Ondo Finance’s ONDO gained nearly 20% amid news that the U.S. securities regulator approved spot Ethereum exchange-traded funds.

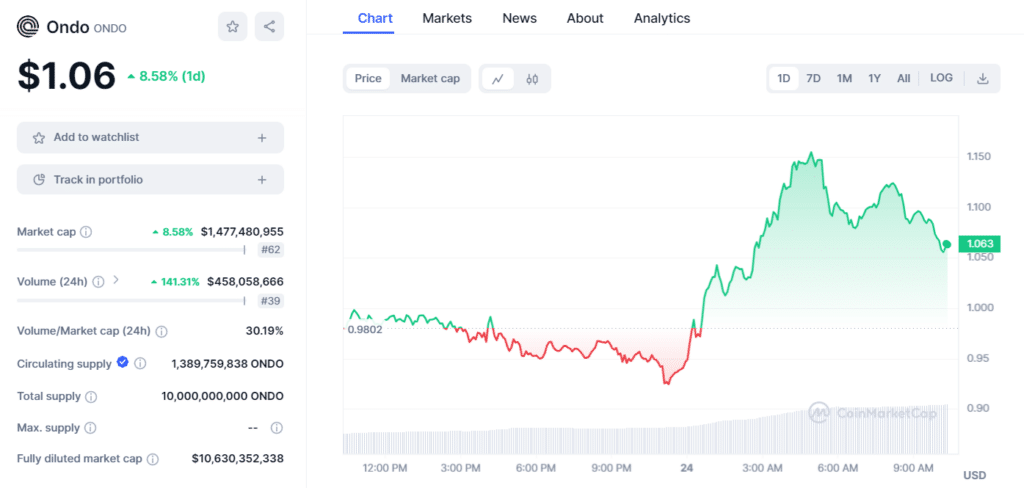

Ondo Finance, a tokenized real-world asset (RWA) platform backed by Pantera Capital, witnessed a remarkable surge in its ONDO token, which soared nearly 20% to reach an all-time high of $1.16. This spike came in the wake of the U.S. Securities and Exchange Commission (SEC) approving spot Ethereum exchange-traded funds (ETFs), fueling market expectations for a future rally.

The precise reason behind ONDO’s rapid surge remains somewhat ambiguous, but the platform’s strategic partnerships with major financial institutions, like BlackRock, may have influenced investor sentiment.

In late March, Ondo Finance transferred $95 million of its assets to BlackRock’s tokenized fund, BUIDL, to facilitate instant settlements for its U.S. Treasury-backed token, OUSG. Although this specific transaction is unlikely to have directly triggered ONDO’s recent price movement, the association with BlackRock appears to have bolstered confidence among ONDO holders regarding the token’s prospects.

BlackRock, known as the dominant force in the spot crypto ETF market, holds the largest share of spot Bitcoin ETFs, surpassing even Micro Strategy in Bitcoin accumulation for its iShares Bitcoin ETF (IBIT) within a short amount of time. BlackRock also filed a Spot Ethereum ETF application, which was recently approved by the U.S. financial watchdog.

The SEC’s approval of spot Ethereum ETFs has fueled speculation within the crypto community about the potential for more altcoin-focused ETFs, especially for tokens linked to BlackRock. However, there have been no indications from the SEC about the approval of any spot altcoin ETFs thus far.

Nonetheless, Bloomberg analyst James Seyffart has already suggested the possibility of other tokens, such as Solana, eventually securing their own spot ETFs. According to Seyffart, the selection of altcoins for ETFs will depend on investor demand, though he predicts a spot Solana ETF might not materialize for several years, given the SEC “isn’t dancing around SOL’s status like they have ETH.”