U.S. regulators shun spot Ethereum ETFs: What about ETH’s price?

05/14/2024 13:00

Is it time to give up all hopes for an Ethereum spot ETF in the United States? Here's what you should know as the tides turn.

- Expectations for an Ethereum spot ETF has gotten significantly low in the community.

- Ethereum’s market performance continues to lag behind the majority of its peers.

Gary Gensler’s SEC is known for playing power games with the cryptocurrency industry, like taking their time to approve any kind of application for crypto products.

They eased up a bit this year with the approval of eleven spot Bitcoin [BTC] ETFs.

Ethereum Spot ETF, when?

Now, all eyes have turned to Bitcoin’s immediate sibling, Ethereum [ETH]. Applications have been filed quite some time ago for what the community sees as Gensler’s only preferred crypto to have its own spot ETF.

None has been approved, and the SEC has been noticeably quiet about it all. Just a few days ago, Grayscale withdrew their application for the ETH ETF., and didn’t reveal their reasons for it either.

The lack of engagement from the SEC with applications from ETF issuers plus Grayscale’s withdrawal have fueled speculation in the community that approval is not on the horizon.

This sentiment is mirrored in the market, with outflows totaling $14 million last week, according to data by CoinShares.

Furthermore, ARK Invest and 21Shares have revised their proposal for a spot Ethereum ETF, removing plans to engage in staking.

In the latest filing, submitted on Friday, the previous clause that allowed 21Shares to stake a portion of the fund’s assets through third-party providers was omitted.

Bloomberg ETF analyst Eric Balchunas mentioned that this update could be an attempt to refine the application based on possible feedback from the United States Securities and Exchange Commission (SEC)/

However, there have been no official statements.

Balchunas also proposed that this amendment might be a strategy to minimize the details the SEC could use to potentially deny the application.

Ethereum’s market movements

Turning our attention to Ethereum’s market, the second-largest cryptocurrency in the world is not having a good time at the moment.

Though all the other cryptos in the top ten have seen modest rises in the past twenty-four hours, Ether hardly budged. At press time, it is still way below its critical support level of $3,000.

Data from Santiment reveals that there is a lot of bearishness among Ethereum traders.

Trading volumes have gone down, liquidations are low, but not because investors are staying put, but likely because they’re bored.

Unlike Bitcoin, Ethereum hasn’t made any kind of major price movements this year. And the bulls are now unimpressed.

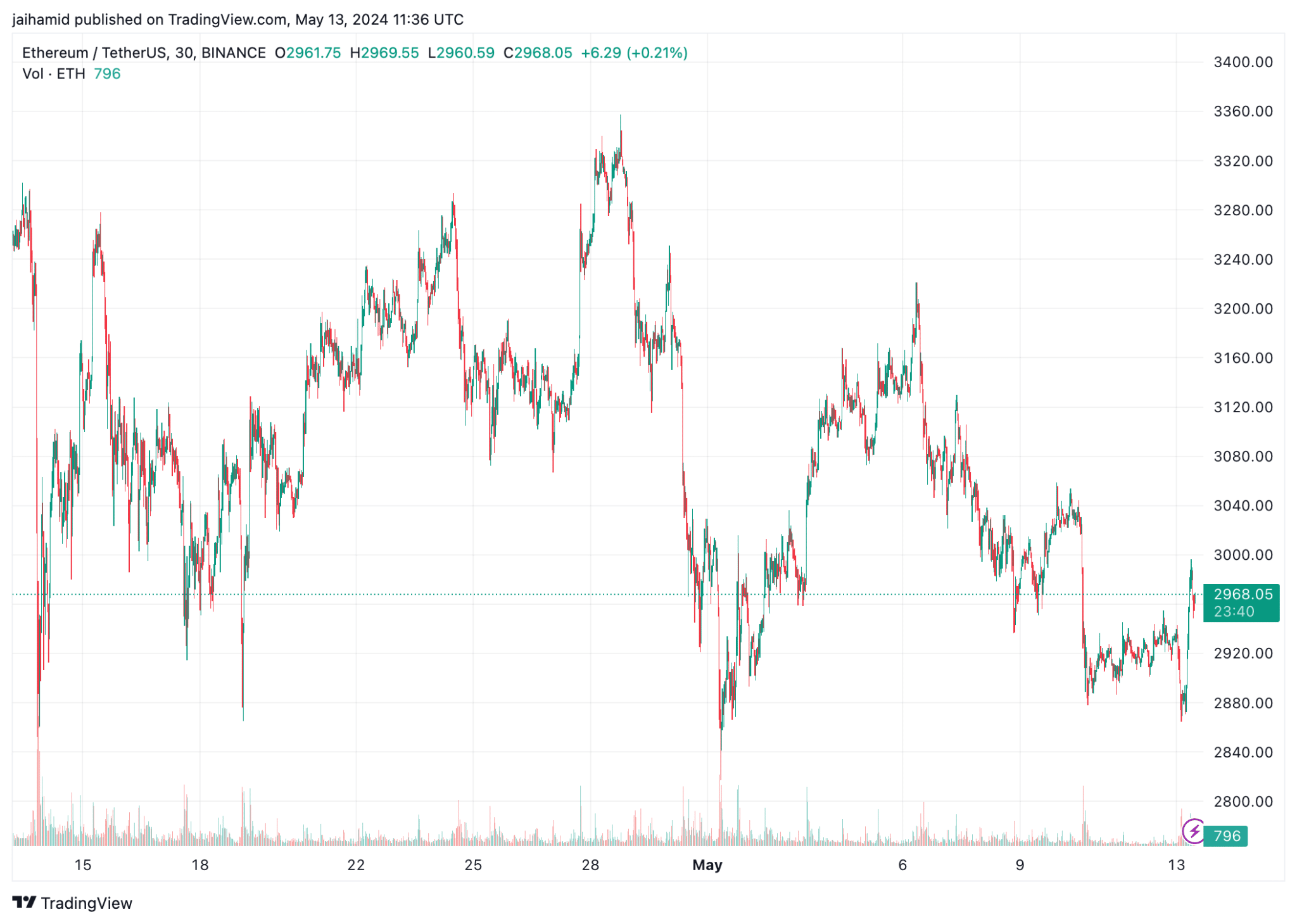

AMBCrypto took a look at the ETH/USDt pair on TradingView and discovered extreme volatility with multiple ups and downs.

The highest peak approaches the $3,340 level, indicating strong buying interest, while the lowest nears $2,840, where selling pressure intensifies.

The price repeatedly tested support around $2,900 this past month, as indicated by multiple touches on this line but without actually breaking it, showing resilience at this level.

Read Ethereum’s [ETH] Price Prediction 2024-25

Recently, the price shows a slight upward movement around $2,968, suggesting a tentative recovery or consolidation phase. But still, it failed. Ethereum was worth $2,958 at press time.

Given this context, the short-term prediction for Ethereum would lean towards a continuation of bearish trends.