April 10 its intention to “fight” after receiving notice that the SEC is mulling a lawsuit against the company. While details remain unclear, Uniswap claims that its UNI token is not a security and that its platform doesn’t qualify as a US securities exchange or broker.

Meanwhile, on April 25, software development company Consensys filed a lawsuit against the SEC and its five commissioners over claims it plans “to regulate ETH as a security.”

Today, Consensys took an important step towards preserving access to ether and by extension the Ethereum blockchain in the U.S. We are suing the SEC and fighting back against its overzealous regulatory overreach. You can find more of my thoughts here: https://t.co/VmvOsrCxjw… https://t.co/5IubZo69FW

— Joseph Lubin (@ethereumJoseph) April 25, 2024

But even amid the regulatory uncertainty surrounding Ethereum in the US, Hong Kong has taken a bold step forward. On April 30, the Hong Kong Stock Exchange launched spot Bitcoin- and Ether-based ETFs. The Hong Kong-based ETFs – managed by China Asset Management, Harvest Global, Bosera and HashKey – only reached $12.4 million in trading volume during the first day, which pales compared to the first-day trading volume of U.S. spot Bitcoin ETFs, valued at $4.6 billion. Although the volume was relatively small, it’s important to note that Hong Kong’s ETF market is significantly smaller than the US market.

Ethereum Ecosystem Updates

The Ethereum ecosystem continues to buzz with innovation, focusing on scalability, security and stablecoins. Here’s a breakdown of some key developments from April 2024.

ZK-proofs for Streamlined Business Processes

Big Four accounting firm Ernst & Young (EY) launched an Ethereum-based solution called EY OpsChain Contract Manager (OCM), which will use zero-knowledge proofs to help its private business clients simplify complex contracts.

OKX Embraces Layer 2 for Lower Fees

Cryptocurrency exchange OKX announced integration with Ethereum Layer-2 solutions. This integration aims to provide users with significantly lower transaction fees and faster settlement times when trading on Ethereum.

USDC Expands to ZKSync

Stablecoin issuer Circle expanded support for its native stablecoin, USD Coin (USDC) to Ethereum zero-knowledge layer-2 solution zkSync. This move will enable users to make fast and low-cost USDC transactions on ZKSync. “Many leading ecosystem apps and DeFi protocols are expected to support native USDC on zkSync for payments, trading, borrowing, lending,” wrote Circle in its April 9 announcement. The zkSync integration expands USDC’s reach to a total of 16 blockchains, including major players like Ethereum, Solana, Base and Arbitrum.

Ethena USDe Now Available on Binance, Bybit, OKX, and Bitget

Ethena Labs, the team behind USDe, added Bitcoin as collateral to its synthetic dollar-backed stablecoin on the Ethereum network, hoping to scale “significantly” from its current $2 billion supply. Ethena Labs also integrated with centralized exchange wallets of Binance, Bybit, OKX, and Bitget and airdropped a total of $450 million worth of Ethena (ENA) tokens to participants in April.

We are excited to announce our integration with exchange wallets

The integrated wallets are:@Web3WithBinance@Bybit_Official@okxweb3@BitgetWallet

Users locking USDe for at least 7 days through exchange Web3 wallets are eligible for a 20% reward boost starting today pic.twitter.com/kUJOLiKeKM

— Ethena Labs (@ethena_labs) April 10, 2024

Movement Labs to Build Network of Move-based Blockchains

Movement Labs, a San Francisco-based blockchain development team, secured $38 million in a Series A funding round. The funding round was led by Polychain Capital and included participation from prominent firms like Aptos Labs, Bankless Ventures, OKX Ventures and eight other venture capitalists.

Movement Labs aims to leverage Move-based Ethereum Virtual Machines (EVMs) to address security vulnerabilities and improve transaction throughput within the Ethereum ecosystem. These Move-EVMs offer enhanced protection against reentrancy attacks, a common exploit that has plagued major protocols like Curve and KyberSwap in the past.

According to Movement Labs, smart contract vulnerabilities led to a staggering $5.4 billion in losses between 2022 and 2023. Their solution aims to mitigate these risks and build a more secure foundation for future blockchain applications.

Ethereum-Based Protocols and DEXs

DeFi total value locked nearly doubled in Q1 2024 (from a Q4 2023 low of $36 billion to peak at almost $97 billion in the first quarter of 2024), reaching a two-year high. Ethereum’s liquid staking innovations, particularly Lido and EigenLayer’s explosive growth, are key drivers, according to the report published by QuickNode and Artemis.

According to recent data from CryptoQuant, Ethereum staking hit a new all-time high, with over 27,1% of all Ether now staked (on April 28), despite the fluctuating ETH price.

Earlier this year, Ethereum focused its development efforts on improving the blockchain’s ability to process Layer 2 transaction data, as exemplified by the March 13 Dencun upgrade, which lowered Layer 2 transaction fees. This focus on scalability will benefit Layer 2 networks like Base or Optimum. Analysts at VanEck predict that the Ethereum scaling ecosystem, which could include thousands of specialized Layer 2 chains, could reach $1 trillion in market capitalization by 2030.

