Long-Term Ethereum Investor Sells $12.7 Million in ETH

05/13/2024 20:40

A long-term Ethereum investor has transferred over $12 million in ETH to Coinbase, suggesting potential sale plans.

A long-standing Ethereum investor known by their wallet address 0x2ce recently transferred a significant quantity of Ethereum (ETH) to Coinbase.

This movement involved 4,153 ETH, valued at approximately $12.17 million, based on the current exchange rate of $2,931 per ETH.

Are Long-Term Ethereum Investors Cashing Out?

Initially, 0x2ce sent the funds to an intermediary wallet – 0x1d9, before the final transfer to the centralized exchange, Coinbase. Such movements to platforms like Coinbase generally indicate a plan to sell, contrasting with withdrawals to self-custody wallets, which suggest an intent to hold.

Regarding profitability, according to the on-chain analysis platform Spot On Chain, the crypto whale has realized substantial gains. He initially acquired 12,423 ETH from Poloniex at an average cost of only $11.03 per ETH, amounting to an estimated total of $137,000 between July 26 and August 8, 2016.

Since that initial acquisition, this investor has deposited 9,436 ETH to exchanges like Coinbase and Luno at an average price of $2,245, totaling about $21.2 million.

“The crypto whale still holds 2,566 ETH ( ~ $7.48 million) in a sub-wallet 0x2e3,” Spot On Chain said.

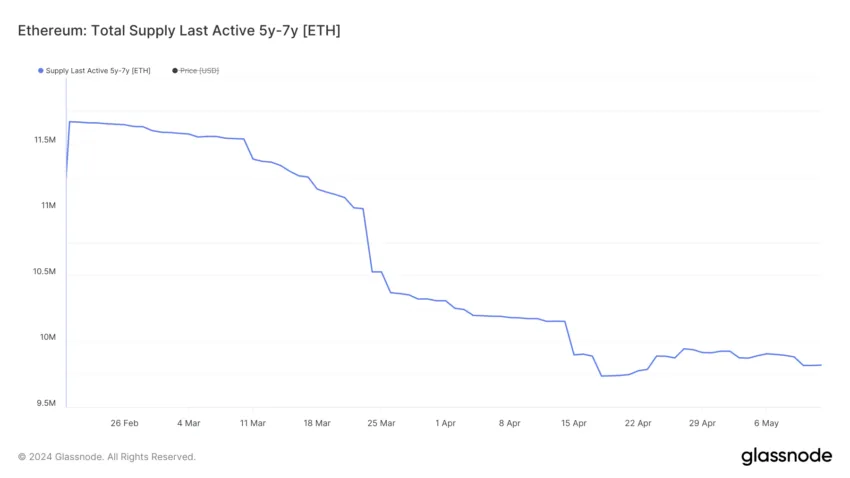

This transaction is part of a broader pattern observed among Ethereum long-term holders. Data from the on-chain analysis platform Glassnode reveals a decline in the total supply of ETH that had remained unmoved for five to seven years. Specifically, this metric has decreased by over 15%, dropping from 11.6 million ETH tokens during late February to the current 9.8 million ETH.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Despite this trend of large-scale disposals, experts remain optimistic about Ethereum’s market outlook. Hitesh Malviya, the founder of the on-chain analysis platform – DYOR, points out several positive signals.

“ETH is close to finding a bottom,” Malviya said.

These positive signs include the fair price model on DYOR, which recently turned bullish. Moreover, the TVL (Total Value Locked) to market cap ratio has increased by 16.91% in the last 30 days, and the average on-chain demand has begun to rise.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.