Michael Saylor Views Ethereum ETF as Crypto Industry Victory

05/27/2024 01:08

Michael Saylor, a prominent Bitcoin advocate and MicroStrategy chairman, says the SEC approval of an ETH ETF is good for BTC.

MicroStrategy executive chairman and co-founder Michael Saylor appears to be reassessing his stance on Ethereum after the US Securities and Exchange Commission’s (SEC) approval of spot exchange-traded funds (ETFs).

In the latest episode of the “What Bitcoin Did For Me” podcast, Saylor called the SEC’s decision positive news for Bitcoin and the entire crypto industry.

Ethereum ETF Approval Signals More Support for Crypto

According to Saylor, the SEC’s recent approval of several Ethereum ETFs showed the crypto industry’s growing political influence. Last week, the financial regulator unexpectedly approved several ETH-related financial instruments, with many industry insiders suggesting this reversal might have political motivations.

As such, several stakeholders suggested the approval highlighted a positive shift in President Joe Biden’s stance towards cryptocurrencies.

“Is this good for Bitcoin or not? Yeah, I think it’s good for Bitcoin, in fact, I think it may be better for Bitcoin because I think that we are politically much more powerful and supported by the entire crypto industry,” Saylor said.

Michael Saylor believes the Ethereum ETFs will boost the institutional adoption of cryptocurrencies. According to him, more institutions will now recognize crypto as a legitimate asset class and allocate capital across various cryptocurrencies. However, he maintains Bitcoin would receive the largest share of these investments as the “leader” of the market.

“I think mainstream investors will say oh there is a crypto asset class now, maybe we’ll allocate 5% or 10% to the crypto asset class, but Bitcoin will be 60% or 70% of that,” Saylor noted.

Read more: Who Owns the Most Bitcoin in 2024?

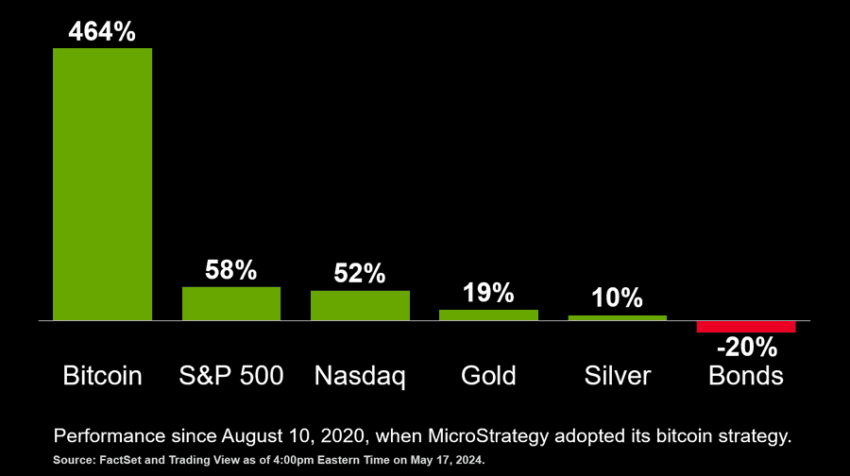

The MicroStrategy chairman also seized the opportunity to express confidence in Bitcoin’s future. Saylor and his company hold a significant position in the top cryptocurrency and have consistently maintained a pro-BTC disposition. The Virginia-based company is the largest public holder of Bitcoin and has amassed over 214,000 BTC, valued at approximately $15 billion.

“I’m quite the optimist, I actually think that Bitcoin is going to succeed, it is succeeding, it’s succeeding as fast as it could reasonably succeed, and we ought to try to avoid the tendency to [mess] with it,” Saylor chimed.

Meanwhile, Saylor’s current stance on Ethereum has significantly shifted from his previous position. Earlier, he stated that the SEC would classify ETH as a security under its regulatory purview. He predicted that other cryptos, including BNB, Solana, and XRP, would suffer the same fate.

“None of [these tokens] will ever be wrapped by a spot ETF, none of them will be accepted by Wall Street, none of them will be accepted by mainstream institutional investors as crypto assets,” he claimed.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.