Ethereum: What does ETH’s future hold as investors continue to leave?

05/14/2024 10:00

Ethereum's recent price decline seems to be turning investors away. Where does the price of ETH go from here?

- Ethereum’s price fell by nearly 10% in a week.

- Technical analysis suggested a possible short-term recovery, with key metrics indicating reduced investor interest.

Ethereum’s [ETH] price has seen a significant downturn, with a nearly 10% drop in the past week and 1% decline in the past day, bringing it to a 24-hour low of $2,868.

This decline is more pronounced compared to Bitcoin [BTC], which has managed to breach notable price marks despite the current market conditions.

The downturn in Ethereum’s market performance is attributed to several factors, including massive whale activities that have introduced substantial volatility and selling pressure into the market.

Indicators of declining investor interest in Ethereum

Further compounding Ethereum’s market woes are the declining metrics of network activity.

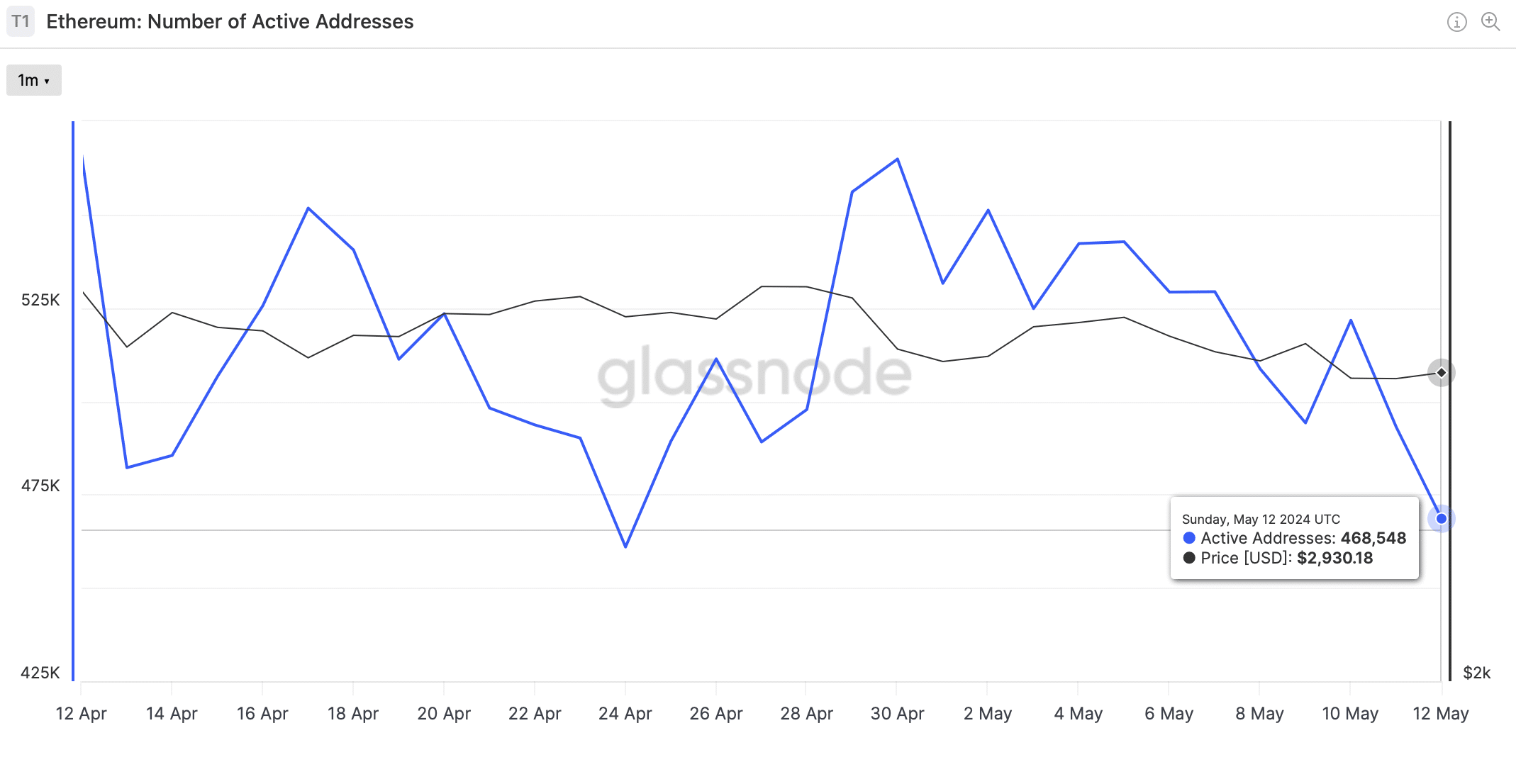

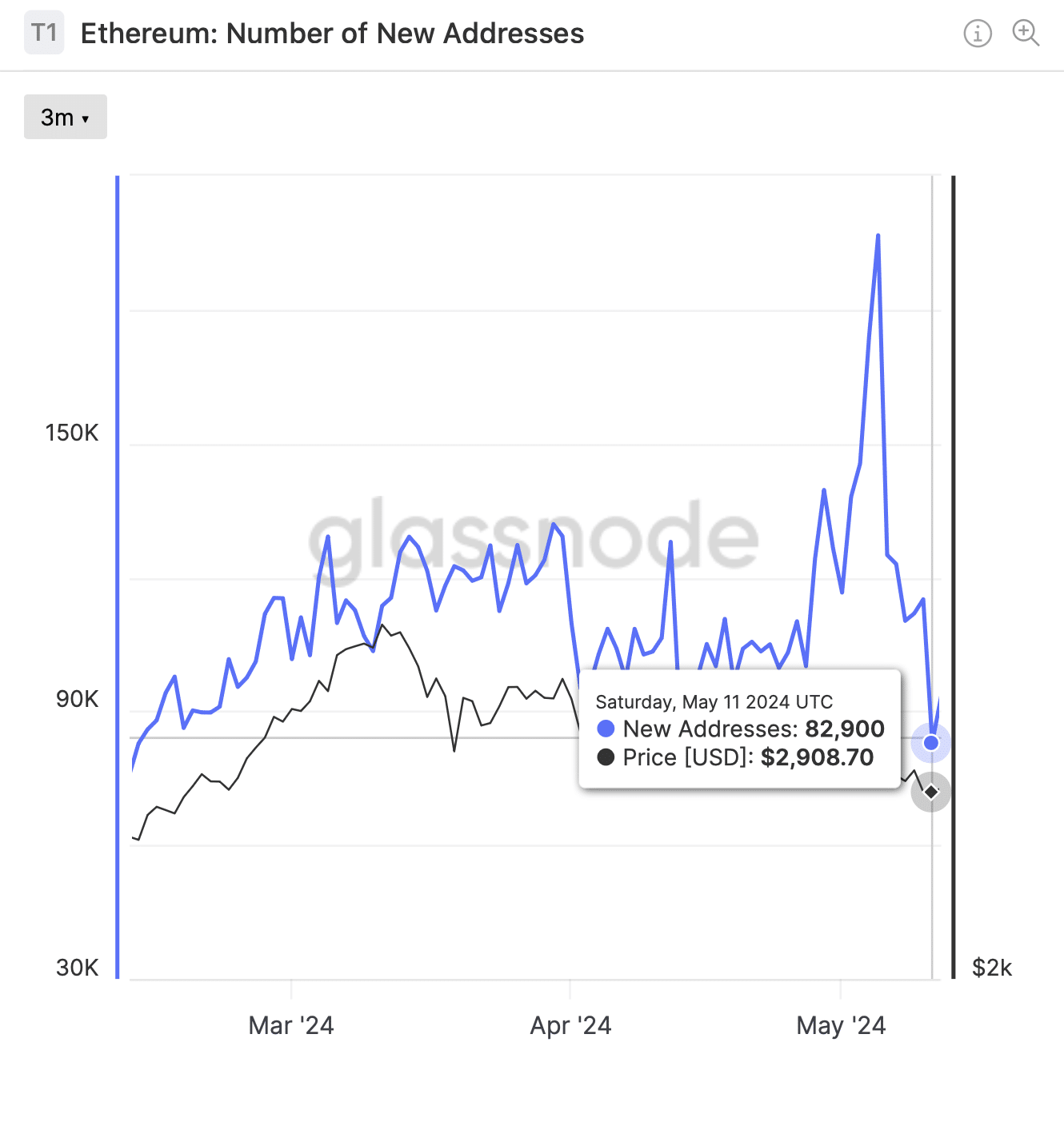

According to AMBCrypto’s look at Glassnode’s data, Ethereum’s active addresses have decreased from a peak of 564,868 in late April to 468,548 as of press time.

This decline in active addresses is paralleled by a drop in the number of new addresses—from 196,629 earlier in the month to below 85,000 on the 11th of May.

These metrics highlight a waning investor interest in Ethereum during this period.

