Ethereum to $4K now? THIS shows that sellers are backing off

05/24/2024 04:00

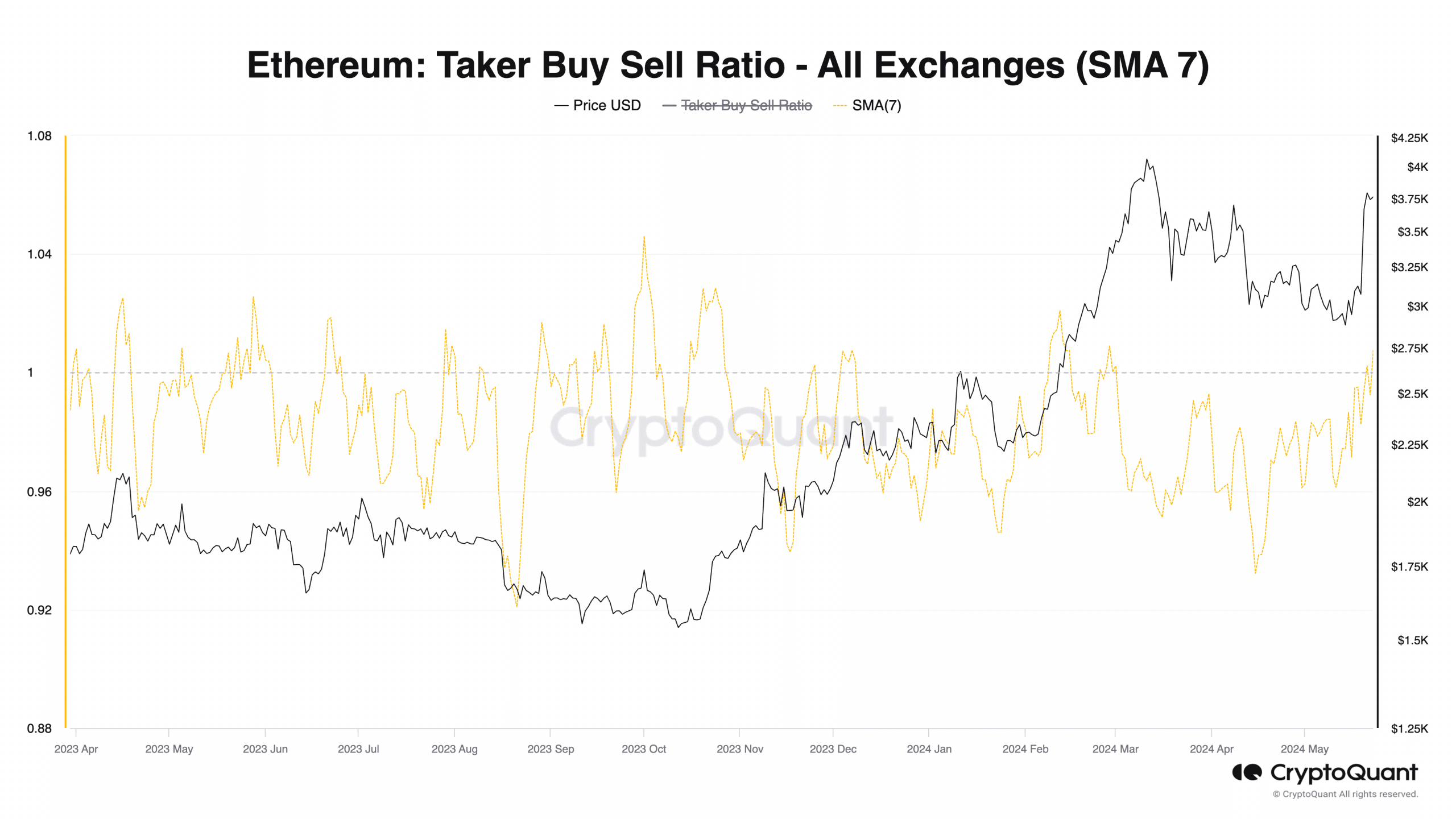

Ethereum’s [ETH] taker buy-sell ratio, observed using a 7-day simple moving average (SMA), is poised to cross above its 1-center line.

- ETH’s Taker Buy Sell Ratio rallied toward 1.

- This suggested a decline in selling pressure in its Futures market.

Ethereum’s [ETH] Taker Buy Sell Ratio, observed using a 7-day simple moving average (SMA), was poised to cross above its 1-center line at press time, according to CryptoQuant’s data.

This suggested a decline in sell orders in the coin’s perpetual Futures market.

ETH’s Taker Buy Sell Ratio measures the ratio between the coin’s buy and sell volumes in its Futures market.

When the metric rallies towards 1 or returns a value greater than 1, it signals more buy volume in the market than sell volume. Conversely, a value below 1 indicates more sell volume than buy volume.

As of this writing, ETH’s taker buy-sell ratio was 0.99, having climbed 3% since the beginning of the month.

Prior to this, this metric had been in decline. In a recent report, pseudonymous CryptoQuant analyst ShayanBTC noted that ETH’s Taker Buy Sell Ratio –

“Has consistently been below 1 for the past few months, suggesting that sellers have been more active in the ETH futures market.”

