As the expectations of the spot Ethereum (ETH) exchange-traded fund (ETF) approval come closer, traders place bigger bets on ETH rather than Bitcoin (BTC).

According to a CryptoQuant report shared with crypto.news, the ETH-BTC open interest ratio has increased from 0.54 to 0.67 over the past week. This shows traders are getting a higher exposure to Ethereum rather than Bitcoin due to the expectations of the spot ETH ETF approval.

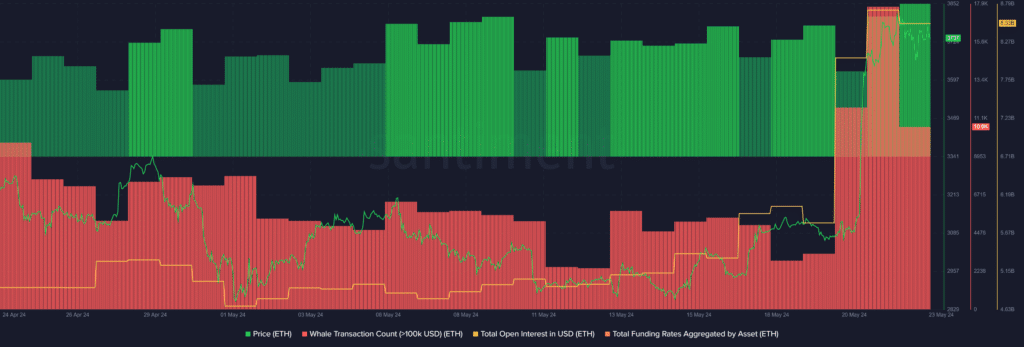

Data from Santiment shows that the ETH total open interest is currently standing at $8.53 billion. The total funding rate aggregated by Ethereum increased from 0.016% to 0.018% over the past 24 hours.

The indicator shows that the amount of traders betting on a further ETH price surge has risen and a series of large liquidations would be expected due to high price volatility.

Moreover, the demand for Ethereum has also increased from “Permanent Holders” — holders who buy an asset and never sell, excluding exchange addresses — per CryptoQuant. These addresses have accumulated more than 100,000 ETH on May 20, the highest level since September 2023.

Despite the growing accumulation and interest, the Ethereum net inflows into the exchanges reached 62,000 tokens on May 20. According to CryptoQuant, most of the assets went into Binance and Bybit crypto exchanges.

Per data from Santiment, the number of whale transactions consisting of at least $100,000 worth of ETH declined by 40% in the past 24 hours — currently sitting at 10,689 transactions per day.

This movement combined with the exchange inflows shows that investors are waiting for the ETH ETF approval and high price volatility would be expected due to the traders’ short-term profit-taking.

ETH is up by 1.7% in the past 24 hours and is trading at $1,810 at the time of writing. The asset’s market cap is sitting at $457 billion with a daily trading volume of $24.6 billion.

It’s important to note that Ethereum could face a steep downward momentum if the U.S. SEC rejects or delays the spot ETH ETFs.