NewsBriefs - Elon Musk denies advising Donald Trump on crypto matters

05/31/2024 00:33

Elon Musk has refuted claims reported by Bloomberg that he is a crypto advisor for Donald Trump's presidential campaign. These discussions were suggested to underscore Musk’s influence and Trump's strategic focus on crypto to attract voters. Additionally, Trump, who previously viewed crypto skeptically, now openly supports the crypto industry and has begun accepting crypto donations for his campaign, aiming to promote US leadership in this sector.

Editor-curated news, summarized by AI

Elon Musk denies advising Donald Trump on crypto matters

Elon Musk has refuted claims reported by Bloomberg that he is a crypto advisor for Donald Trump's presidential campaign. These discussions were suggested to underscore Musk’s influence and Trump's strategic focus on crypto to attract voters. Additionally, Trump, who previously viewed crypto skeptically, now openly supports the crypto industry and has begun accepting crypto donations for his campaign, aiming to promote US leadership in this sector.

Latest

-

Elon Musk denies advising Donald Trump on crypto matters

Elon Musk has refuted claims reported by Bloomberg that he is a crypto advisor for Donald Trump's presidential campaign. These discussions were suggested to underscore Musk’s influence and Trump's strategic focus on crypto to attract voters. Additionally, Trump, who previously viewed crypto skeptically, now openly supports the crypto industry and has begun accepting crypto donations for his campaign, aiming to promote US leadership in this sector.

Expand

-

Rep. Tom Emmer criticizes SEC chair Gary Gensler's approach to crypto regulation

At the Consensus conference, Rep. Tom Emmer criticized SEC Chair Gary Gensler's management of crypto regulations, labeling it as overly authoritative and harmful to the industry. Emmer accused Gensler of misusing his open-door policy to initiate lawsuits against crypto projects post-discussions. He also mentioned the recent passing of the CBDC Act aimed at avoiding CCP-style surveillance, and highlighted the increasing significance of the crypto voter demographic, especially among young US voters.

Expand

-

Nasdaq pulls back Hashdex Ethereum ETF proposal after SEC approves others

Nasdaq has withdrawn its proposal to list the Hashdex Nasdaq Ethereum ETF despite the US Securities and Exchange Commission approving similar Ethereum ETFs from eight different issuers, including major players like BlackRock and Fidelity. This decision, taking place a day after these approvals, was unexpected, especially since Hashdex had not amended its proposal unlike its competitors.

Expand

-

Mastercard launches Crypto Credential service for secure blockchain transactions

Mastercard has introduced the Mastercard Crypto Credential, enabling users of crypto exchanges to conduct transactions using aliases instead of complex wallet addresses. This new feature enhances security by verifying wallet compatibility, preventing the loss of funds due to incompatible asset or blockchain support. Initially available in Latin America and Europe through exchanges like Bit2Me, Lirium, and Mercado Bitcoin, the service is expanding, with new partners like Brazilian exchange Foxbit. The Crypto Credential also facilitates compliance by supporting the exchange of Travel Rule information required for cross-border transactions, thereby promoting transparency and preventing illicit activities.

Expand

-

Gemini Earn to return $2.18 billion in crypto to users, says Winklevoss-owned exchange

Gemini Earn users will receive over $2 billion worth of cryptocurrency, restored in the same amount originally lent, following a 232% recovery rate since withdrawal stoppages in November 2022., according to a statement from Cameron Winklevoss to The Block. The Gemini exchange, directed by the Winklevoss twins, has committed to redistributing assets following the collapse of the Earn program's partner, Genesis Global Capital. Despite ongoing legal battles including a lawsuit from the US Securities and Exchange Commission, Gemini assures further returns within the next year and settles with a $37 million fine to the New York regulator.

Expand

-

Former FTX executive Ryan Salame receives 7.5-year sentence and $11 million fine

Former FTX executive Ryan Salame has been sentenced to seven and a half years in prison and fined over $11 million for his role in making unlawful political contributions and operating an unlicensed money-transmitting business. His sentence also includes three years of supervised release. Salame, who held high-ranking positions at Alameda Research and FTX Digital Markets, was involved in a scheme that compromised the integrity of US elections and financial systems by utilizing illegal methods to foster FTX's rapid growth and size.

Expand

-

Semler Scientific invests $40 million in Bitcoin, boosting stock prices by 32%

Semler Scientific, a public-listed healthcare company, has added $40 million in Bitcoin to its treasury, marking a significant strategy shift in asset management. This purchase, amounting to 581 BTC, has propelled the company's stocks to rise by 32.4%. Highlighting Bitcoin’s attributes as a finite asset and potential inflation hedge, the company’s chairman, Eric Semler, expressed confidence in Bitcoin's role as 'digital gold' with prospects for substantial returns. This move also aligns with broader institutional acceptance and recent SEC approvals for Bitcoin ETFs.

Expand

-

Solana validators vote to redirect all priority fees to themselves, ending current fee split

Solana validators have decided to allocate 100% of priority fees to themselves, discontinuing the previous arrangement of splitting the fees 50/50 between burning and rewarding validators. This decision, passed with 77% approval through proposal SIMD-0096, addresses concerns about side deals and network security issues. However, critics like Hanko Baggins worry that removing the burn mechanism could negatively affect Solana’s long-term market stability and price due to increased inflation.