EigenLayer Launched its New Token

On April 29, the largest restaking protocol by TVL on Ethereum introduced a white paper outlining its new token, EIGEN. This token is designed to power applications requiring verifiable consensus, like prediction markets, data storage solutions and virtual gaming environments. Several regions, including the United States and Canada, will be excluded from the upcoming airdrop.

EigenLayer removed the limits on all liquid staking tokens (LSTs) on April 16, according to an X announcement. EigenLayer launched on mainnet on April 10. While users staking LSTs via EigenLayer get a cut of rewards, the lower security needs of Actively Validated Services (AVSs) could be a future concern. On April 22, pseudonymous developer Chudnov stated that EigenLayer may soon face a “yield crisis” as the value of the assets locked on its platform is growing faster than what is needed to secure the network.

1/ EigenLayer is facing a *major* yield crisis, and nobody is talking about it. @eigenlayer has >$15B in TVL but AVS's will actually need less than *10%* of that for security, which means yields may fall off a cliff

— chudnov (@chudnovglavniy) April 22, 2024

Uniswap Surpassed $2 Trillion in Trading Volume

The largest DEX operating on the Ethereum blockchain, Uniswap, eclipsed $2 trillion in total trading volume on April 5. This achievement comes just over five and a half years after Uniswap’s launch in November 2018 Data from a Dune Analytics dashboard, compiled by Uniswap’s Zach Wong (Strategy & Operations Lead). The total number of wallets on Uniswap skyrocketed from 3.03 million in May 2023 to 7.26 million in May 2024, an increase of approximately 140%.

Additionally, Uniswap recently integrated with Robinhood Connect to allow its users to purchase cryptocurrencies with funds from their Robinhood accounts or a debit card, as well as via bank transfer.

Puffer Finance Fuels Liquid Staking Growth

Puffer Finance, a liquid staking project built on Ethereum restaking protocol EigenLayer, successfully raised $18 million in a Series A funding round. This influx of capital will likely fuel further development of their platform, which allows users to stake ETH while maintaining liquidity.

According to DefiLlama, Puffer Finance surpassed a TVL of $1.2 billion shortly after its early testing phase in February. To date, the protocol has raised a total of $23 million in venture capital funding.

Etherscan Ads Fuel Massive Phishing Campaign

A large-scale phishing campaign has been uncovered, targeting users of the popular Ethereum blockchain explorer, Etherscan. On April 8, a vigilant community member known as McBiblets identified several Etherscan advertisements as fraudulent. These ads, disguised as legitimate content, aimed to steal users’ crypto wallets when clicked.

All the other phishing sites it's linked to pic.twitter.com/4PjxnYn3ny

— McBiblets (@mcbiblets) April 7, 2024

Degen Chain Reached the Highest TPS

A new player has emerged in the Ethereum scaling race: Degen Chain. Launched in late March, this application-specific Layer-3 blockchain leverages Arbitrum Orbit’s technology and Base’s settlement layer for Ethereum. This approach seems to be paying off, as Degen Chain achieved on April 19 the highest transaction count per second (TPS) within the Ethereum ecosystem over a 24-hour period. Clocking in at 35.7 TPS, Degen Chain even surpassed Base, the layer-2 solution it utilizes, which reached 29.7 TPS during the same timeframe.

Ethereum NFTs

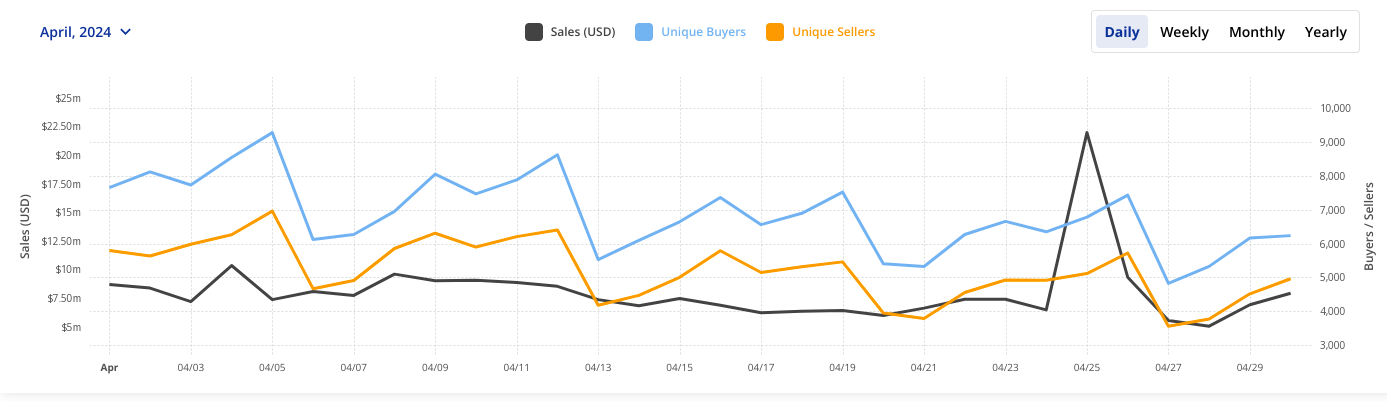

NFT sales volumes for all blockchains declined in April after hitting a year-to-date high in early March. Ethereum NFT sales led the pack with a significant drop in line with the fluctuating ETH price.