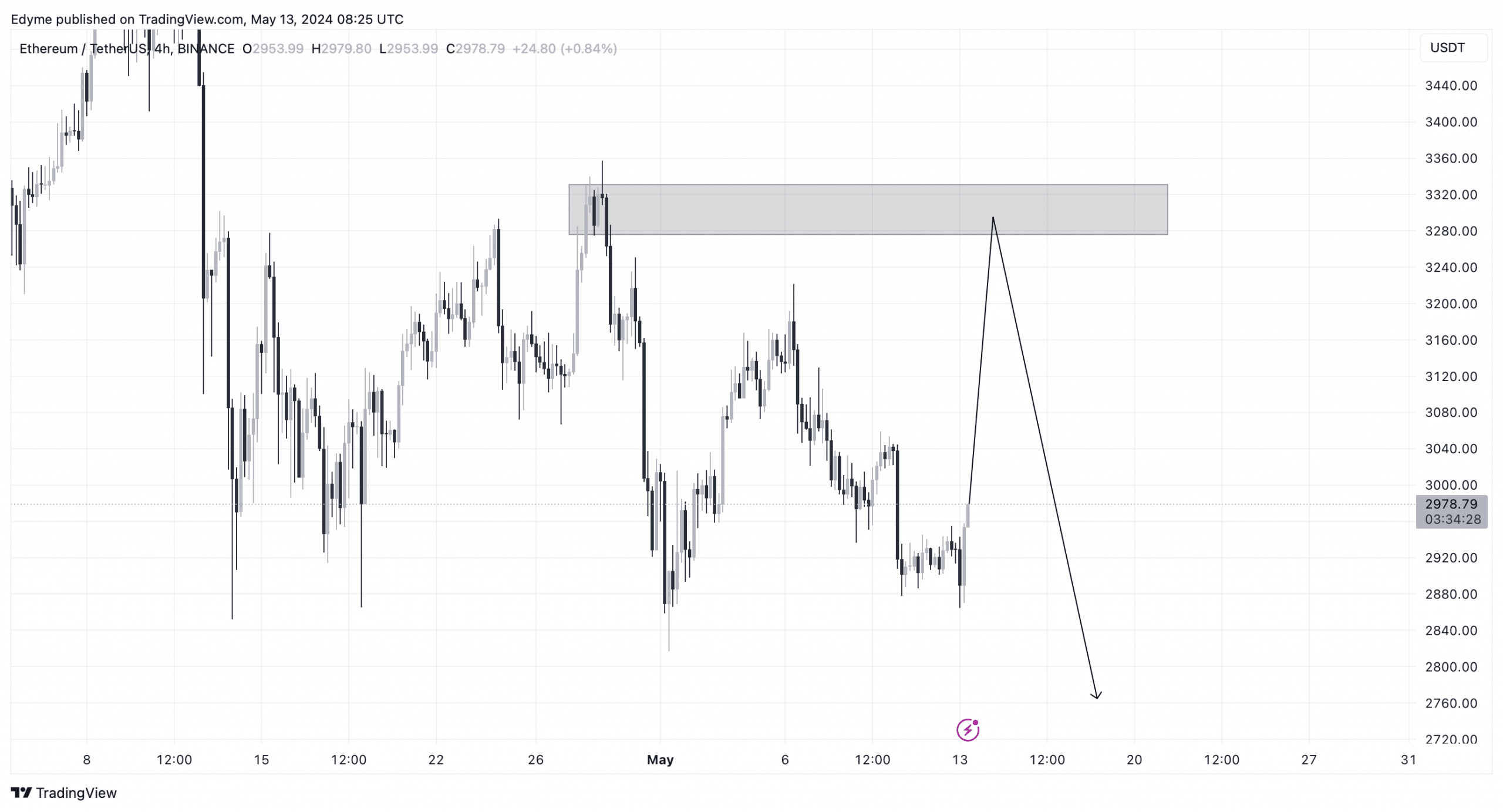

From a technical analysis perspective, Ethereum has broken significant support structures on the daily chart, indicating bearish pressure.

The 4-hour chart revealed that, at press time, there was liquidity near the $3,200 region that needed to be taken before any major downward continuation.

This suggested that Ethereum could experience a short-term rise above the $3,000 mark before potentially dropping to around the $2,800 level, setting the stage for a potential rally thereafter.

Read Ethereum’s [ETH] Price Prediction 2024-25

Notably, the deposit of Ethereum into the exchange coincides with the reactivation of two Bitcoin wallets that had been dormant for nearly 11 years.

Each of these wallets, holding 500 BTC, liquidated their entire holdings, which was yet another spot of bad news for investors.