Expand

-

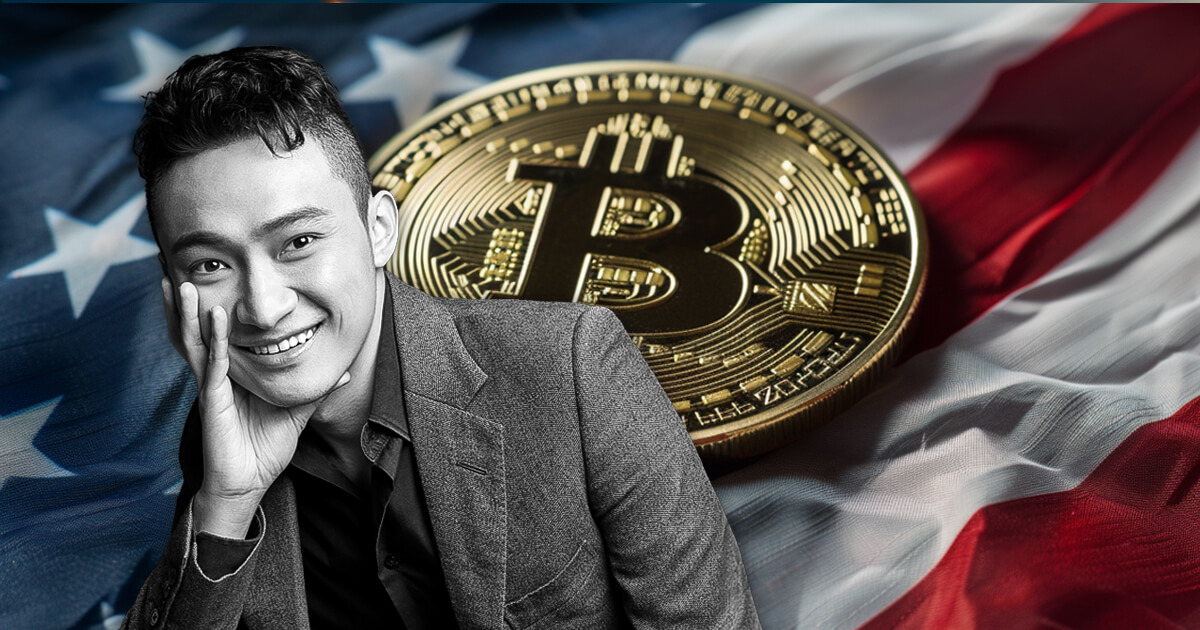

Justin Sun calls for crypto community support for pro-crypto US presidential candidates

Justin Sun, the founder of Tron blockchain, has advocated for the crypto community's support of a pro-crypto presidential candidate in the upcoming US elections to ensure the sector's influence on regulatory decisions. This appeal highlights the strategic political involvement necessary for the growth and acceptance of crypto within the broader US economy, amidst shifting political and regulatory attitudes towards cryptocurrencies.

Expand

-

Bitcoin must reach $70,000 to trigger new highs, experts say

Crypto expert Michael van de Poppe stated that Bitcoin needs to break through the $70,000 mark to potentially set a new all-time high (ATH). Despite a long consolidation phase anticipated by analysts like Arthur Hayes and Rekt Capital, the potential breakout from $70,000 could lead to a significant bullish trend, with predictions of reaching up to $78,000 and further setting the stage for a higher surge towards $100,000.

Expand

-

Trump pushes for US dominance in the crypto sector

Donald Trump, potential Republican presidential candidate, has articulated strong support for leading the global crypto sector, emphasizing the necessity for the US to hold a prime position and not settle for less.

Expand

-

Bitcoin.org reinstates Bitcoin whitepaper after legal battle with Craig Wright

The Bitcoin whitepaper has been restored on the Bitcoin.org website following a legal dispute involving Craig Wright, who falsely claimed to be the creator of Bitcoin known as Satoshi Nakamoto. Wright had initially forced the removal of the document from the site citing copyright infringement. However, his claim was discredited, and despite winning a default lawsuit due to non-appearance by the defendant Cøbra, the document is now publicly accessible again.

Expand

-

SEC approves 8 Ethereum spot ETFs

The SEC has authorized the introduction of spot Ethereum ETFs after concluding a rigorous registration and exchange communication process. This approval could potentially channel between $15 to $45 billion of institutional funds into the Ethereum market within the first year, as forecasted by Standard Chartered's expert. Multiple leading crypto firms such as Fidelity and Grayscale have adapted to SEC regulations by confirming non-participation in ETH staking for yields. This move follows the recent approval of Bitcoin ETFs and reflects a more favorable regulatory environment for crypto under the current US administration.

Expand

-

ByBit counters insolvency rumors amid scrutiny of Ethena's stablecoin operations

Recent rumors suggested ByBit might be insolvent, impacting Ethena's $2.5 billion stablecoin, USDe. Despite these rumors, which ByBit has denied, Ethena's asset prices have not dropped and the company maintains its collateral off-exchange. Ethena, championed by Arthur Hayes, offers a 37% yield through complex trades meant to protect against ETH price fluctuations, but faces significant risks due to its centralization and dependency on crypto exchanges like ByBit.

Expand

-

Nvidia's Q1 results soar as AI crypto tokens gain

Nvidia has reported a first-quarter revenue of $26 billion, surpassing market expectations with a 5.5% increase. Following this announcement, AI crypto tokens, including Fetch.ai, Render, Bittensor, SingularityNET, and AIOZ Network, have seen significant price gains. Despite a general downturn in the crypto market, these AI-related tokens surged in response to Nvidia’s strong financial performance and strategic corporate decisions, notably the introduction of a stock split and projections of further revenue growth.

Expand