Tokens with low initial circulating supply to fully dilute value ratios and threaten the crypto market.

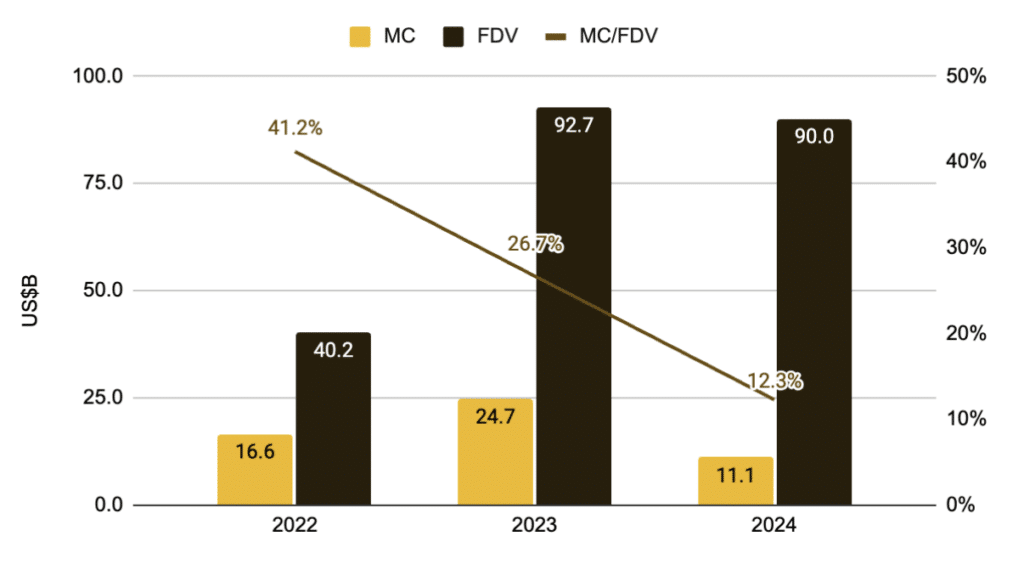

Binance experts have published a new report analyzing tokens launched in 2024. The study shows that the initial circulating supply to fully diluted value (FDV) ratio was the lowest in several years, indicating potentially high selling pressure that could negatively impact the crypto market.

At the same time, the total number of tokens issued since the beginning of 2024 is already close to the 2023 figure, with Binance analysts suggesting that the number of projects with high FDV, dictated by low initial circulating supply, is constantly growing.

With a capitalization to FDV ratio of 12.3%, approximately $80 billion of financial injections will be required to support the current prices of these tokens. Experts noted that this will support demand and balance pressure from sellers.

Low circulating supply driving initial price increases

The main reason for this trend is the low volume of circulating supply when tokens are launched. With the same volume of demand, a low share of circulating supply stimulates price increases at the project launch stage.

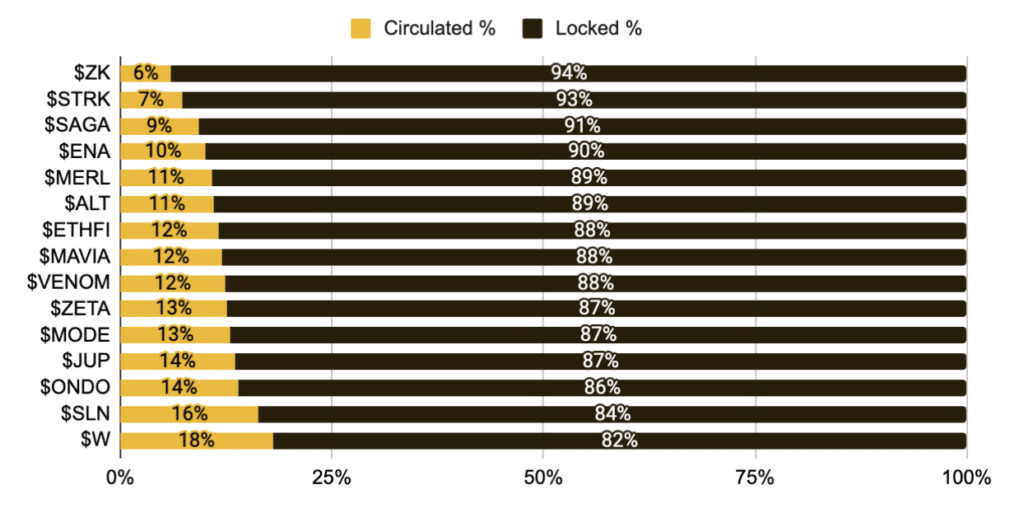

The launch of such projects has changed the market dynamics, increasing selling pressure. According to the report, tokens worth $155 billion will be unlocked by 2030. In light of this, it is extremely important to consider and monitor the schedules for the release of new volumes of assets onto the market.

The role of meme coins in the market

Experts conclude that structure is partly responsible for the new wave of demand for meme coins. Moreover, they noted that some investors see this asset class as a way to counter large projects that are launched with the participation of institutional investors.

Meme coins have become a serious part of the landscape in the crypto world. Analysts at Franklin Templeton believe that this type of asset has gained popularity due to the desire of some traders to make quick profits with low fees.

The excitement around meme coins does not subside. These tokens are still showing significant growth despite the overall dynamics of the crypto market, with the market capitalization of meme exceeding $58 billion.