NewsBriefs - Roaring Kitty triggers 300% surge in Solana-based memecoin $GME

06/03/2024 10:59

Following the return of Keith Gill, known as "Roaring Kitty," the Solana-based memecoin $GME experienced a 300% increase in market cap, surpassing $100 million. Gill's social media activity, including a post on Reddit revealing significant GameStop stock and options purchases, coincided with heightened trading volumes and value spikes in related meme tokens.

Editor-curated news, summarized by AI

Roaring Kitty triggers 300% surge in Solana-based memecoin $GME

Following the return of Keith Gill, known as "Roaring Kitty," the Solana-based memecoin $GME experienced a 300% increase in market cap, surpassing $100 million. Gill's social media activity, including a post on Reddit revealing significant GameStop stock and options purchases, coincided with heightened trading volumes and value spikes in related meme tokens.

Latest

-

Crypto funds see record $15 billion in 2024 with strong Bitcoin and Ethereum inflows

In 2024, crypto funds achieved a new milestone with total inflows hitting $15 billion, bolstered by significant contributions in May and a robust week that saw $185 million enter the market. Bitcoin led the charge with $148 million in inflows, showcasing continued confidence among investors, while Ethereum reversed a previous downtrend with substantial inflows, partly due to SEC approval for a spot-based ETF. Despite these positive movements in crypto, trading volumes decreased, and blockchain equities experienced notable outflows.

Expand

-

Linea scrutinized for halting block production after Velocore hack

Ethereum layer-2 blockchain Linea halted its block production to prevent further losses following a hack on Velocore, a decentralized exchange on its network, which compromised 700 ETH ($2.6 million). This decision, meant to inhibit the hacker's ability to transfer stolen funds, has faced criticism for undermining the principles of decentralization and censorship resistance. Despite the backlash, Linea defended its actions and reaffirmed its future commitment to creating a decentralized and censorship-resistant environment to enhance security without central oversight.

Expand

-

Roaring Kitty triggers 300% surge in Solana-based memecoin $GME

Following the return of Keith Gill, known as "Roaring Kitty," the Solana-based memecoin $GME experienced a 300% increase in market cap, surpassing $100 million. Gill's social media activity, including a post on Reddit revealing significant GameStop stock and options purchases, coincided with heightened trading volumes and value spikes in related meme tokens.

Expand

-

House Financial Services Committee urges President Biden to reconsider veto on SAB 121 affecting crypto custody

The House Financial Services Committee, led by Chairman Patrick McHenry and Senator Cynthia Lummis, has requested President Joe Biden to reconsider his potential veto of the Congressional Review Act resolution, which seeks to overturn SEC's Staff Accounting Bulletin 121 (SAB 121). The bulletin restricts highly regulated financial institutions from holding Bitcoin and other tokens. This bipartisan initiative passed both Senate and House votes and is seen as a critical measure to safeguard essential crypto custody services and consumers.

Expand

-

Ether options indicate bullish sentiment for June with $5,000 calls

Open interest in Ether options is heavily concentrated on $5,000 calls for the end-of-June expiry, reflecting a bullish stance among traders. This optimism is evident in the active use of call spreads between the $4,000 and $5,000 price points, aiming to capitalize on potential price increases. The options market's put-call ratio further supports this bullish outlook, although some traders are adapting to possible downsides due to delays in the ether ETFs launch.

Expand

-

Elon Musk denies advising Donald Trump on crypto matters

Elon Musk has refuted claims reported by Bloomberg that he is a crypto advisor for Donald Trump's presidential campaign. These discussions were suggested to underscore Musk’s influence and Trump's strategic focus on crypto to attract voters. Additionally, Trump, who previously viewed crypto skeptically, now openly supports the crypto industry and has begun accepting crypto donations for his campaign, aiming to promote US leadership in this sector.

Expand

-

Rep. Tom Emmer criticizes SEC chair Gary Gensler's approach to crypto regulation

At the Consensus conference, Rep. Tom Emmer criticized SEC Chair Gary Gensler's management of crypto regulations, labeling it as overly authoritative and harmful to the industry. Emmer accused Gensler of misusing his open-door policy to initiate lawsuits against crypto projects post-discussions. He also mentioned the recent passing of the CBDC Act aimed at avoiding CCP-style surveillance, and highlighted the increasing significance of the crypto voter demographic, especially among young US voters.

Expand

-

Nasdaq pulls back Hashdex Ethereum ETF proposal after SEC approves others

Nasdaq has withdrawn its proposal to list the Hashdex Nasdaq Ethereum ETF despite the US Securities and Exchange Commission approving similar Ethereum ETFs from eight different issuers, including major players like BlackRock and Fidelity. This decision, taking place a day after these approvals, was unexpected, especially since Hashdex had not amended its proposal unlike its competitors.

Expand

-

Mastercard launches Crypto Credential service for secure blockchain transactions

Mastercard has introduced the Mastercard Crypto Credential, enabling users of crypto exchanges to conduct transactions using aliases instead of complex wallet addresses. This new feature enhances security by verifying wallet compatibility, preventing the loss of funds due to incompatible asset or blockchain support. Initially available in Latin America and Europe through exchanges like Bit2Me, Lirium, and Mercado Bitcoin, the service is expanding, with new partners like Brazilian exchange Foxbit. The Crypto Credential also facilitates compliance by supporting the exchange of Travel Rule information required for cross-border transactions, thereby promoting transparency and preventing illicit activities.

