Ethereum ETFs could ‘grab 20%’ share of BTC ETFs: Analyst predicts

05/30/2024 13:00

An ETF analyst reiterates that spot ETH ETF could hit about 20% of US spot BTC ETF performance across trading volumes, flows, and assets.

- US ETH ETF could attract less capital flows compared to US BTC ETF products

- The analyst based his projection on ETH vs. BTC futures ETFs and Silver vs. Gold.

The much-awaited launch of US spot Ethereum [ETH] ETF (exchange-traded funds) may struggle to replicate the success of the Bitcoin [BTC] ETF. According to Bloomberg ETF analyst Eric Balchunas, the much-hyped spot ETH ETFs might grab about ‘20%’ of the BTC ETF’s market share.

Part of Balchunas’ analysis read,

“I’d at least divide by 5 when it comes to expectations around the Ether spot ETFs re-flows/volume/media/everything relative to spot bitcoin ETFs. That said, grabbing 20% of what they got would be huge win/successful launch by normal ETF standards.’

Ethereum ETF vs. Silver ETF

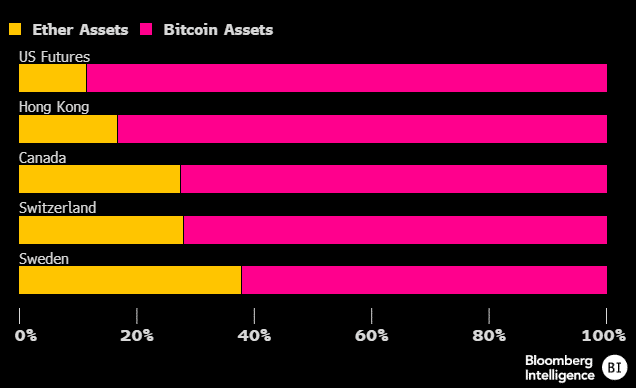

The analyst’s 20% of the BTC ETF market share was based on the current market share on the futures market. ETH ETF instruments are already available in various jurisdictions as futures ETF offerings.

Based on the futures market share between BTC and ETH, Balchunas showed that ETH only commanded about 20% on average, a likely scenario that could happen to spot ETFs, too.

“The poor showing of the eth futures is a big part of my calculus. That said, the stronger showings in Europe have me splitting the difference with the final prediction of 20% share.”

Additionally, the analyst equated BTC to Gold and Ethereum to Silver and made another analysis and assumption Gold vs Silver ETF basis. Per Balchunas, Silver ETF currently has only 15% of Gold ETFs’ market share. He stated,

“Many won’t feel the need to go beyond bitcoin/gold for their crypto/precious metals allocation.”

As of 28th May, the US spot BTC ETFs had $13.7 billion in total flows. Based on Balchuna’s projection, that could equate to $2.7 billion of ETH ETFs over the same period.

However, from a Hong Kong perspective, especially based on the leading ETF funds from Bosera, BTC flows were twice as much as ETH flows for the spot products.

According to Farside data, Hong Kong’s Bosera spot BTC ETF saw total inflows of $15.3 million, compared to its ETF product’s $7.5 million. That translates to about 50% of BTC ETF flows for Bosera spot ETH ETF.

However, according to CoinMarketCap data, ETH’s $454 billion spot market cap was 34% of BTC’s $1.3 trillion.

That said, the US spot ETH ETF products could launch in July, with some analysts expecting the ETH price to hit $4.5K before they start trading.