Chainlink (LINK) Outlook: How Bitcoin Could Shape Bearish Trends

05/14/2024 16:30

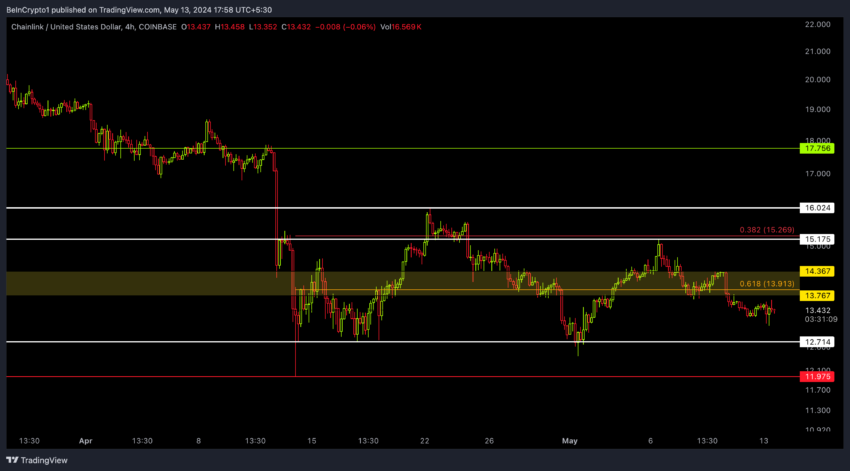

Chainlink's recent price movement and on-chain activity. Despite Bitcoin's rally, Chainlink couldn't break key resistance at $13.7.

In today’s analysis, we will delve into the recent price action of Chainlink (LINK) and its on-chain activity to understand the underlying trends and potential future movements.

Even though Bitcoin’s price surged from $60,700 to $63,000 within hours. Chainlink’s price failed to surpass the significant mid-term resistance level of $13.7. Curious about the reason? Let’s zoom In for a closer examination.

Chainlink Price Action Remains Bearish

The current price of LINK is trading below a significant yellow range, which is critical to observe over the next few days. This range could act as a resistance level. The fact that the price remains below this range signals a bearish sentiment in the market.

Interestingly, even as Bitcoin recovered to $63,000 yesterday, LINK did not exhibit comparable price appreciation, which aligns with bearish trends observed in similar tokens like PYTH. In addition, a decreasing trading volume has contributed to a deep price correction.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

Key Observations:

– Resistance Watch: The yellow range is crucial; breaking above could suggest a bullish reversal, whereas continued resistance confirms bearish pressures.

– Comparative Underperformance: Unlike Bitcoin, LINK’s lack of recovery is a point of concern, reflecting broader market uncertainty or specific challenges within the Chainlink ecosystem.

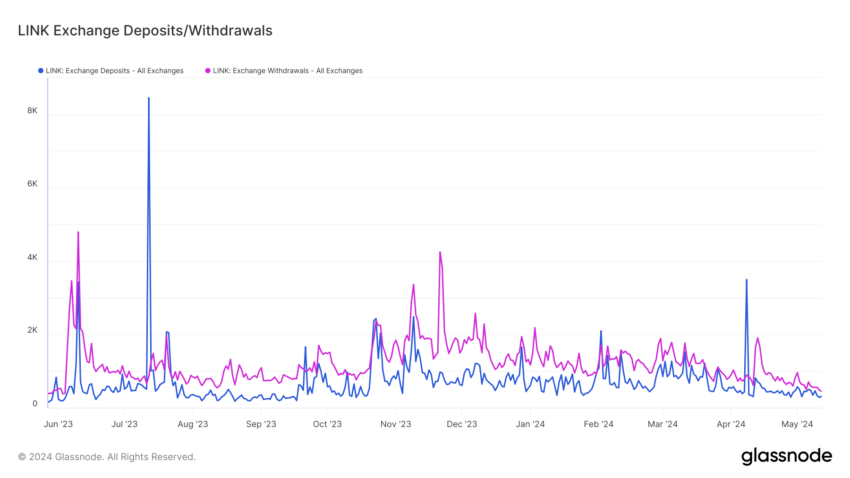

– Volume Trends: The decrease in trading volume, coupled with reduced exchange activity, indicates a lack of trader confidence, which could further decline the price.

A closer look at the on-chain metrics reveals that exchange deposits and LINK withdrawals have decreased significantly, leading to very low trading volumes. This drop in active trading volume is a bearish indicator and suggests that the price may continue to face downward pressure, potentially reaching the major mid-term resistance level of $11.9.

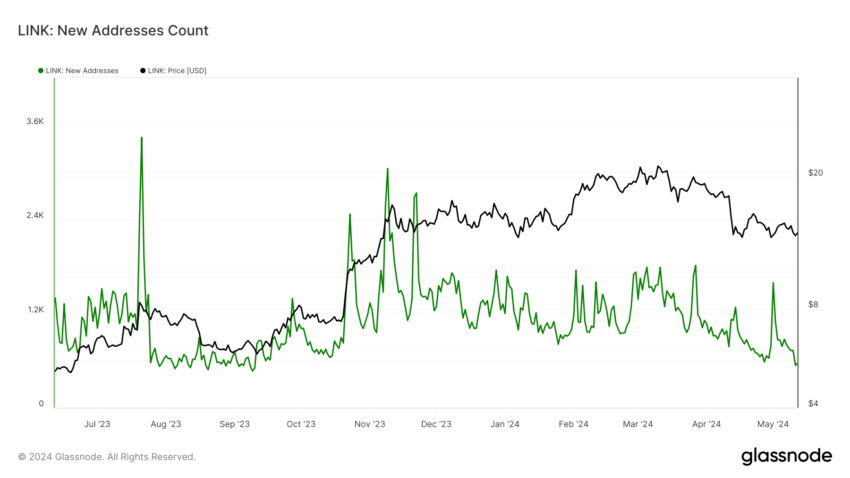

Additionally there has been a noticeable decline in the number of new addresses created on the Chainlink network, as depicted in the provided chart.

This downturn in active address creation correlates closely with the decline in LINK’s price, underscoring a reduced demand from new market investors.

Chainlink is currently exhibiting several bearish signs. The key to its short-term price movement will be its ability to break above the noted resistance range. Investors should monitor trading volumes and exchange activity as indicators of potential shifts in market sentiment.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

As always, it’s essential to approach trading cautiously, considering the volatile nature of crypto markets.

LINK Price Projection: How BTC Can Influence Price

- Bearish to Neutral Outlook: Chainlink’s price struggles below key resistance, with declining trading volumes and low exchange activity. This indicates strong bearish signals amidst a lack of new investor interest

- Bitcoin’s Influence: If Bitcoin continues its upward momentum towards $65,000, it could positively impact Chainlink.

- Conditional Resistance: Should Bitcoin fall below $60,800, LINK might experience a notable mid-term price decline, possibly extending its bearish trend.

- Price Projections: In the bearish scenario, LINK’s price could potentially fall to $11.9.

- Our recommendations for traders: If Bitcoin hits $60,800, expect LINK to drop 12%. A $65,000 BTC price could boost LINK to $15. Traders should consider waiting to buy LINK at a lower price, around $12 – $12.5. Setting a stop loss at $11.5 and aiming for a sell price of $15 might be a smarter move.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.