Expand

-

Gemini Earn to return $2.18 billion in crypto to users, says Winklevoss-owned exchange

Gemini Earn users will receive over $2 billion worth of cryptocurrency, restored in the same amount originally lent, following a 232% recovery rate since withdrawal stoppages in November 2022., according to a statement from Cameron Winklevoss to The Block. The Gemini exchange, directed by the Winklevoss twins, has committed to redistributing assets following the collapse of the Earn program's partner, Genesis Global Capital. Despite ongoing legal battles including a lawsuit from the US Securities and Exchange Commission, Gemini assures further returns within the next year and settles with a $37 million fine to the New York regulator.

Expand

-

Former FTX executive Ryan Salame receives 7.5-year sentence and $11 million fine

Former FTX executive Ryan Salame has been sentenced to seven and a half years in prison and fined over $11 million for his role in making unlawful political contributions and operating an unlicensed money-transmitting business. His sentence also includes three years of supervised release. Salame, who held high-ranking positions at Alameda Research and FTX Digital Markets, was involved in a scheme that compromised the integrity of US elections and financial systems by utilizing illegal methods to foster FTX's rapid growth and size.

Expand

-

Semler Scientific invests $40 million in Bitcoin, boosting stock prices by 32%

Semler Scientific, a public-listed healthcare company, has added $40 million in Bitcoin to its treasury, marking a significant strategy shift in asset management. This purchase, amounting to 581 BTC, has propelled the company's stocks to rise by 32.4%. Highlighting Bitcoin’s attributes as a finite asset and potential inflation hedge, the company’s chairman, Eric Semler, expressed confidence in Bitcoin's role as 'digital gold' with prospects for substantial returns. This move also aligns with broader institutional acceptance and recent SEC approvals for Bitcoin ETFs.

Expand

-

Solana validators vote to redirect all priority fees to themselves, ending current fee split

Solana validators have decided to allocate 100% of priority fees to themselves, discontinuing the previous arrangement of splitting the fees 50/50 between burning and rewarding validators. This decision, passed with 77% approval through proposal SIMD-0096, addresses concerns about side deals and network security issues. However, critics like Hanko Baggins worry that removing the burn mechanism could negatively affect Solana’s long-term market stability and price due to increased inflation.

Expand

-

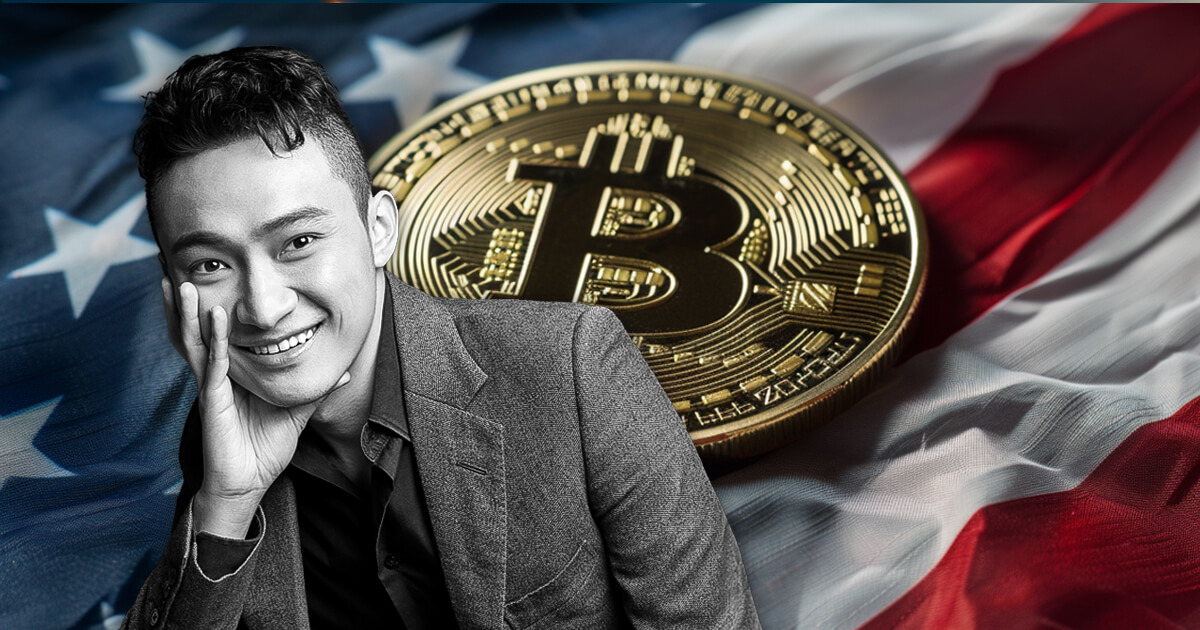

Justin Sun calls for crypto community support for pro-crypto US presidential candidates

Justin Sun, the founder of Tron blockchain, has advocated for the crypto community's support of a pro-crypto presidential candidate in the upcoming US elections to ensure the sector's influence on regulatory decisions. This appeal highlights the strategic political involvement necessary for the growth and acceptance of crypto within the broader US economy, amidst shifting political and regulatory attitudes towards cryptocurrencies.

Expand

-

Bitcoin must reach $70,000 to trigger new highs, experts say

Crypto expert Michael van de Poppe stated that Bitcoin needs to break through the $70,000 mark to potentially set a new all-time high (ATH). Despite a long consolidation phase anticipated by analysts like Arthur Hayes and Rekt Capital, the potential breakout from $70,000 could lead to a significant bullish trend, with predictions of reaching up to $78,000 and further setting the stage for a higher surge towards $100,000.

Expand