According to CryptoSlam data, the sales volume of Ethereum-based NFTs reached $240.8 million in April, 103% less than the values recorded in March ($488.9 million). The data further revealed that the Ethereum network has attracted around 69k buyers and 59k sellers of NFTs during April. The number of NFT transactions on Solana reached more than 509k in March, 27% less than the previous month (648k).

The most traded NFTs last month were Bitcoin-based “Uncategorized Ordinals”, followed by Ethereum-based NFTs CryptoPunks and Bored Ape Yacht Club.

In a noteworthy sale, a CryptoPunk NFT from the CryptoPunks series has been sold for 4,000 ETH (approximately $12.4 million). The anonymous buyer acquired Punk #635, one of only nine rare Alien Punks within the collection of 10,000 Ethereum-based NFTs. This sale propels Punk #635 to the fourth-highest price ever paid for a CryptoPunk. The record holder remains Alien Punk #5822, which sold for 8,000 ETH (over $23.7 million at the time) in early 2022.

Luxury fashion house Louis Vuitton announced the drop of a varsity jacket worth around $8,400, which will have both the physical garment and a corresponding NFT. Designed by Pharrell Williams, record producer, and singer-songwriter, the jacket is part of the brand’s ongoing Via NFT project.

A Los Angeles burger restaurant themed around a Bored Ape Yacht Club (BAYC) NFT closed its doors after two years of operation. The branding and intellectual property are reportedly being acquired by a decentralized autonomous organization (DAO).

The NFT collection Doodles unveiled its plans for an upcoming animated film titled “Dullsville and The Doodleverse.” The film will feature the voices of rappers Lil Wayne and Coi Leray.

Notable NFT launches in April:

- Quantveilz (April 5 – April 12): Quantveilz is a collection of 10,000 hand-crafted NFTs. Owning a Quantveilz grants access to a thriving community, potential participation in future games, and exclusive perks within their ecosystem.

- Fancy Girls Web3 (April 9 – April 16): Fancy Girls Web3 offers 10,000 metaverse-ready avatar NFTs. Ownership grants potential benefits like building NFT brands and accessing exclusive project products within Fancy Girls’ metaverse.

- Frame (April 23 – April 30): Frame is a collection of 9,999 hand-drawn character portraits stored as NFTs. Each portrait boasts intricate details, vibrant colors and diverse face types, ensuring individuality. This artist-crafted collection aims to showcase the fusion of artistic expression and technological innovation.

- GoofBudz (April 24 – May 01): GoofBudz is an NFT collection of 10,000 algorithmically generated NFT avatars. GoofBudz features a vibrant collection of hand-drawn characters with quirky features and distinct personalities. Each GoofBudz NFT is programmatically generated from a pool of unique features, ensuring a high degree of visual diversity.

Looking Ahead – Can the ETH Price Go Higher?

April presented a mixed bag for Ethereum and its ecosystem. The month commenced with significant price volatility for ETH, marked by a sharp decline from its peak on April 8 to a 50-day low by April 13. Despite a partial recovery mid-month, ETH faced resistance in breaking key resistance levels, reflecting underlying weakness in the market sentiment.

On the on-chain front, Ethereum exhibited signs of both strength and weakness. While total value locked (TVL) in DeFi surged to its highest levels since July 2022, indicating sustained activity within DeFi, other metrics like daily active addresses and daily transactions saw declines over the month. Moreover, Ethereum-based crypto investment products experienced negative outflows, contrasting with the positive inflows seen in some other altcoins.

Regulatory uncertainties surrounding the approval of spot Ether ETFs in the U.S. loomed large over investor sentiment. The SEC’s delay in decisions regarding several spot Ether ETF proposals, coupled with concerns expressed by industry analysts, contributed to market apprehension. The lack of clarity on whether Ethereum qualifies as a security further added to the ambiguity surrounding regulatory oversight.

Despite the regulatory challenges, the Ethereum ecosystem continued to witness notable developments in scalability and security. Projects like EY OpsChain Contract Manager (OCM), Circle’s USDC expansion, and Ethena Labs’ USDe integration showcased ongoing innovation within the Ethereum space.

The proliferation of Layer 2 solutions and the burgeoning DeFi ecosystem underscored Ethereum’s resilience and potential for long-term growth. However, concerns lingered regarding security vulnerabilities and scalability issues, as evidenced by movements like Movement Labs’ efforts to address smart contract risks.

NFT activities on the Ethereum blockchain saw a decline in sales volume compared to March, reflecting broader market trends. Nonetheless, notable sales such as the acquisition of a rare CryptoPunk NFT and Louis Vuitton’s foray into NFTs highlighted continued interest and adoption in the NFT space.