According to the analyst, the ratio changed its course when the recent rally began and has since climbed with ETH’s price.

“This upward trend in the Taker Buy Sell Ratio indicates a potential shift in market dynamics. If the ratio continues to rise, it may signal a reduction in aggressive selling pressure.”

ETH is in good hands

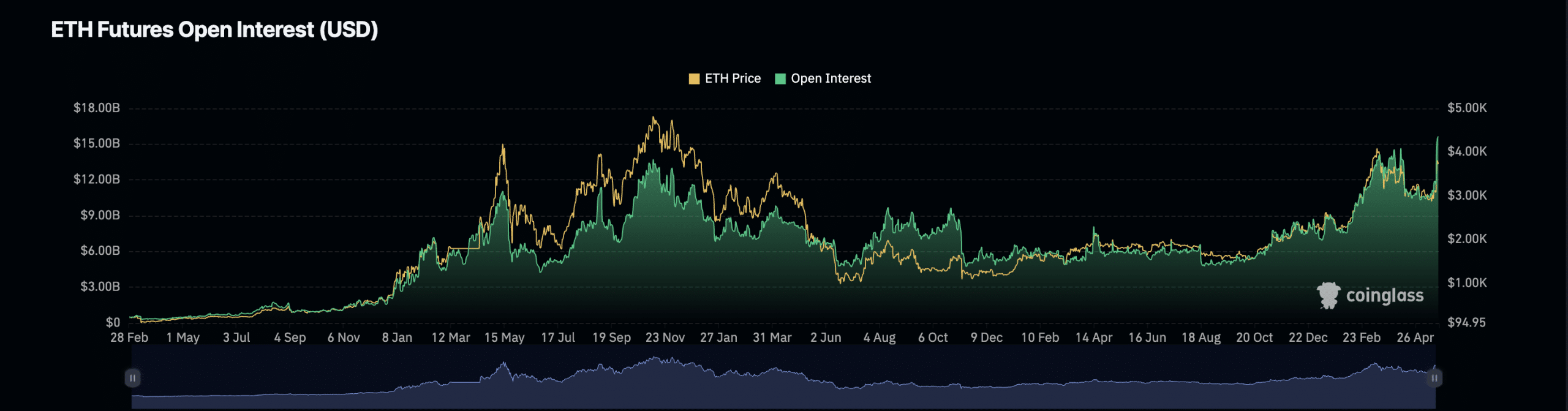

A closer look at ETH’s Futures market confirmed the possibility of a continued price rally. According to Coinglass’ data, the coin’s Futures Open Interest has rallied to a new all-time high of $16 billion.

Futures Open Interest tracks the total number of outstanding Futures contracts or positions that have not been closed or settled.

When it rises like this, it suggests that more market participants are opening new positions.

Is your portfolio green? Check out the ETH Profit Calculator

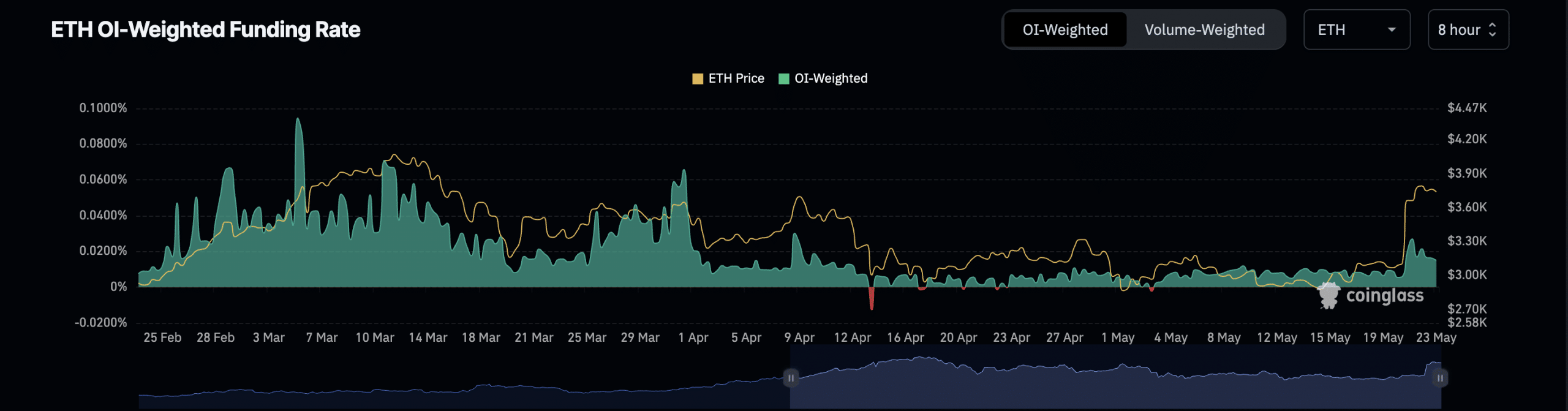

Further, the coin’s Funding Rate has remained positive. This is used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When ETH’s Futures Funding Rates return a positive value, it means there is a strong demand for long positions. This is a bullish signal and an indicator that the altcoin’s price will continue to grow.