Ethereum (ETH) Futures Open Interest Soars as $4,000 Target Approaches

05/23/2024 18:30

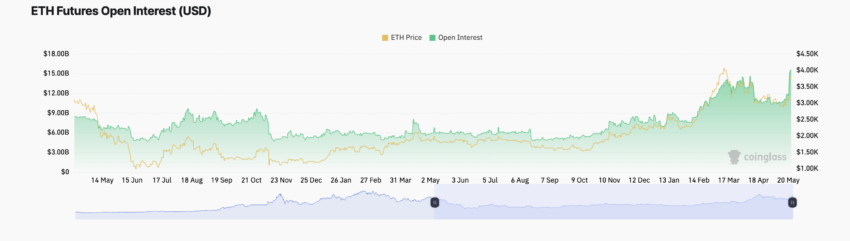

Increased activity in ETH’s derivatives market pushes its futures open interest to an all-time high of $16 billion.

Ethereum’s (ETH) futures open interest has climbed to an all-time high of $16 billion amid the recent rally in the general cryptocurrency market.

This surge comes as the leading altcoin attempts to reclaim the $4,000 price level and rally toward its all-time high of $4,891, which it recorded three years ago.

Ethereum Futures Traders Put in More Buy Orders

As of this writing, ETH’s futures open interest was $16 billion. Its recent uptrend began on May 19 and has since increased 45%.

ETH’s futures open interest measures the total number of the coin’s futures contracts that have yet to be settled or closed. When it rises in this manner, it indicates an increase in market participants entering new positions.

Assessed on a year-to-date, ETH’s open interest has grown by 69%.

In addition, the rise in ETH’s futures open interest is accompanied by a positive funding rate. As of this writing, ETH’s funding rate was 0.014%.

The funding rate refers to the periodic payment made between traders in an asset’s futures market to ensure its contract price stays close to the spot price.

When the funding rate is positive, traders who hold long positions pay those with short positions. This usually occurs when the futures price is higher than the spot price. Indicating a higher demand for buying than selling.

Read more: 9 Best Places To Stake Ethereum in 2024

The combined reading of ETH’s rising open interest and positive funding rate suggests significant bullish activity in the coin’s futures market. It means that the number of market participants opening new positions and holding the altcoin in the expectation of a rally is rising.

ETH Price Prediction: The Yays Have It

Confirming the ongoing bullish trend, ETH’s Relative Strength Index (RSI) was in an uptrend at press time. With a value of 71.21, the momentum indicator signaled that market participants prefer to accumulate more ETH rather than sell their coins.

Further, the coin’s Chaikin Money (CMF), which tracks the flow of liquidity into and out of ETH’s market, rested above its center zero line at 0.22.

A CMF above zero indicates market strength, suggesting high capital inflow.

If the inflow of “new money” into the ETH market continues to rise, the coin may leave the $3790 level behind it to trade at $3838.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if profit-taking activity ensues and the bears re-emerge, ETH’s price might drop to $3633.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.